Those holding Herbalife Ltd. (NYSE:HLF) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 21% in the last twelve months.

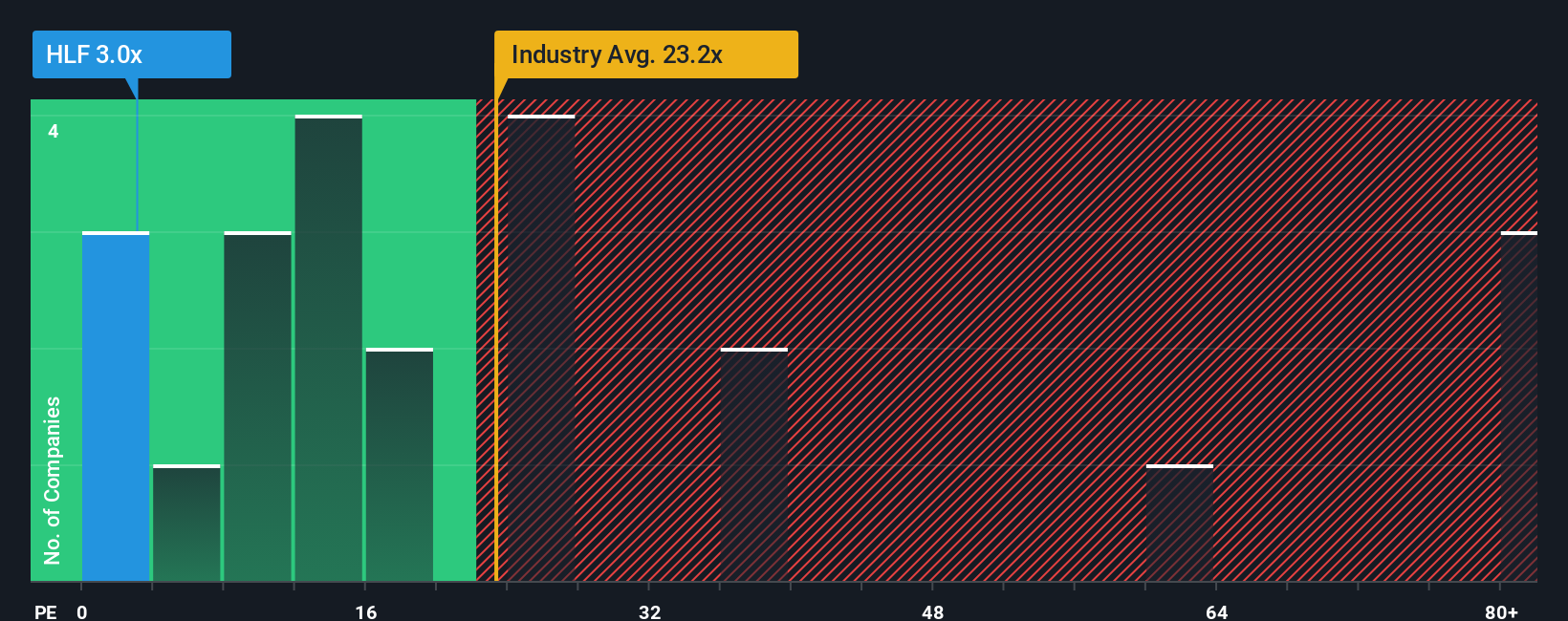

Although its price has surged higher, Herbalife may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 3x, since almost half of all companies in the United States have P/E ratios greater than 19x and even P/E's higher than 33x are not unusual. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's superior to most other companies of late, Herbalife has been doing relatively well. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Herbalife

Is There Any Growth For Herbalife?

The only time you'd be truly comfortable seeing a P/E as depressed as Herbalife's is when the company's growth is on track to lag the market decidedly.

Retrospectively, the last year delivered an exceptional 101% gain to the company's bottom line. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 28% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the three analysts covering the company suggest earnings growth is heading into negative territory, declining 30% over the next year. That's not great when the rest of the market is expected to grow by 13%.

In light of this, it's understandable that Herbalife's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What We Can Learn From Herbalife's P/E?

Shares in Herbalife are going to need a lot more upward momentum to get the company's P/E out of its slump. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Herbalife maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Herbalife (3 are concerning!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.