Oracle (NYSE:ORCL) experienced a 48% price increase over the last quarter, aligning with several pivotal developments. Notably, Fortify Children's Health's utilization of Oracle Health Data Intelligence highlighted the firm's innovation in enhancing pediatric care, which could have influenced investor confidence. Additionally, fourth-quarter earnings showed increased revenue and net income, supporting Oracle's robust performance. The announcement of quarterly cash dividends may also have bolstered shareholder sentiment. While these factors supported Oracle's strong returns, the overall market rose 12% over the past year, indicating Oracle's move was robust, yet broadly in line with market trends.

Be aware that Oracle is showing 2 weaknesses in our investment analysis.

Find companies with promising cash flow potential yet trading below their fair value.

The recent developments at Oracle, including its collaboration with Fortify Children's Health and solid fourth-quarter earnings, are likely to reinforce its strong market performance. These initiatives could drive greater investor confidence, potentially boosting predicted revenue and earnings. The alliance in pediatric care showcases Oracle's innovation, aligning with its cloud expansion narrative. Such technological ventures might amplify projected revenue and support earnings growth if Oracle capitalizes on increased AI demand and database migration through its multi-cloud partnerships.

Over a more extended period, Oracle's shares have delivered a total return of 317.75% over five years, a substantial growth demonstrating its successful trajectory. Comparatively, over the past year, Oracle has outperformed the broader U.S. market, which rose 12.2%. Furthermore, Oracle's returns surpassed those of the U.S. Software industry, which saw a 19.7% increase over the same year, underscoring Oracle's robust relative performance.

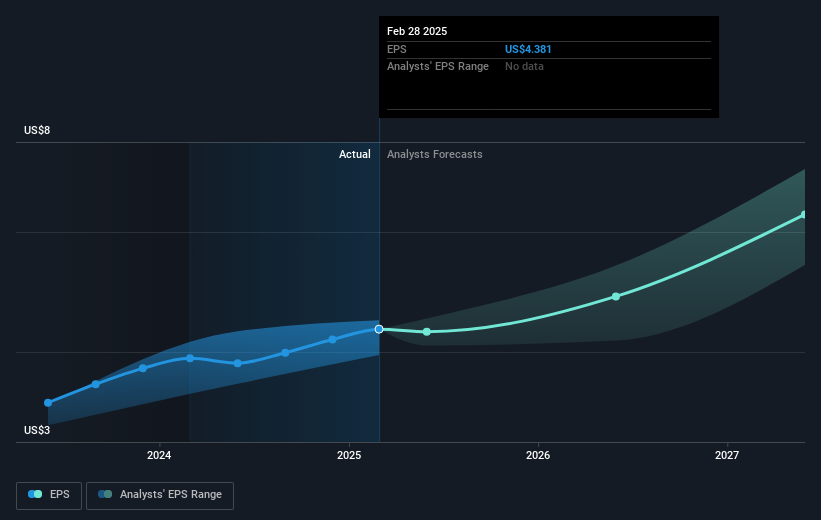

The recent share price rise of 48% in a quarter shows a degree of alignment with optimistic future revenue and earnings forecasts. Analysts estimate revenue growth of 15.8% annually over the next three years, alongside increasing profit margins. However, execution risks and currency volatility could impact earnings. Currently, Oracle's share price is slightly below the consensus price target of US$178.12, suggesting potential room for growth amid accelerated cloud performance and strategic initiatives. Investors are encouraged to evaluate these factors alongside Oracle's expanding cloud infrastructure capabilities and evolving market position.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com