11 analysts have shared their evaluations of Waste Management (NYSE:WM) during the recent three months, expressing a mix of bullish and bearish perspectives.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 3 | 5 | 0 | 0 |

| Last 30D | 0 | 1 | 1 | 0 | 0 |

| 1M Ago | 1 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 1 | 3 | 0 | 0 |

| 3M Ago | 1 | 1 | 1 | 0 | 0 |

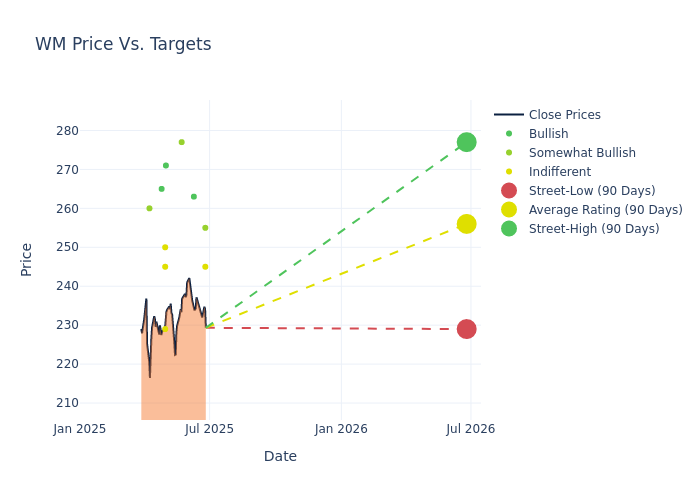

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $254.55, with a high estimate of $277.00 and a low estimate of $229.00. Marking an increase of 7.22%, the current average surpasses the previous average price target of $237.40.

Deciphering Analyst Ratings: An In-Depth Analysis

A comprehensive examination of how financial experts perceive Waste Management is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Devin Dodge | BMO Capital | Raises | Market Perform | $245.00 | $241.00 |

| Noah Kaye | Oppenheimer | Raises | Outperform | $255.00 | $251.00 |

| Rob Wertheimer | Melius Research | Announces | Buy | $263.00 | - |

| Tami Zakaria | JP Morgan | Raises | Overweight | $277.00 | $225.00 |

| Bryan Burgmeier | Citigroup | Raises | Buy | $271.00 | $260.00 |

| Sabahat Khan | RBC Capital | Raises | Sector Perform | $229.00 | $227.00 |

| David Manthey | Baird | Raises | Neutral | $245.00 | $235.00 |

| Jon Windham | UBS | Raises | Neutral | $250.00 | $240.00 |

| Wesley Brooks | HSBC | Raises | Buy | $265.00 | $210.00 |

| Jon Windham | UBS | Raises | Neutral | $240.00 | $230.00 |

| Konark Gupta | Scotiabank | Raises | Sector Outperform | $260.00 | $255.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Waste Management. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Waste Management compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Waste Management's stock. This comparison reveals trends in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Waste Management's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Waste Management analyst ratings.

Discovering Waste Management: A Closer Look

WM ranks as the largest integrated provider of traditional solid waste services in the United States, operating 263 active landfills and about 332 transfer stations. The company serves residential, commercial, industrial, and medical end markets and is also a leading recycler in North America.

Understanding the Numbers: Waste Management's Finances

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Positive Revenue Trend: Examining Waste Management's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 16.65% as of 31 March, 2025, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: Waste Management's net margin is impressive, surpassing industry averages. With a net margin of 10.58%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Waste Management's ROE stands out, surpassing industry averages. With an impressive ROE of 7.54%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 1.43%, the company showcases effective utilization of assets.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 2.76, caution is advised due to increased financial risk.

How Are Analyst Ratings Determined?

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.