Ulta Beauty (NasdaqGS:ULTA) recently reaffirmed its earnings guidance for fiscal year 2025 and appointed Chris Lialios as Interim CFO following Paula Oyibo’s departure. Over the last quarter, Ulta's stock price rose by approximately 24%. This substantial increase aligns modestly with the market's healthy growth trajectory but notably surpasses the market's 12% rise over the past year. The company's consistent earnings projections and strategic leadership changes, including the appointment of Lauren Brindley as Chief Merchandising and Digital Officer, may have bolstered investor confidence, adding weight to the robust price movement observed in the period.

Buy, Hold or Sell Ulta Beauty? View our complete analysis and fair value estimate and you decide.

Find companies with promising cash flow potential yet trading below their fair value.

The recent executive shifts at Ulta Beauty, joining the reaffirmed earnings guidance, suggest a strengthened management focus on aligning leadership with key strategic areas. This can impact their narrative by instilling greater investor confidence as the company launches new initiatives like Beyoncé's hair care line and bolsters digital capabilities. These efforts aim to enhance guest engagement and, subsequently, revenue growth. While the leadership transition may induce short-term uncertainty, it can also bring fresh perspectives and strategies to maintain and potentially enhance market positioning.

Over the last five years, Ulta's shareholders have enjoyed a total return of 125.52%, reflecting the company's enduring market performance while the share price increase of about 24% over the last quarter indicates growing investor enthusiasm. However, the share price's close proximity to the analyst consensus target suggests a potential stabilization, aligning closely with market evaluations. Notably, Ulta surpassed the US market's 12% return in the past year, underscoring its resilience and ability to outperform broader economic dynamics. Compared to the Specialty Retail industry average return of 7.7%, Ulta still stands out positively.

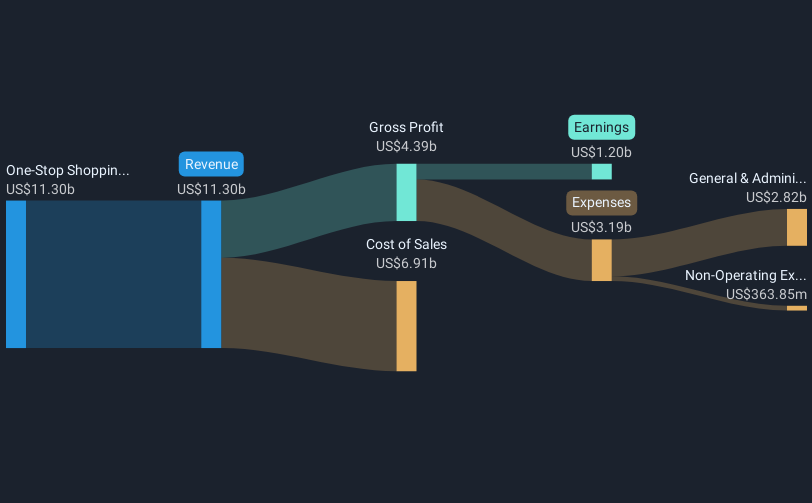

Despite competitive pressures and macroeconomic challenges, the sustained revenue and earnings projections, with an estimated US$11.42 billion in revenue and US$1.2 billion in earnings, provide a stable outlook. However, analysts anticipate a slight compression in profit margins over the next few years. The consensus price target of US$411.39 is modestly ahead of Ulta's current price of US$387.14, implying a cautious market sentiment surrounding future growth prospects. Investors are encouraged to consider this balance of growth initiatives and potential near-term hurdles as they assess their long-term investment thesis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com