State Street (NYSE:STT) recently made headlines with its appointment as fund administrator and transfer agent for COtwo Advisors, potentially bolstering its portfolio of services in the expanding carbon market. Despite a wider market climb of 12% over the past year, State Street's price move of 12% in the last quarter may have been more influenced by recent corporate activities, such as the integration of its LINK trading platform and executive appointments enhancing leadership stability. These developments likely complemented broader market gains, underlining investor confidence in the company's strategic growth and operational enhancements.

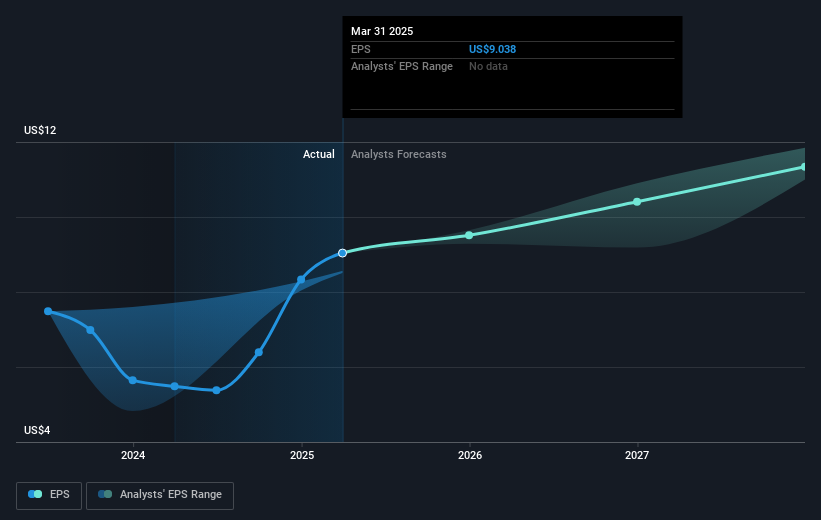

State Street's recent engagement as fund administrator and transfer agent for COtwo Advisors may enhance its footprint in the carbon market, potentially boosting service-related revenues. By integrating initiatives like LINK trading and strengthening leadership, the company appears to be setting a foundation for sustained growth in an evolving market. These actions can have a ripple effect on revenue and earnings forecasts, as analysts project revenue to grow 3% annually over the next few years, despite facing economic uncertainties and a fluctuating interest rate environment.

Over a five-year period, State Street has generated an impressive total return of 93.20% when accounting for share price appreciation and dividends. This performance aligns with the company's broader efforts to expand offerings and increase efficiency. In comparison to the broader market over the past year, State Street outperformed, demonstrating substantial growth compared to the US Capital Markets industry return of 27.3%. The current share price of US$90.75, when viewed against the analyst consensus price target of US$105.33, indicates potential upside, suggesting positive investor sentiment aligned with the company's operational enhancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com