Throughout the last three months, 11 analysts have evaluated BioNTech (NASDAQ:BNTX), offering a diverse set of opinions from bullish to bearish.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 8 | 1 | 2 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 3 | 0 | 1 | 0 | 0 |

| 2M Ago | 3 | 1 | 1 | 0 | 0 |

| 3M Ago | 1 | 0 | 0 | 0 | 0 |

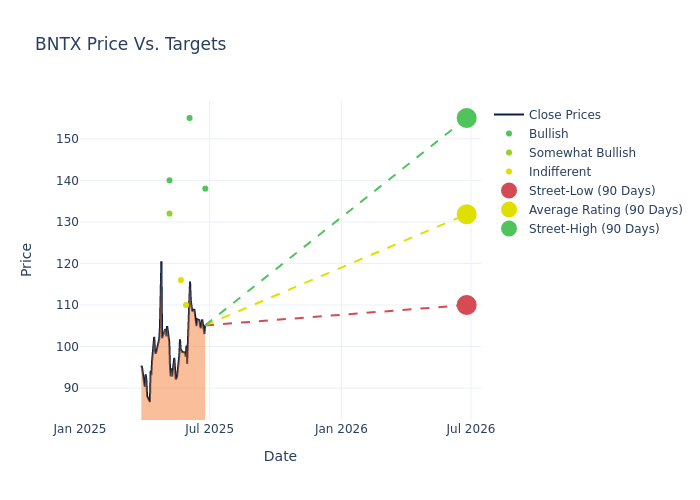

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $135.18, with a high estimate of $155.00 and a low estimate of $110.00. Highlighting a 3.58% decrease, the current average has fallen from the previous average price target of $140.20.

Understanding Analyst Ratings: A Comprehensive Breakdown

An in-depth analysis of recent analyst actions unveils how financial experts perceive BioNTech. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Robert Burns | HC Wainwright & Co. | Maintains | Buy | $138.00 | $138.00 |

| Robert Burns | HC Wainwright & Co. | Lowers | Buy | $138.00 | $145.00 |

| Robert Burns | HC Wainwright & Co. | Raises | Buy | $145.00 | $134.00 |

| Asthika Goonewardene | Truist Securities | Raises | Buy | $155.00 | $151.00 |

| Asad Haider | Goldman Sachs | Announces | Neutral | $110.00 | - |

| Jessica Fye | JP Morgan | Lowers | Neutral | $116.00 | $120.00 |

| Robert Burns | HC Wainwright & Co. | Maintains | Buy | $134.00 | $134.00 |

| Robert Burns | HC Wainwright & Co. | Lowers | Buy | $134.00 | $145.00 |

| Geoff Meacham | Citigroup | Lowers | Buy | $140.00 | $145.00 |

| Terence Flynn | Morgan Stanley | Lowers | Overweight | $132.00 | $140.00 |

| Robert Burns | HC Wainwright & Co. | Lowers | Buy | $145.00 | $150.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to BioNTech. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of BioNTech compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of BioNTech's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on BioNTech analyst ratings.

Get to Know BioNTech Better

BioNTech is a Germany-based biotechnology company that focuses on developing cancer therapeutics, including individualized immunotherapy, as well as vaccines for infectious diseases, including covid. The company's oncology pipeline contains several classes of drugs, including mRNA-based drugs to encode antigens, neoantigens, cytokines, and antibodies; cell therapies; bispecific antibodies; and antibody-drug conjugates, or ADCs. BioNTech is partnered with several large pharmaceutical companies, including Roche, Eli Lilly, Pfizer, Sanofi, and Genmab. Covid vaccine Comirnaty is its first commercialized product.

Financial Insights: BioNTech

Market Capitalization: Indicating a reduced size compared to industry averages, the company's market capitalization poses unique challenges.

Decline in Revenue: Over the 3M period, BioNTech faced challenges, resulting in a decline of approximately -2.56% in revenue growth as of 31 March, 2025. This signifies a reduction in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Health Care sector.

Net Margin: BioNTech's net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of -227.46%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of -2.17%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): BioNTech's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of -1.9%, the company may face hurdles in achieving optimal financial performance.

Debt Management: BioNTech's debt-to-equity ratio is below the industry average. With a ratio of 0.02, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Understanding the Relevance of Analyst Ratings

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.