Wall Street's Most Accurate Analysts Weigh In On 3 Consumer Stocks With Over 8% Dividend Yields

Benzinga · 13h ago

Share

Listen to the news

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the consumer discretionary sector.

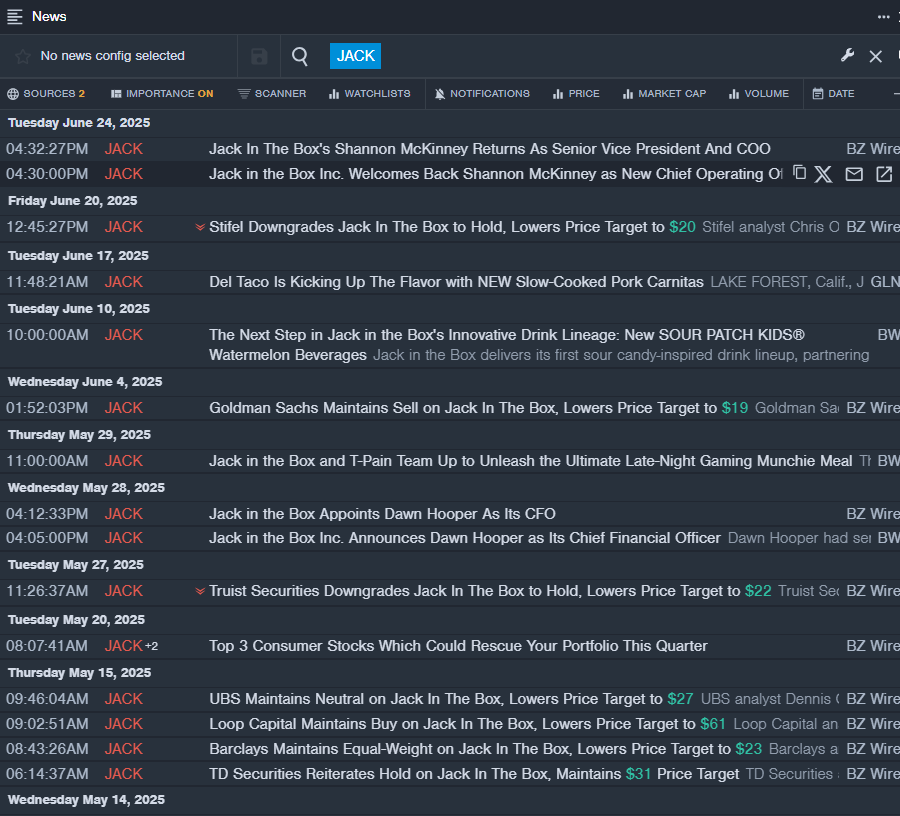

Jack in the Box Inc. (NASDAQ:JACK)

- Dividend Yield: 10.26%

- Stifel analyst Chris O'Cull downgraded the stock from Buy to Hold and cut the price target from $32 to $20 on June 20, 2025. This analyst has an accuracy rate of 76%.

- Truist Securities analyst Jake Bartlett downgraded the stock from Buy to Hold and slashed the price target from $51 to $22 on May 27, 2025. This analyst has an accuracy rate of 75%.

- Recent News: On June 24, Jack in the Box announced the return of Shannon McKinney as senior vice president, chief operating officer and new member of the executive leadership team.

- Benzinga Pro’s real-time newsfeed alerted to latest JACK news.

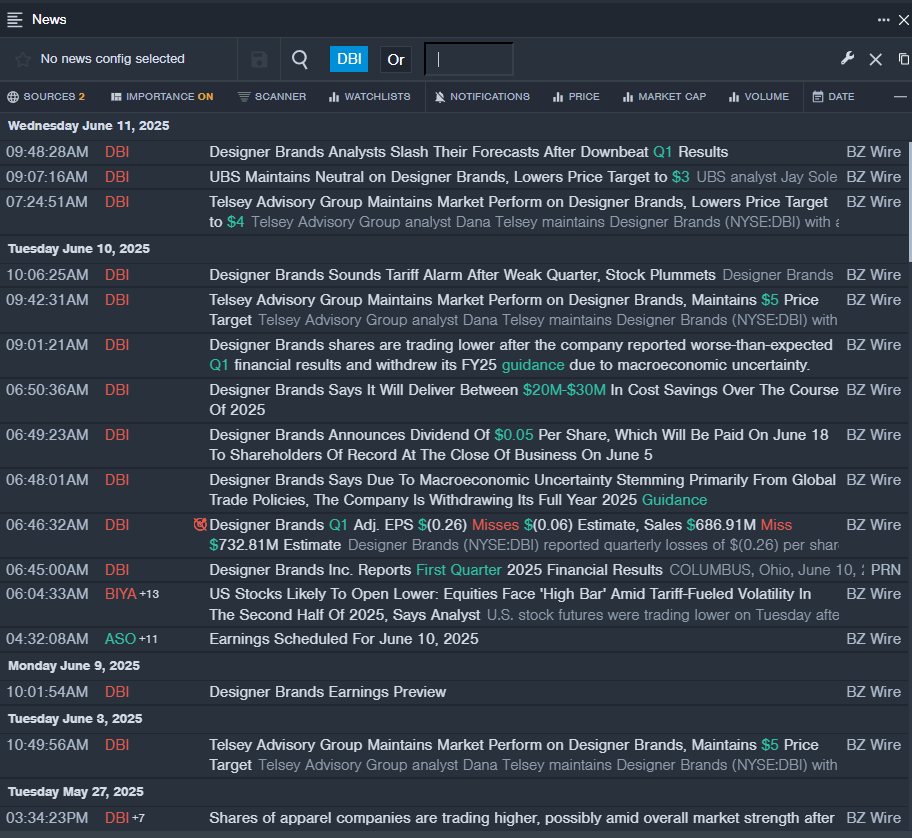

Designer Brands Inc. (NYSE:DBI)

- Dividend Yield: 8.77%

- UBS analyst Jay Sole maintained a Neutral rating and lowered the price target from $3.5 to $3 on June 11, 2025. This analyst has an accuracy rate of 70%.

- Telsey Advisory Group analyst Dana Telsey maintained a Market Perform rating and slashed the price target from $5 to $4 on June 11, 2025. This analyst has an accuracy rate of 60%.

- Recent News: On June 10, Designer Brands reported worse-than-expected first-quarter financial results and withdrew its FY25 guidance due to macroeconomic uncertainty.

- Benzinga Pro's real-time newsfeed alerted to latest DBI news

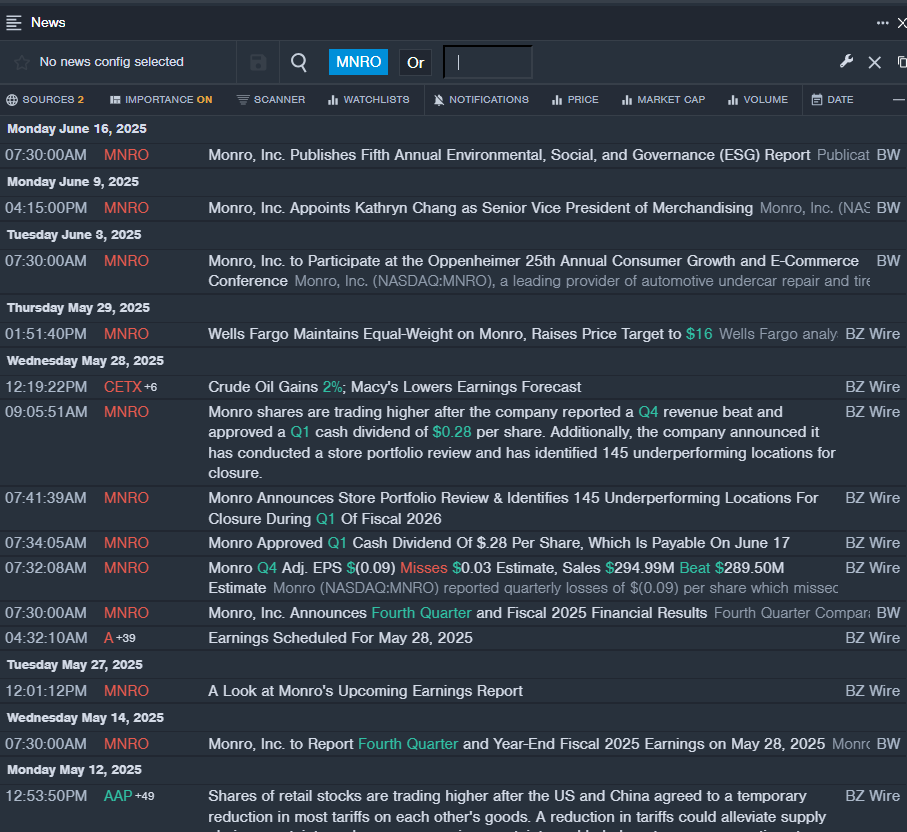

Monro, Inc. (NASDAQ:MNRO)

- Dividend Yield: 8.16%

- Wedbush analyst Seth Basham maintained an Outperform rating and cut the price target from $27 to $19 on April 1, 2025. This analyst has an accuracy rate of 68%.

- Stephens & Co. analyst Rick Nelson initiated coverage on the stock with an Equal-Weight rating and a price target of $31 on Oct. 15, 2024. This analyst has an accuracy rate of 71%.

- Recent News: On May 28, Monro reported a fourth-quarter revenue beat and approved a first-quarter cash dividend of 28 cents per share.

- Benzinga Pro’s real-time newsfeed alerted to latest MNRO news

Read More:

Photo via Shutterstock

Disclaimer:This article represents the opinion of the author only. It does not represent the opinion of Webull, nor should it be viewed as an indication that Webull either agrees with or confirms the truthfulness or accuracy of the information. It should not be considered as investment advice from Webull or anyone else, nor should it be used as the basis of any investment decision.

What's Trending

No content on the Webull website shall be considered a recommendation or solicitation for the purchase or sale of securities, options or other investment products. All information and data on the website is for reference only and no historical data shall be considered as the basis for judging future trends.

Copyright © 2025 Webull. All Rights Reserved