Rockwell Automation (NYSE:ROK) recently announced the adoption of its FactoryTalk PharmaSuite by Sintetica SA, a step aimed at enhancing production efficiency in Switzerland. This strategic movement aligns with several impactful product launches and client collaborations over the past quarter, during which the company's shares rose 20%. Additional developments include enhancements in industrial computing technology for energy projects and significant client implementations in various sectors, which contributed to a robust performance. These initiatives likely added weight to broader market trends, which rose 12% over the past year, supporting Rockwell's positive movement.

Find companies with promising cash flow potential yet trading below their fair value.

The recent announcement by Rockwell Automation regarding the adoption of its FactoryTalk PharmaSuite by Sintetica SA could further solidify Rockwell's market position and enhance its production efficiency. Over the longer-term period of three years, the company's total return, including dividends, was 72.54%, indicating strong performance. However, compared to the US market, which saw a 12.2% increase over the past year, Rockwell's performance outpaced this broader trend.

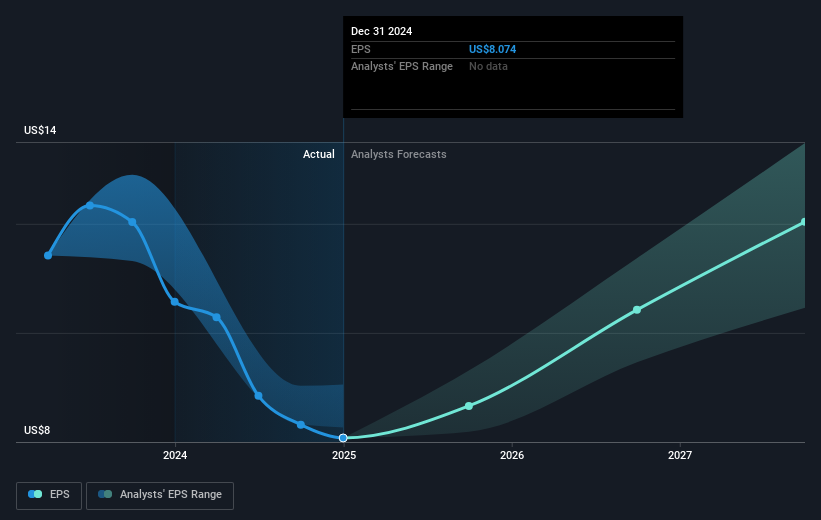

This news, potentially contributing to increased revenue and improved earnings forecasts, aligns with Rockwell's efforts to boost resiliency and enhance operational capabilities. Analysts have set a consensus price target of US$317.13, reflecting a modest discount of 1.66% from the current share price of US$253.05. The focus on innovation and customer expansion, through collaborations like that with Sintetica SA, might help sustain Rockwell's growth trajectory amid market uncertainties. As these developments unfold, revenue growth and earnings potentials are likely to be impacted positively, supporting analyst forecasts of US$9.4 billion revenue and US$1.4 billion earnings by 2028.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com