Keurig Dr Pepper (NasdaqGS:KDP) recently announced its partnership with Chillhouse, enhancing its product allure with a unique blend of coffee and lifestyle experiences. Last month, the company's share price moved up by 1.91%, closely reflecting the broader market's 1.9% rise in the past week. The collaboration, which introduced innovative products like the K-Brew + Chill™ and a co-branded manicure, aligns with the company's commitment to consumer-focused convenience. While these initiatives reinforce brand innovation, the stock's movement parallels general market trends, suggesting these developments may have complemented broader market gains rather than solely driving the change.

The recent partnership between Keurig Dr Pepper and Chillhouse is poised to inject new life into the company's brand. By combining unique coffee and lifestyle experiences, this collaboration could enhance the appeal of Keurig Dr Pepper's offerings, potentially leading to positive shifts in consumer preferences. Over the past five years, the company's total shareholder return, including dividends, was 30.72%. Despite a challenging year where Keurig Dr Pepper underperformed the US market's 12.2% return, the long-term returns provide a sturdy backdrop for investors assessing this latest strategic move.

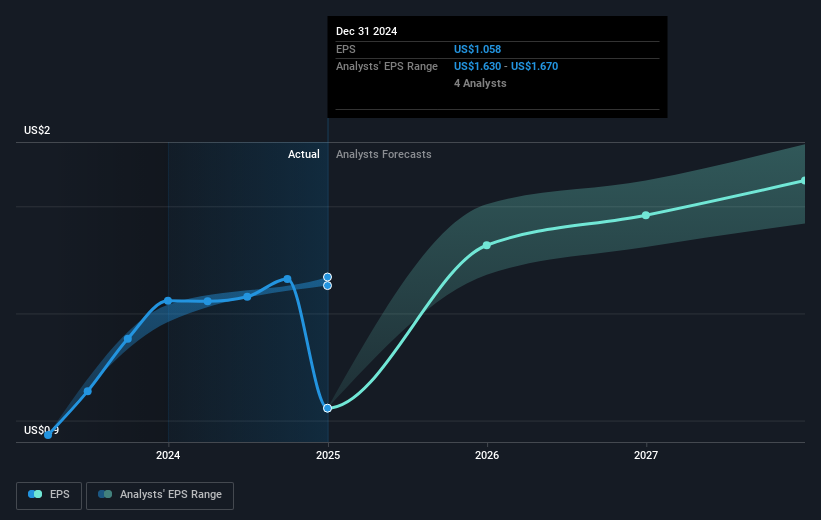

This new initiative may also impact revenue and earnings forecasts. Analysts project a 3.9% annual revenue growth, which remains slightly conservative compared to the US market's anticipated 8.7% growth. With efforts to innovate through strategic partnerships like the Chillhouse collaboration, there is potential for increased consumer attraction, possibly fueling revenue and earnings growth beyond current expectations. However, cost pressures in certain segments could offset these gains if not managed effectively.

With a current share price around $34.12 and a consensus analyst target of $38.62, there is an 11.6% potential upside to the stock. This implies room for growth should the new partnership successfully translate into higher revenue and improved margins. Yet, the price movement, aligned closely with market trends, suggests a broader market influence on the stock price beyond just this recent announcement. Investors are encouraged to weigh these factors and monitor how this partnership influences Keurig Dr Pepper's trajectory in the months ahead.

Assess Keurig Dr Pepper's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com