Marriott International (NasdaqGS:MAR) recently announced a multi-unit agreement to introduce four new City Express by Marriott properties in El Salvador, marking the brand's entry into the country. The expansion aligns with Marriott's growth strategy in the Caribbean and Latin America region. During the last quarter, Marriott's stock price rose by nearly 10%, a notable increase compared to the market's 12% rise over the past 12 months. The company's robust earnings growth and strategic market expansions would have supported Marriott's performance, aligning with broader market trends seen in the recent 1.9% market climb.

Outshine the giants: these 21 early-stage AI stocks could fund your retirement.

The recent expansion announcement of Marriott International's City Express by Marriott properties in El Salvador aligns with its strategy for growth in the Caribbean and Latin America. This move is expected to bolster future revenue and earnings forecasts by enhancing Marriott's market presence and diversifying its portfolio. This expansion could reinforce investor confidence, potentially narrowing the discount between the current share price of US$251.96 and the analyst consensus price target of US$271.87, which is a 7.3% increase from its current level. Given Marriott's existing revenue of US$6.68 billion and earnings of US$2.48 billion, such expansion efforts could lend substantial support to its long-term growth trajectory despite macroeconomic uncertainties.

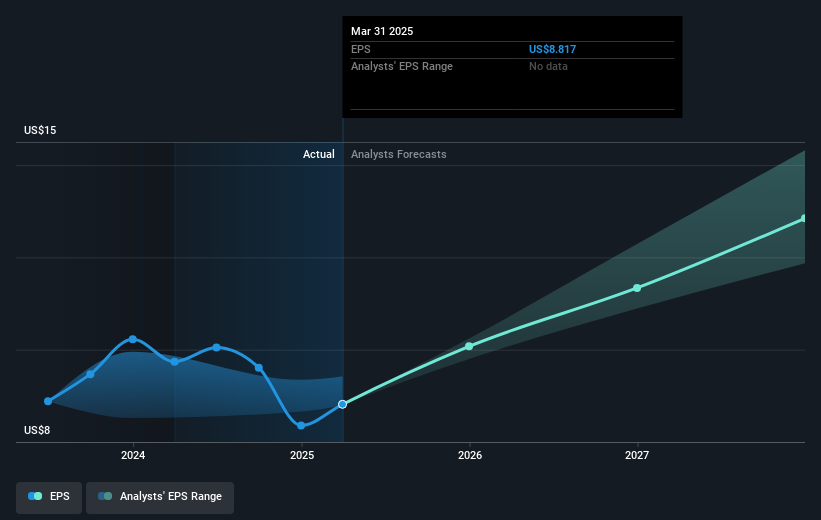

Over the past five years, Marriott's total shareholder return was 220.12%, indicating strong long-term performance. However, in the last year, the company's share price did not outperform the U.S. Hospitality industry, which saw an 18% increase, as opposed to Marriott's share performance slightly below that. The stock price gain of nearly 10% in the last quarter relative to a 12% market rise suggests momentum, but highlights a short-term variability against its industry benchmark. The new ventures into El Salvador and continual digital enhancements suggest a positive outlook for long-term revenue growth, essential for achieving the 23.5% annual revenue growth forecast, which exceeds the market's expected 8.7% rise. This provides a basis for potential earnings of US$3.4 billion by 2028 amid evolving market conditions.

Understand Marriott International's track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com