SBA Communications (NasdaqGS:SBAC) recently announced its selection to implement fiber connectivity at the Wyld Oaks development. This partnership highlights the company's focus on expanding infrastructure solutions, aligning with market trends favoring technological integration in mixed-use communities. Over the last quarter, SBA Communications experienced a 8% increase in share price, comfortably outpacing the broader market's 2% rise. Contributing factors include improved financial performance, with increased net income and earnings per share despite a slight drop in sales. Additionally, a robust shareholder return strategy with a new share buyback program and sustained dividends likely supported investor confidence.

Find companies with promising cash flow potential yet trading below their fair value.

The announcement of SBA Communications' implementation of fiber connectivity at the Wyld Oaks development may play a crucial role in augmenting the company's growth trajectory. This strategic endeavor aligns with their focus on technological integration, potentially bolstering future revenue streams through increased infrastructure solutions. Over the past year, the company's total return, which includes share price appreciation and dividends, was 22.50%. This reflects a robust performance relative to the broader market, despite some macroeconomic uncertainties that could impact future capital allocation.

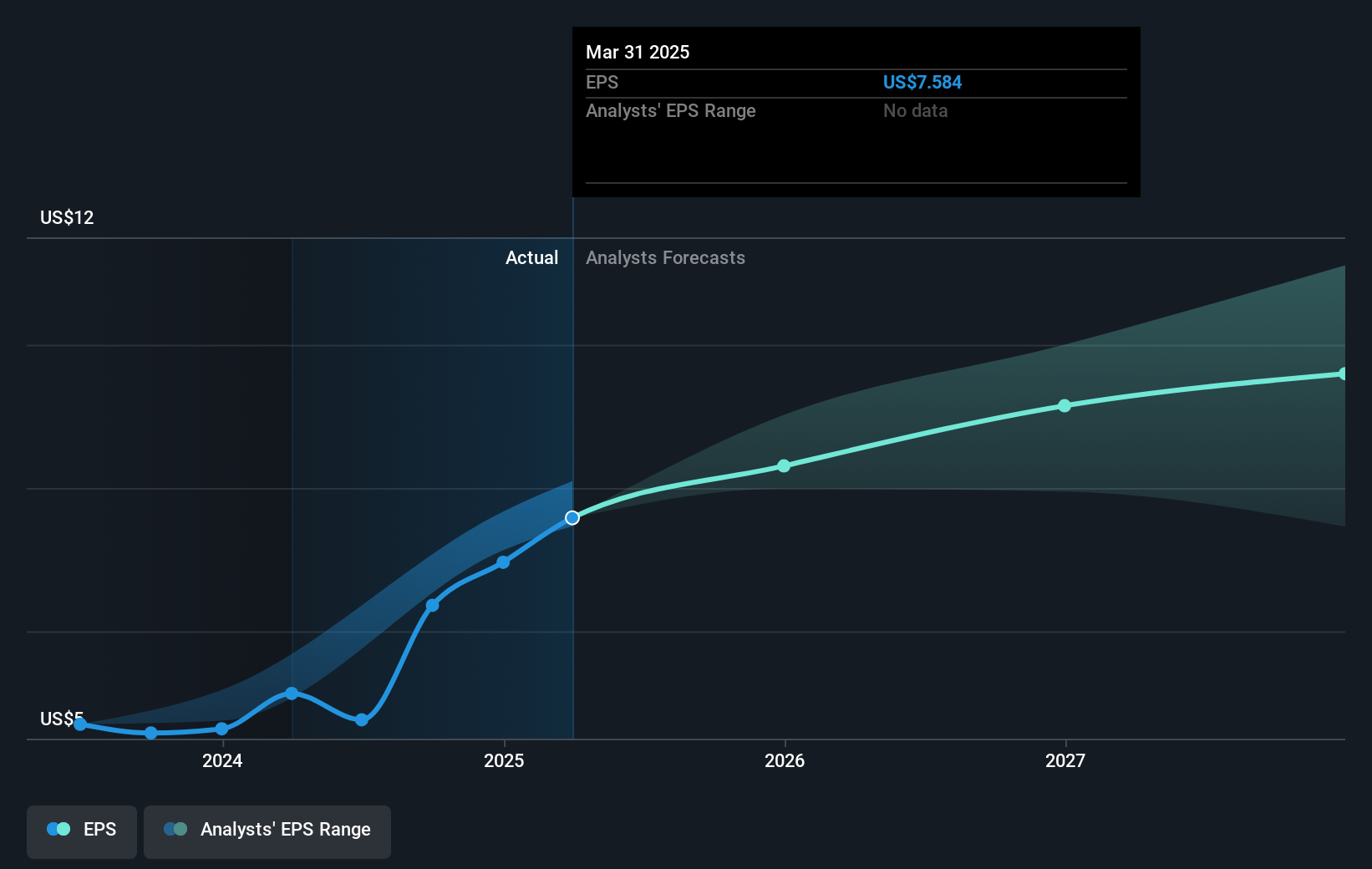

SBA Communications' commitment to ongoing infrastructure expansion and efficient capital allocation, as highlighted by their market exits, may positively influence revenue and earnings forecasts. Analysts expect annual revenue growth of 4.2% and a rise in profit margins, setting a foundation for future financial strength. However, with the current share price at US$242.83, there’s a relatively modest 4.1% gap to the consensus price target of US$253.24, suggesting the stock may currently be fairly valued by the market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com