Last week, Dover (NYSE:DOV) experienced a price increase of approximately 2.5%, coinciding with the launch of new Side-by-Side Dispensing Cartridges by its subsidiary Techcon. This innovative product caters to multiple sectors, showcasing Dover's adaptability and ongoing commitment to industry needs. The market overall rose by 1.7% in the same period, suggesting that Dover's price movement aligned broadly with market trends. While the launch likely added weight to Dover's positive performance, it did not significantly diverge from broader market gains, given the lack of other impacting events in the week.

Buy, Hold or Sell Dover? View our complete analysis and fair value estimate and you decide.

The recent launch of Techcon's Side-by-Side Dispensing Cartridges aligns with Dover's broader strategic focus on innovation and sector-specific solutions, potentially supporting their revenue and earnings growth forecasts. While the market as a whole rose last week, Dover's shares marginally outperformed, which might reflect confidence in the new product's contribution to future performance. However, this short-term movement should be viewed in light of the company's 5-year total return of 101.40%, indicating sustained growth over a more extended period. This longer-term performance highlights Dover's ability to generate significant shareholder value, roughly aligning with industry performance.

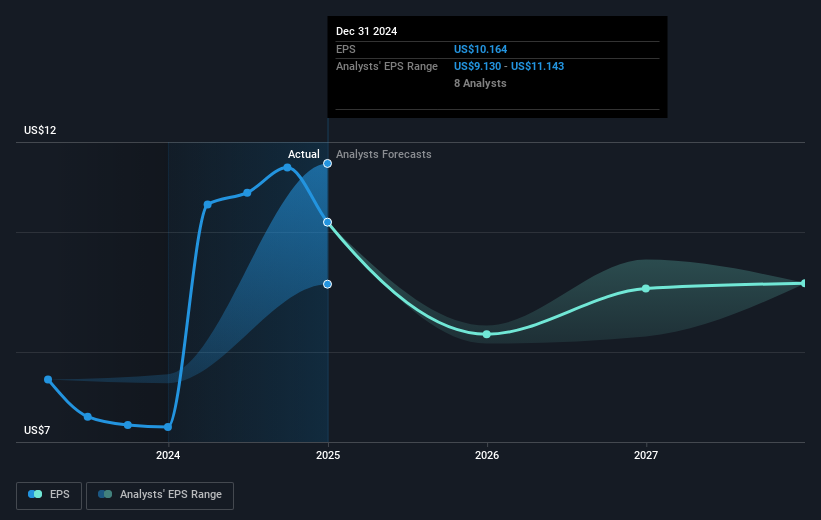

In terms of revenue and earnings outlook, Techcon's product could bolster Dover's growth trajectory, considering its relevance across different sectors. Analysts estimate revenue growth of 4.3% annually, with earnings expected to rise to US$1.2 billion by May 2028. The current share price of US$170.71 positions it at a 13.8% discount to the consensus price target of approximately US$197.93, suggesting potential upside if the company's growth initiatives, such as this product launch, effectively translate into higher earnings. The price movement, coupled with the new product's anticipated market uptake, might positively contribute to achieving the projected earnings and further investor confidence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com