Gilead Sciences (NasdaqGS:GILD) recently entered an exclusive agreement with Kymera Therapeutics to advance a molecular glue degrader program targeting CDK2, enhancing its oncology pipeline. Additionally, the FDA approved Yeztugo as a breakthrough HIV prevention option. Both events underscore Gilead's strength in innovation. Despite these developments, Gilead's share price remained flat over the past month, contrasting with the broader market's 1.9% rise in seven days. While these initiatives add positive weight to Gilead's trajectory, the price move was largely aligned with general market trends, without distinct deviation from market dynamics.

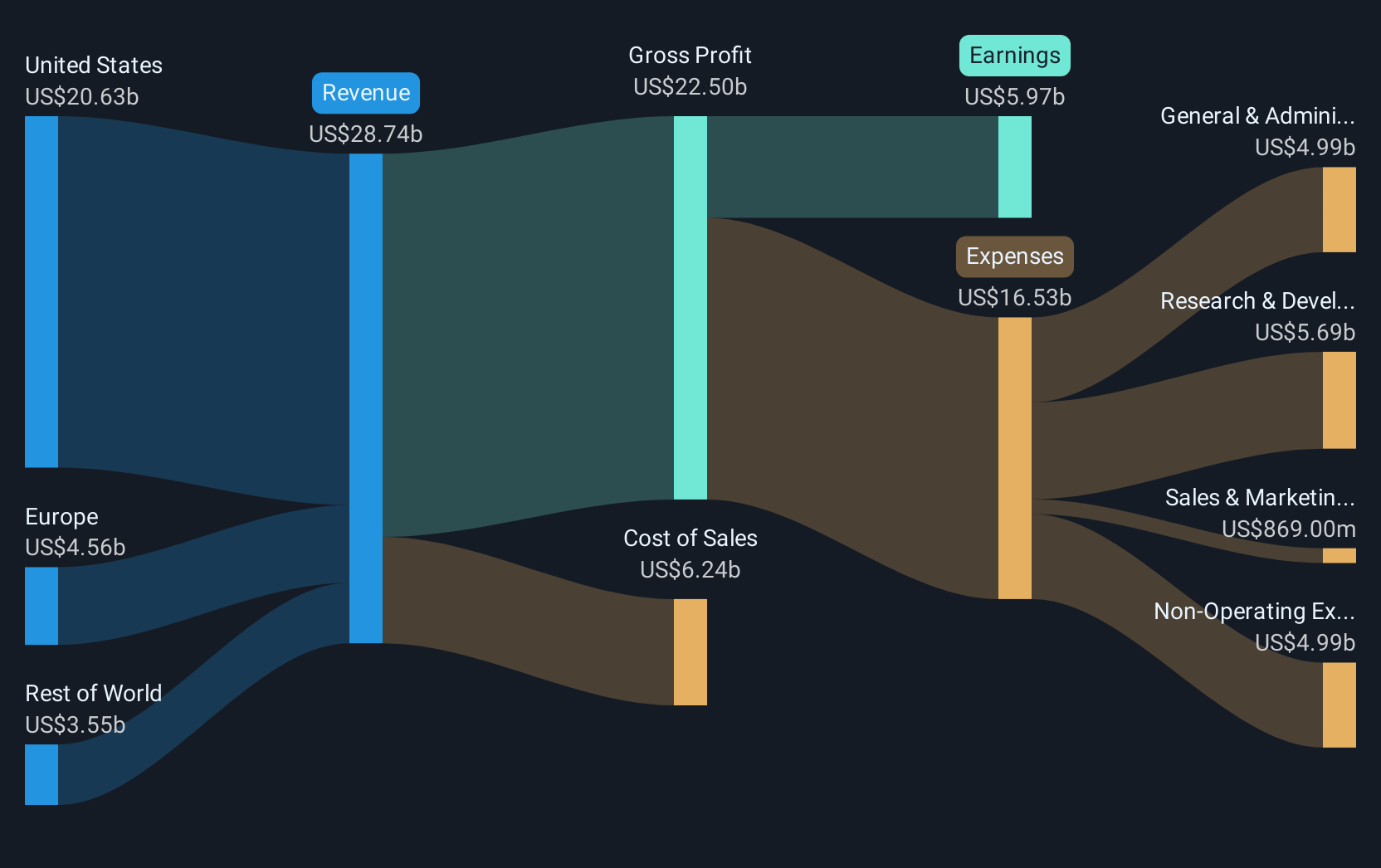

The recent FDA approval of Yeztugo for HIV prevention and the exclusive agreement with Kymera Therapeutics could significantly impact Gilead Sciences’ revenue and earnings forecasts. These advancements are expected to enhance its oncology pipeline and bolster its position in the HIV therapy market, potentially leading to expanded revenue channels. This newfound potential aligns with the company's strategy to capture larger markets and diversify its top line, supporting the optimistic forecast of a 5.7% annual revenue growth over the next three years.

Over the past three years, Gilead's total return has reached 91.82%, reflecting solid long-term performance. This is despite recent share price stagnation amid broader market movements. Over the past year, Gilead has exceeded the US Biotechs industry, which returned a decline. Analysts' consensus places the future value of Gilead at US$116.77 per share, a slight discount from the current US$97.88. However, bullish projections estimate a price of US$140.00, indicating potential for upside if the company's innovative efforts translate to financial growth. Despite some challenges like pricing pressures and competition, these strategic introductions may counterbalance risks, fostering sustained growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com