- Johnson & Johnson released a series of encouraging clinical trial results for several key therapies, including IMAAVY™ for generalized myasthenia gravis, new CAR T-cell and bispecific antibody therapies in oncology, expanded data for TREMFYA® in psoriatic arthritis, and bleximenib in acute myeloid leukemia, all showcased at major international conferences.

- These simultaneous pipeline updates highlight the breadth of Johnson & Johnson's late- and early-stage R&D efforts, reinforcing its focus on specialty pharmaceuticals and accelerating innovation in high-need therapeutic areas.

- With IMAAVY™ showing sustained efficacy in a difficult-to-treat neurological condition, we'll look at how these positive data readouts inform Johnson & Johnson’s future investment narrative.

Johnson & Johnson Investment Narrative Recap

To own Johnson & Johnson stock, you generally have to back its long-term shift toward innovative medicines and specialty pharma, betting that a robust pipeline can offset looming biosimilar headwinds, notably STELARA's loss of exclusivity. Recent clinical updates reinforce the pipeline strength but do not materially change the biggest near-term catalyst, growth in next-generation therapies, or the major overhang, which remains ongoing legal risks including fresh talc verdicts.

Among the recent announcements, new data for IMAAVY™ in generalized myasthenia gravis stands out for its potential to strengthen Johnson & Johnson’s immunology franchise just as pressure mounts from biosimilar competition. Encouraging results here support the company’s efforts to build a more resilient portfolio to offset product and patent cycles.

Conversely, emerging legal exposures tied to the talc litigation highlight the kind of risk investors need to watch for...

Read the full narrative on Johnson & Johnson (it's free!)

Exploring Other Perspectives

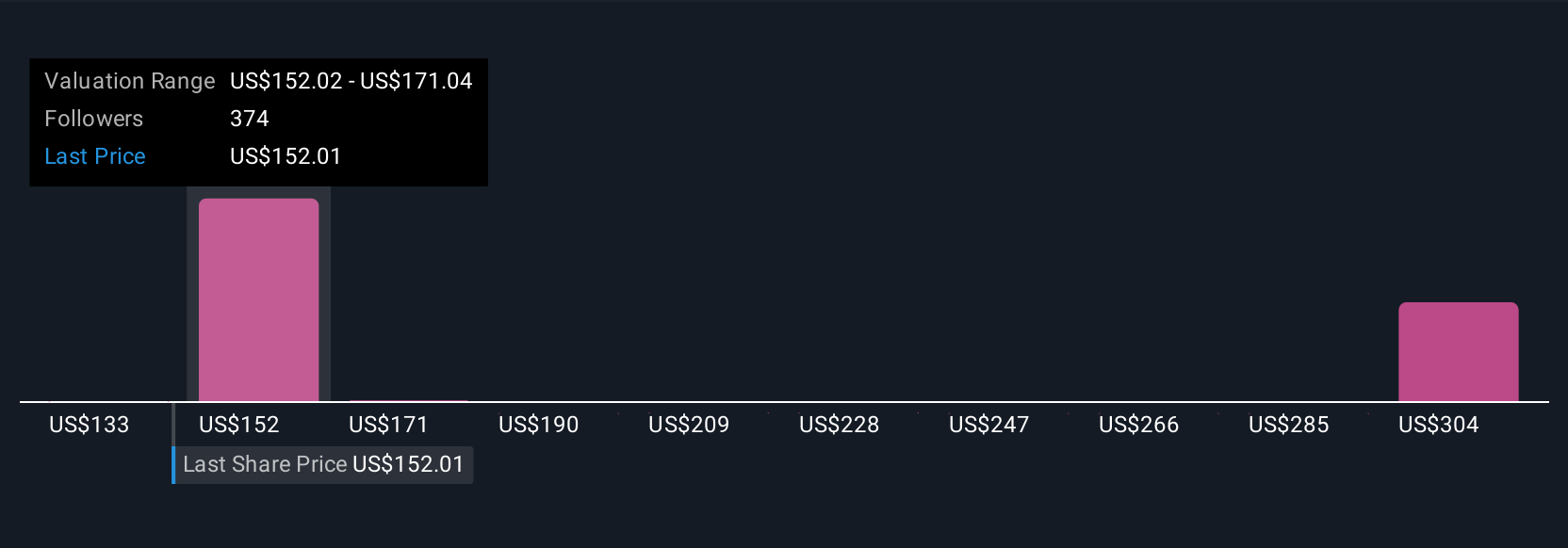

With 22 fair value estimates from the Simply Wall St Community ranging between US$133 and US$323, views on Johnson & Johnson’s future value run wide. While many foresee upside from the pipeline, recent legal setbacks could affect earnings and influence longer-term conviction among shareholders, explore the full spectrum of alternative viewpoints.

Build Your Own Johnson & Johnson Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Johnson & Johnson research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Johnson & Johnson research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Johnson & Johnson's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 23 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 24 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com