- Moody's Corporation is set to present at its European Insurance Conference in London on June 17, 2025, with senior executives providing sector updates and perspectives on risk assessment in financial institutions.

- This event offers Moody's a high-profile forum to share its insights on credit outlooks and industry risks, potentially shaping perceptions among key investors and insurance market participants.

- We’ll explore how Moody’s active engagement with European insurers may influence expectations for its risk assessment and financial institutions businesses.

Moody's Investment Narrative Recap

To be a Moody’s shareholder, you need to believe in the enduring relevance of its credit ratings and risk analytics for financial markets, even as financing activity shifts and regulatory needs evolve. While the upcoming European Insurance Conference in London highlights Moody's outreach to institutional clients, the impact of this event on the company's key short-term catalyst, growth in private credit and structured finance, appears limited; meanwhile, revenue risks from delayed financings due to market volatility remain a central concern.

Of recent company updates, the April announcement of a new partnership with MSCI stands out, aiming to deliver independent risk assessments for private credit investments. This initiative aligns directly with Moody’s focus on expanding its offer to private credit markets, addressing a major catalyst and providing potential support for revenue streams tied to ratings and analytics.

In contrast, ongoing market uncertainty that could trigger delays in customer decision-making is something investors should be aware of…

Read the full narrative on Moody's (it's free!)

Exploring Other Perspectives

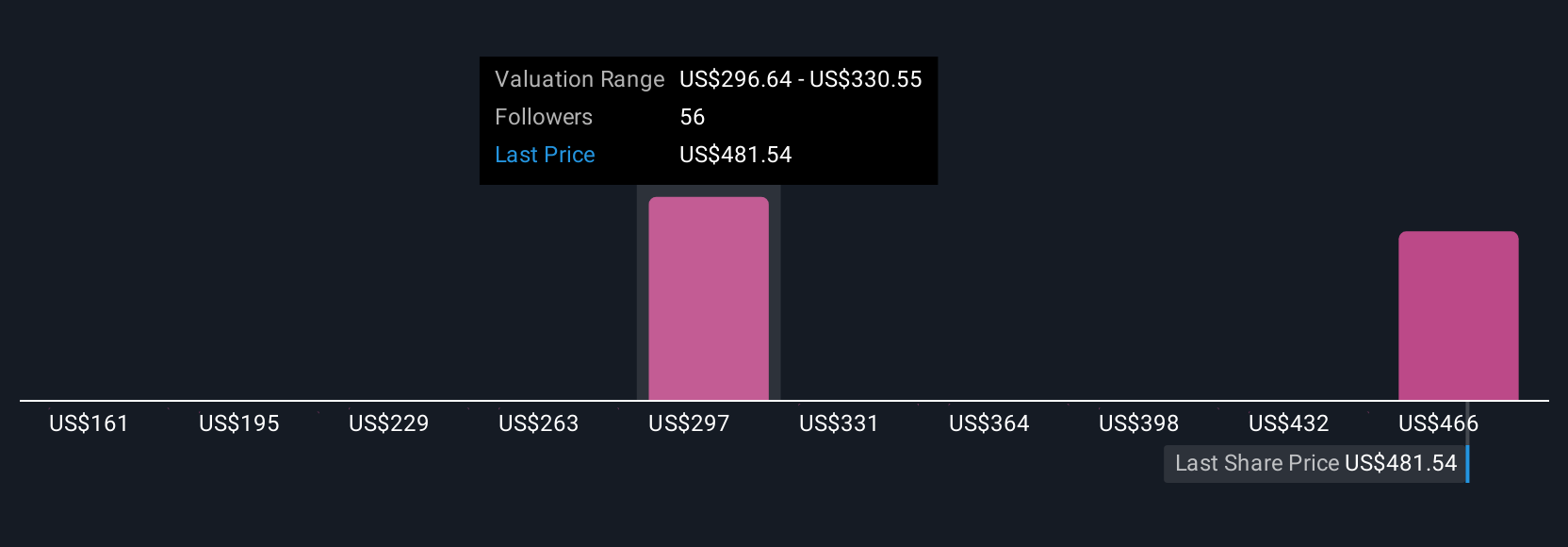

Simply Wall St Community members see fair value for Moody’s shares ranging widely from US$161 to US$500.10, with 12 unique views. As market participants weigh these differences, the push into private credit and evolving risks around transaction timing highlight the many ways Moody’s future could play out.

Explore 12 other fair value estimates on Moody's - why the stock might be worth as much as $500.10!

Build Your Own Moody's Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Moody's research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Moody's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Moody's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover 17 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com