Providing a diverse range of perspectives from bullish to bearish, 12 analysts have published ratings on United Rentals (NYSE:URI) in the last three months.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 5 | 4 | 2 | 0 | 1 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 1 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 3 | 2 | 0 | 0 |

| 3M Ago | 2 | 1 | 0 | 0 | 1 |

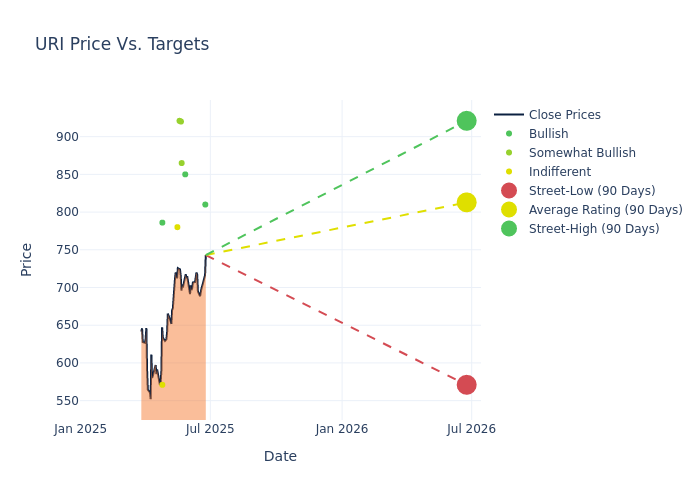

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $760.0, a high estimate of $921.00, and a low estimate of $485.00. Highlighting a 2.81% decrease, the current average has fallen from the previous average price target of $782.00.

Analyzing Analyst Ratings: A Detailed Breakdown

A comprehensive examination of how financial experts perceive United Rentals is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Kyle Menges | Citigroup | Raises | Buy | $810.00 | $740.00 |

| Jerry Revich | Goldman Sachs | Raises | Buy | $850.00 | $770.00 |

| Ken Newman | Keybanc | Announces | Overweight | $865.00 | - |

| Tami Zakaria | JP Morgan | Raises | Overweight | $920.00 | $780.00 |

| David Raso | Evercore ISI Group | Lowers | Outperform | $921.00 | $974.00 |

| Steven Fisher | UBS | Raises | Neutral | $780.00 | $485.00 |

| Jamie Cook | Truist Securities | Raises | Buy | $786.00 | $732.00 |

| Mircea Dobre | Baird | Raises | Neutral | $571.00 | $535.00 |

| Tami Zakaria | JP Morgan | Lowers | Overweight | $750.00 | $1000.00 |

| Kyle Menges | Citigroup | Lowers | Buy | $650.00 | $720.00 |

| Jamie Cook | Truist Securities | Lowers | Buy | $732.00 | $956.00 |

| Steven Fisher | UBS | Lowers | Sell | $485.00 | $910.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to United Rentals. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of United Rentals compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of United Rentals's stock. This analysis reveals shifts in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of United Rentals's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on United Rentals analyst ratings.

Delving into United Rentals's Background

United Rentals is the world's largest equipment rental company. It principally operates in the United States and Canada, where it commands approximately 15% share in a highly fragmented market. It serves three end markets: general industrial, commercial construction, and residential construction. Like its peers, United Rentals historically has provided its customers with equipment that was intermittently used, such as aerial equipment and portable generators. As the company has grown organically and through hundreds of acquisitions since it went public in 1997, its catalog (fleet size of $21 billion) now includes a range of specialty equipment and other items that can be rented for indefinite periods. 2024 revenue totaled $15.3 billion.

Unraveling the Financial Story of United Rentals

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Revenue Growth: United Rentals displayed positive results in 3M. As of 31 March, 2025, the company achieved a solid revenue growth rate of approximately 6.71%. This indicates a notable increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Industrials sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 13.93%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 5.95%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): United Rentals's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 1.84%, the company showcases efficient use of assets and strong financial health.

Debt Management: United Rentals's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 1.59.

The Basics of Analyst Ratings

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.