Hewlett Packard Enterprise (NYSE:HPE) recently announced an expanded collaboration with Veeam, a partnership with Miami Freedom Park, and enhancements to its GreenLake and AI solutions, which underline its commitment to innovation in data protection and operational efficiency. These initiatives likely supported the company's 14% share price increase in the last quarter, reflecting a stronger performance compared to the market's 12% rise over the past year. The company's focus on advanced technology and sustainability appears to have bolstered investor confidence, especially given its strategic alliances and product innovations during this period.

You should learn about the 3 warning signs we've spotted with Hewlett Packard Enterprise.

Hewlett Packard Enterprise's recent partnerships and developments, including its expanded collaboration with Veeam and enhancements to GreenLake and AI solutions, point toward potential enhancements in data protection and operational efficiency. These initiatives might bolster revenue growth, particularly as the company leverages its AI and cloud strategies to capture high-margin opportunities. However, regulatory hurdles and market challenges, such as the Department of Justice's lawsuit against the Juniper acquisition, could offset these potential gains, affecting profit margins and future earnings.

Over the longer term, HPE's shares have seen a total return of 125.90% over the past five years, despite underperforming the broader US market's 12.2% increase over the past year. In contrast, within the technology industry, HPE's recent initiatives have been key contributors to the company's recent quarter performance, which outpaced the market's annual return. However, with a price target of US$18.98 compared to the current share price of US$16.49, there remains room for growth.

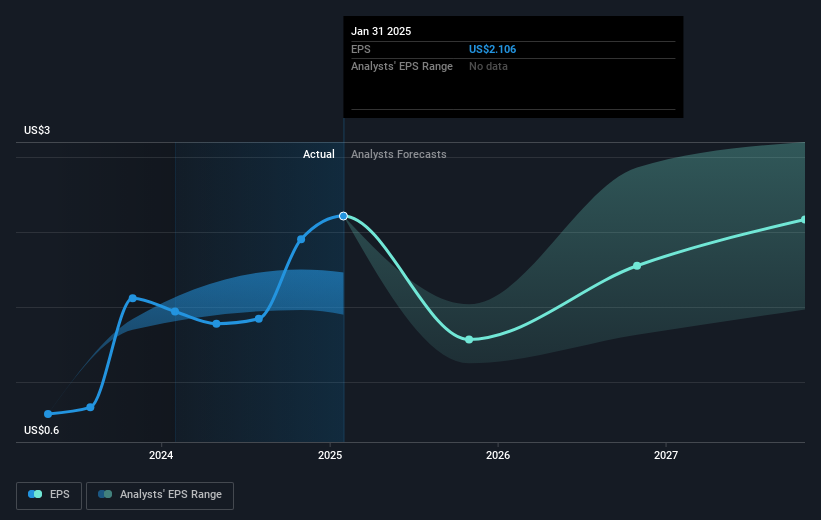

Analyst forecasts anticipate a 4.8% annual growth in revenue, with earnings projected to rise significantly to US$2.7 billion by mid-2028, although expected profit margins may contract. This growth relies heavily on the successful integration of acquisition synergies, effective workforce reductions, and smooth transitions in AI system inventory. The recent price movements, reflecting a share price still discounted to the analyst price target, suggest a market cautiously optimistic yet aware of HPE's potential setbacks.

Understand Hewlett Packard Enterprise's earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com