Veeva Systems (NYSE:VEEV) recently expanded its collaboration with Amazon Web Services, enhancing its cloud capabilities, alongside significant advancements in regulatory information management with Grunenthal. These initiatives align well with the company's growth, potentially contributing to its 21% stock price increase over the last month. This increase significantly surpasses the market's monthly rise of about 2%. Veeva's solid earnings performance and strategic partnerships with medtech firms further bolstered investor confidence, providing a robust foundation for its price movement within the market trends.

Buy, Hold or Sell Veeva Systems? View our complete analysis and fair value estimate and you decide.

Veeva Systems' recent collaboration with Amazon Web Services and advancements with Grunenthal could significantly influence its long-term performance narrative. These strategic partnerships are designed to enhance Veeva's cloud capabilities, potentially driving new revenue channels and improving operational efficiencies. Such initiatives may aid in achieving its 2030 revenue goal of US$6 billion, as they align with the pharmaceutical industry's trend of vendor consolidation for efficiency and speed.

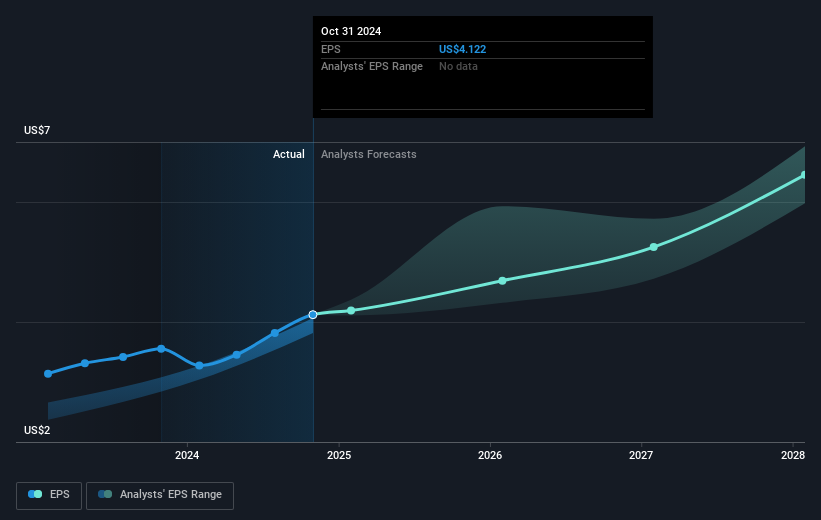

Over the past year, Veeva's total shareholder return, including share price gains and dividends, was 52.84%. This performance considerably outpaced both the US healthcare services industry, which returned 35%, and the broader US market's 12.2% return. Analysts forecast that Veeva's revenue will grow at 10.8% per year, outpacing the US market's average of 8.7%. In terms of earnings, Veeva is expected to see annual growth of 15.2%, exceeding the 14.5% forecast for the US market.

The recent developments may positively impact Veeva's revenue and earnings forecasts, with AI efficiencies and platform improvements expected to enhance margins. Currently, with a share price of US$232.81 and an analyst consensus price target of US$262.35, Veeva's potential upside is approximately 11.3%. This movement should be assessed in the context of projected revenue reaching US$3.9 billion and earnings reaching US$1.1 billion by 2028, supported by a PE ratio adjustment from 53.0x to 48.0x based on anticipated growth. Investors should consider these factors to determine their suitability for inclusion in a diversified portfolio.

Review our growth performance report to gain insights into Veeva Systems' future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com