Lockheed Martin (NYSE:LMT) recently affirmed a third-quarter dividend of $3.30 per share, underscoring its commitment to shareholder value. Over the last quarter, the company's share price rose by 4%, closely aligning with overall market trends as the broader market increased 12% over the past year. Lockheed Martin's robust Q1 2025 earnings, showcasing higher revenue and net income, along with strategic partnerships, likely added to positive sentiment. Announcements like the MoU with Electra.aero and new product developments like AI Fight Club potentially bolstered investor confidence, contributing additional weight to the company's overall performance.

You should learn about the 1 risk we've spotted with Lockheed Martin.

Lockheed Martin's recent dividend affirmation of US$3.30 per share and strategic initiatives, such as partnerships with Electra.aero and technological advancements like the AI Fight Club, signal a substantial commitment to enhancing shareholder value and leveraging innovation for growth. These moves align with the company's broader narrative of integrating AI, 5G, and cloud technologies across defense platforms. The anticipated boost in operational capabilities could attract more contracts, potentially driving revenue growth. However, reliance on cutting-edge systems exposes Lockheed Martin to execution risks and possible cost overruns, affecting profitability metrics.

Over the last five years, Lockheed Martin's total shareholder returns have risen by 45.65%, providing a long-term perspective on the company's robust performance. Despite this, its recent short-term performance shows a 4% share price increase over the last quarter, which is modest compared to the broader market's 12% increase over the past year, indicating some underperformance. This divergence raises questions about the company's ability to sustain growth amidst industry competition and external economic pressures, including potential defense budget cuts.

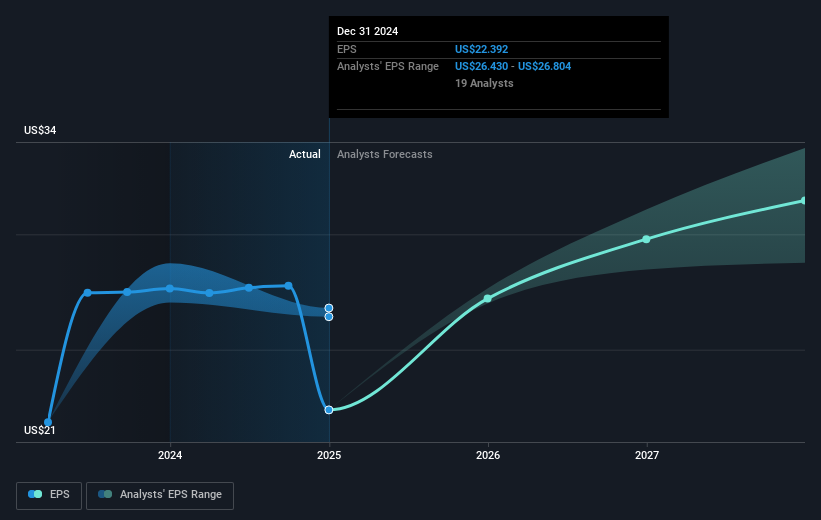

Looking ahead, Lockheed Martin's revenue and earnings forecasts are shaped by these strategic efforts, with analysts predicting a 3.8% annual revenue growth and earnings increasing to US$7.2 billion by 2028. The company's current share price of US$468.21, reflecting a slight discount to the consensus price target of US$523.53, implies a potential upside of approximately 10.6%. Investors may want to consider how these forecasts align with their expectations and how potential risks such as defense budget constraints or geopolitical factors could alter the revenue and earnings trajectory.

Review our historical performance report to gain insights into Lockheed Martin's track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com