ZIM Integrated Shipping Services (NYSE:ZIM) recently reported impressive first-quarter earnings for 2025, with net income rising substantially to USD 295 million and a decrease in its dividend payout to USD 0.74 per share. Despite a 1.43% price move over the last quarter, ZIM's performance aligns with the broader market's upward trend, which rose 1.9% in the past week and 12% over the year. New vessel charter agreements, expected to boost service capabilities, add a positive outlook for future utility though their full impact remains pending. The 1.43% increase seems consistent with overall market dynamics.

The recent earnings announcement from ZIM Integrated Shipping Services, showing a significant improvement in net income, reflects a robust operational phase. However, the decrease in dividend payout to US$0.74 per share signals a potential cautionary approach in capital allocation. With a modest 1.43% share price increase over the last quarter, the market sentiment appears moderately optimistic yet tempered by broader sector dynamics.

Over a longer period, ZIM's total shareholder return has reached 15.62% over the past year. Compared to the shipping industry, where the average return over the same period was a decline of 20.3%, ZIM's performance stands out positively despite recent challenges. The company's current share price of US$14.72, when juxtaposed with the consensus analyst price target of US$14.25, suggests limited immediate upside, though it is crucial for investors to form their personalized viewpoint.

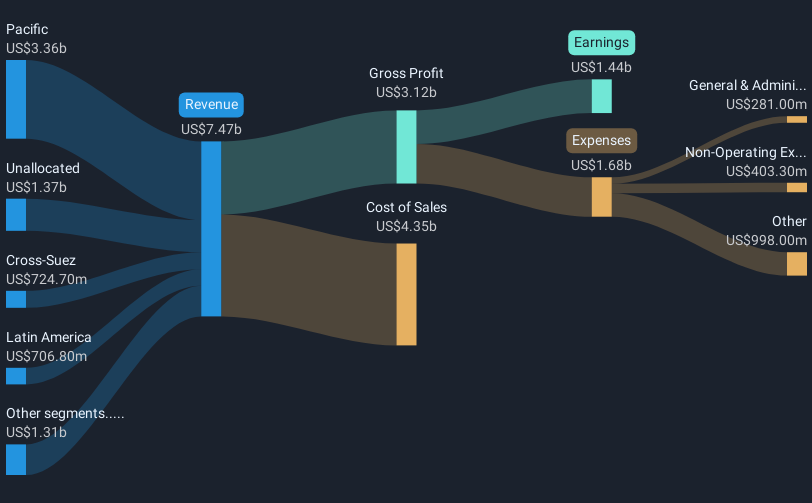

The projections of new port charges and potential trade disputes pose considerable risks to future revenue and earnings. Analysts forecast a substantial 16.9% annual decline in revenue over the next three years. These evolving dynamics, combined with geopolitical uncertainties and declining freight rates, could pressure ZIM's financial outcomes, affecting both near-term earnings forecasts and longer-term growth assumptions. It's essential to monitor how ZIM maneuvers through these operational challenges to sustain its performance trajectory.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com