Across the recent three months, 11 analysts have shared their insights on Danaher (NYSE:DHR), expressing a variety of opinions spanning from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 7 | 0 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 4 | 6 | 0 | 0 | 0 |

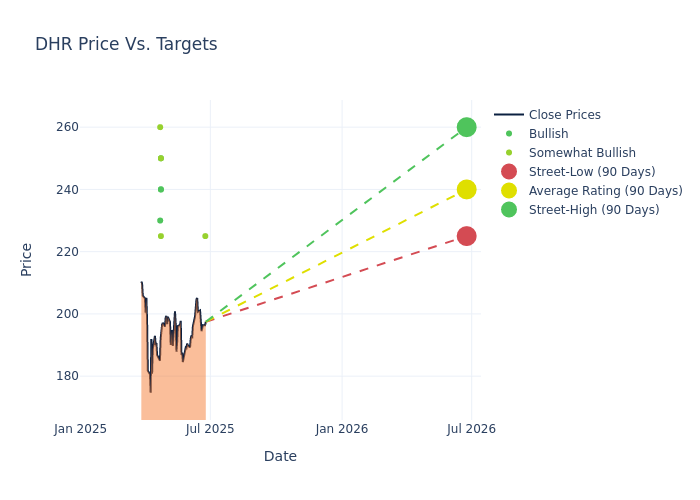

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $233.73, with a high estimate of $260.00 and a low estimate of $205.00. A negative shift in sentiment is evident as analysts have decreased the average price target by 5.62%.

Deciphering Analyst Ratings: An In-Depth Analysis

A clear picture of Danaher's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Luke Sergott | Barclays | Raises | Overweight | $225.00 | $215.00 |

| Conor McNamara | RBC Capital | Maintains | Outperform | $250.00 | $250.00 |

| Matthew Sykes | Goldman Sachs | Lowers | Buy | $240.00 | $260.00 |

| Subbu Nambi | Guggenheim | Maintains | Buy | $250.00 | $250.00 |

| Dan Leonard | UBS | Lowers | Buy | $240.00 | $275.00 |

| Catherine Schulte | Baird | Lowers | Outperform | $225.00 | $231.00 |

| Luke Sergott | Barclays | Raises | Overweight | $215.00 | $205.00 |

| Tycho Peterson | JP Morgan | Lowers | Overweight | $260.00 | $280.00 |

| Tycho Peterson | Jefferies | Lowers | Buy | $230.00 | $260.00 |

| Catherine Schulte | Baird | Lowers | Outperform | $231.00 | $258.00 |

| Luke Sergott | Barclays | Lowers | Overweight | $205.00 | $240.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Danaher. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Danaher compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Danaher's stock. This comparison reveals trends in analysts' expectations over time.

Capture valuable insights into Danaher's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Danaher analyst ratings.

About Danaher

In 1984, Danaher's founders transformed a real estate organization into an industrial-focused manufacturing company. Then, through a series of mergers, acquisitions, and divestitures, Danaher now focuses primarily on manufacturing scientific instruments and consumables in the life science and diagnostic industries after the late 2023 divestiture of its environmental and applied solutions group, Veralto.

Understanding the Numbers: Danaher's Finances

Market Capitalization Analysis: With a profound presence, the company's market capitalization is above industry averages. This reflects substantial size and strong market recognition.

Revenue Challenges: Danaher's revenue growth over 3M faced difficulties. As of 31 March, 2025, the company experienced a decline of approximately -0.95%. This indicates a decrease in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Health Care sector.

Net Margin: Danaher's net margin excels beyond industry benchmarks, reaching 16.62%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Danaher's ROE excels beyond industry benchmarks, reaching 1.9%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 1.22%, the company showcases effective utilization of assets.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.32.

Analyst Ratings: What Are They?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.