On June 24, 2025, Raytheon announced a significant $250 million contract with Mitsubishi Electric Corporation for missile production, enhancing its position in the defense sector. Over the last month, RTX (NYSE:RTX) experienced a 7% price increase. This positive movement aligns with broader market trends, which saw a rise of 1.9% over the past week and 12% over the year. The company's recent contract wins and technological advancements, such as the SPY-6 radar support contract and successful rocket motor tests, likely strengthened investor confidence, contributing positively to its share price performance.

Raytheon's recent $250 million contract with Mitsubishi Electric Corporation for missile production could potentially bolster its revenue stream, an aspect emphasized in analysts' forecasts of 5.2% annual revenue growth over the next three years. This development comes as RTX has shown significant resilience, with an impressive total shareholder return of 159.86% over the past five years up to June 2025, underscoring investor confidence. However, share price movements, while positive at 7% in the last month, show only a modest discount of approximately 1.50% to the current analyst price target of US$143.98.

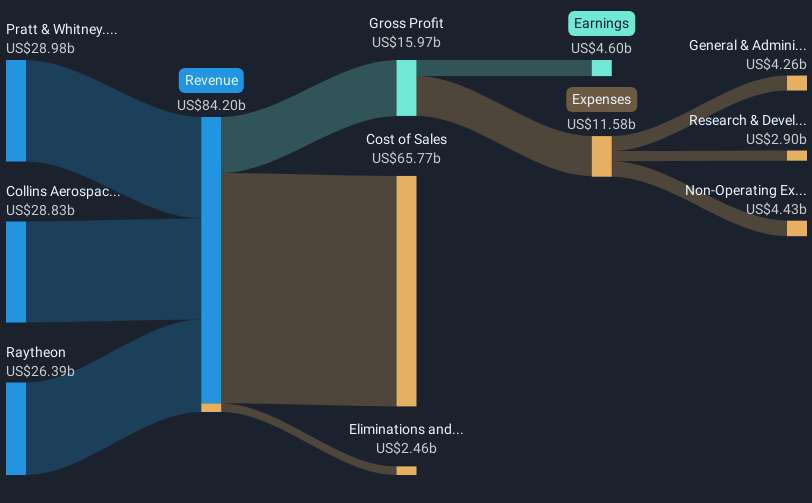

Compared to the market, RTX has outpaced the US Aerospace & Defense industry’s annual return of 37% in the past year. This contract, alongside recent innovations like the GTF Advantage and LTAMDS, could further solidify RTX’s position in the defense sector. Analyst expectations indicate earnings could rise to US$8.5 billion by 2028, suggesting increasing profitability. However, the contract’s implications on earnings might be tempered by broader operational risks, such as tariffs and supply chain challenges, which remain a concern for sustaining profit margins.

The valuation report we've compiled suggests that RTX's current price could be inflated.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com