Charter Communications (NasdaqGS:CHTR) experienced a 6% price increase over the past week, coinciding with significant developments such as an expanded distribution agreement with The Walt Disney Company and a partnership with Nexar. The Disney agreement reintroduces eight Disney-owned networks to Spectrum’s channel lineup and makes Hulu (With Ads) available to Spectrum TV Select customers, potentially enhancing content value. Meanwhile, the Nexar partnership leverages Spectrum's network for improved roadway insights, showcasing advancement in connected technology. These strategic moves align with the company's ongoing efforts to enhance customer offerings, although the broader market rose 2% in the same period.

Every company has risks, and we've spotted 1 risk for Charter Communications you should know about.

Find companies with promising cash flow potential yet trading below their fair value.

The recent collaboration with The Walt Disney Company and Nexar could enhance Charter Communications' service offerings and customer value perception, potentially leading to increased subscriber satisfaction and retention. This aligns with the company's narrative of expanding its mobile and AI capabilities to improve service efficiency and reduce costs. Such strategic endeavors could positively influence the revenue and earnings forecasts, as improvements in content and service could translate into higher customer acquisition and retention, thereby boosting revenue growth.

Over the past year, Charter Communications' total shareholder return, including share price appreciation and dividends, was 36.78%. This outpaces the US Media industry's 0.3% return for the same period. Such a performance highlights Charter's strong market positioning and operational improvements. However, over a longer timeline, one must evaluate this performance, balancing it against potential risks, such as high debt levels and increased competition that may affect sustained growth.

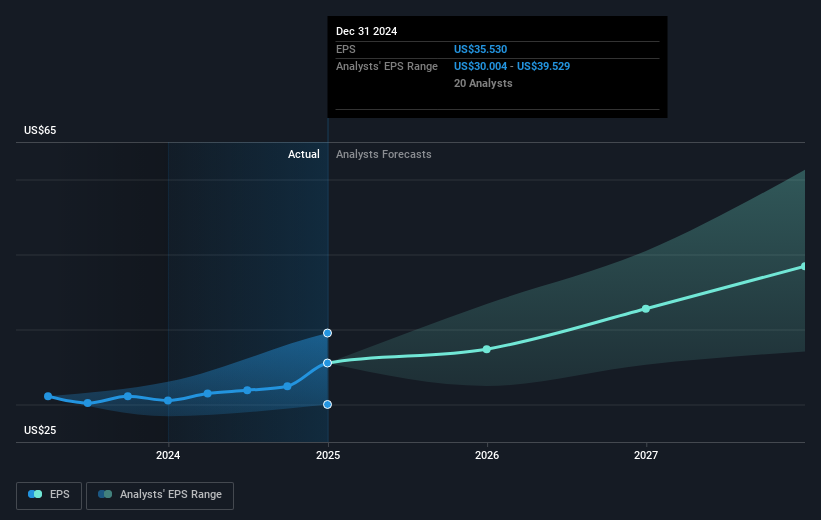

In terms of stock price movement, the recent 6% weekly increase brings the current share price to US$402.01, which remains close to the analyst consensus price target of US$411.92. This suggests a relatively narrow discount and potential for moderate appreciation, assuming analysts' future earnings and revenue projections are realized. Furthermore, maintaining the anticipated earnings growth to reach US$6 billion by May 2028, amidst various industry challenges, remains critical for achieving the consensus price target.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com