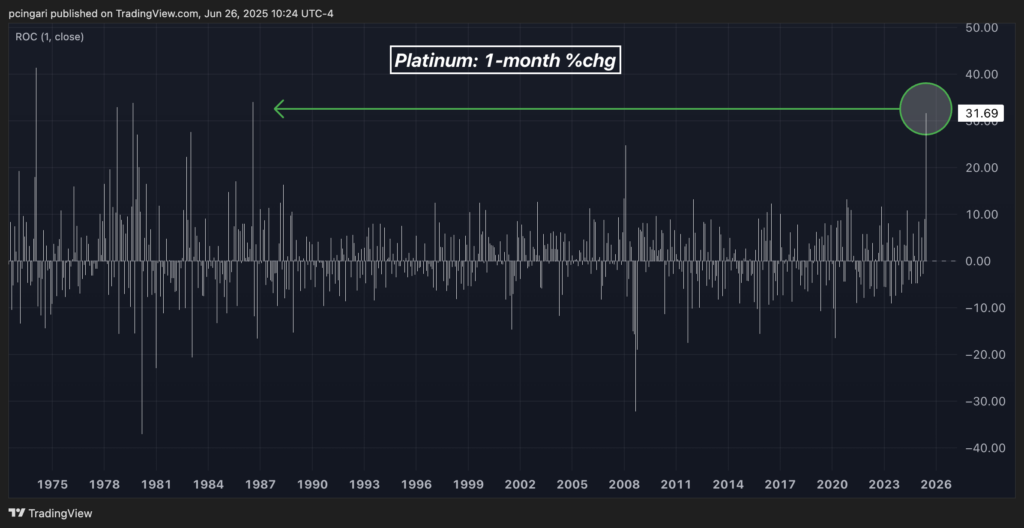

Platinum is staging a spectacular rally this year, rising more than 30% in June alone and hitting $1,390 per ounce—its highest level since September 2014—putting it on track for its best monthly performance since 1986.

The precious metal, closely tracked by the GraniteShares Platinum Shares ETF (NYSE:PLTM), has gained over 50% year-to-date, more than doubling the returns seen in gold, which is up 25%, and silver, which is up 24%, as investors chase platinum amid expectations of continued structural deficits.

Elevated platinum prices are poised to deliver windfall profits for key mining companies with heavy exposure to the metal, many of which have already begun a bull market.

Chart: Platinum Is On Track For Best-Performing Month Since 1986

What's Fueling The Platinum Rally?

According to the World Platinum Investment Council, the rally is underpinned by long-standing supply shortages.

The group projects that platinum market deficits will persist through 2029, averaging 727,000 ounces annually from 2025 to 2029, equivalent to approximately 9% of average demand.

"The platinum investment case remains compelling," the council said, highlighting ongoing shortfalls driven by falling above-ground stockpiles, constrained supply from key producing regions, and rising demand from China's jewelry sector.

These market conditions are largely unaffected by short-term price levels.

Both supply and demand remain highly inelastic, which suggests further upside pressure could continue if investor sentiment remains bullish and physical supply struggles to meet demand.

De-dollarization efforts and broader concerns over global macroeconomic stability have also played a role.

As gold and silver rallied on those themes earlier in the year, platinum and palladium were seen as laggards, attracting "catch-up" trades from institutional and retail investors.

What Are the Platinum Downside Risks Going Forward?

Goldman Sachs sees some downside risks for platinum. In a note shared on June 11, analyst Lina Thomas said, "Chinese buying appears highly price sensitive and tends to fall when prices are high."

She also noted that China's pivot to electric vehicles is reducing long-term demand for platinum in catalytic converters, while increasing scrap supply as internal combustion engine cars are retired.

"In the West, our Autos equity analysts expect the ICE and hybrid vehicle fleet to remain relatively stable," Thomas added.

On the supply side, Goldman expects stable to slightly higher global production, mainly from South Africa, which supplies 70% of the world's platinum.

Unless power outages recur, output is unlikely to decline, as platinum is mined primarily as a by-product and production is less responsive to price fluctuations due to its high fixed costs.

Who Are The Top Platinum Producers?

The global platinum market is concentrated in southern Africa, primarily in South Africa and Zimbabwe.

Anglo American Platinum Ltd. is the world's largest platinum producer and a subsidiary of Anglo American plc (OTCPK: NGLOD). Its operations span South Africa and are heavily exposed to fluctuations in platinum pricing.

Impala Platinum Holdings Ltd. (OTCPK: IMPUF), or Implats, is the second-largest global producer, with significant assets in South Africa and Zimbabwe.

D/B/A Sibanye Stillwater Ltd. (NYSE:SBSW) operates in both South Africa and the U.S., with a diversified portfolio across the platinum group metals (PGMs).

Sibanye Stillwater is the only platinum-focused miner listed on a major U.S. exchange, trading under the ticker SBSW.

Northam Platinum Ltd. (OTCPK: NPLTF) is a mid-tier South African producer with growing mining and processing assets, known for its operational focus on high-grade ore bodies.

African Rainbow Minerals Ltd. (OTCPK: AFBOF) holds significant stakes in platinum group metals projects alongside interests in ferrous and base metals, offering exposure to multiple commodity cycles.

Glencore plc (OTCPK: GLNCY), while not a pure-play platinum producer, maintains platinum exposure through joint ventures and partnerships in southern Africa.

These producers have surged in tandem with platinum's rally, with several posting double-digit gains in June. With market deficits forecast to persist through 2029, investor interest could remain strong, especially if prices stay above $1,300.

Read Next:

Photo: yMediaStock/Shutterstock