Stryker (NYSE:SYK) recently received FDA clearance for its Incompass® Total Ankle System, a significant product innovation that highlights the company's commitment to advancing patient care. Over the last quarter, Stryker's stock price moved up by 5%, a performance that comfortably exceeds the broader market's 1.9% increase over the same period. While the FDA clearance news likely supported this uptrend, other developments—such as the company's robust Q1 earnings and increased dividend declaration—would have further strengthened investor confidence. Together, these factors underscore Stryker's strategic positioning in a market showing consistent growth trends.

You should learn about the 3 risks we've spotted with Stryker.

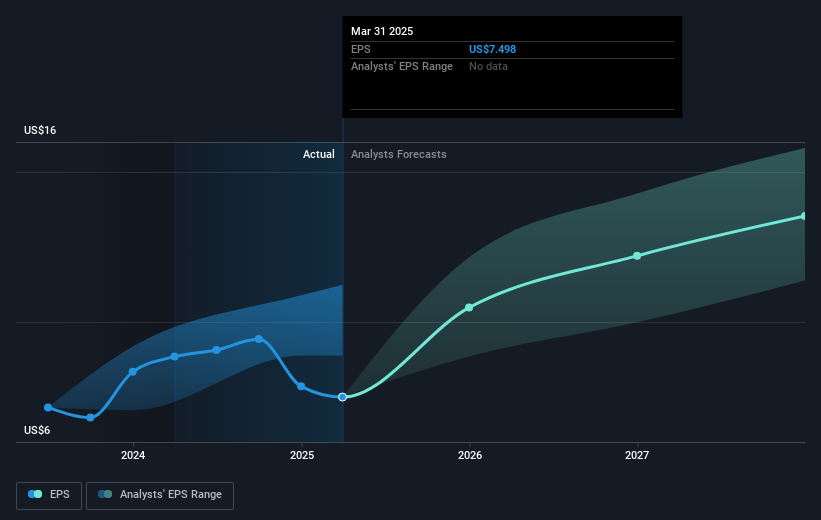

The recent FDA clearance for Stryker’s Incompass® Total Ankle System is expected to enhance its competitive edge and potentially drive further revenue and earnings growth. With the company operating in a consistently expanding market, this approval could bolster Stryker's Robotics and Orthopaedics segments, aligning with forecasted earnings growth. Analysts anticipate earnings reaching US$5.2 billion by May 2028, suggesting that continued innovation like the Incompass® system may support these projections, given Stryker's historical ability to integrate such advancements into its expansion strategy.

Over a five-year period, Stryker has achieved a total shareholder return of 121.01%, underscoring its long-term growth trajectory. This performance contrasts with the one-year return of 12.2% for the broader U.S. market and 9.2% for the U.S. Medical Equipment industry. The company's success has been bolstered by its ongoing international expansion and adoption of robotic-assisted surgeries, which are poised to drive revenue, particularly following product launches such as the Mako systems.

Although Stryker's current share price of US$377.52 suggests a discount compared to the consensus price target of US$424.26, the FDA clearance could act as a catalyst for future upward momentum in its stock value. The price target, reflecting an 11.0% increase from today's price, assumes Stryker's continued ability to manage economic headwinds, such as tariff impacts and supply chain disruptions, through operational efficiencies and integration of strategic acquisitions. Investors should remain cautious, considering both the positive potential of recent news and the challenges posed by external economic factors.

Learn about Stryker's historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com