Providing a diverse range of perspectives from bullish to bearish, 25 analysts have published ratings on Dollar Tree (NASDAQ:DLTR) in the last three months.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 9 | 3 | 12 | 1 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 4 | 2 | 7 | 0 | 0 |

| 2M Ago | 2 | 0 | 0 | 0 | 0 |

| 3M Ago | 3 | 1 | 4 | 1 | 0 |

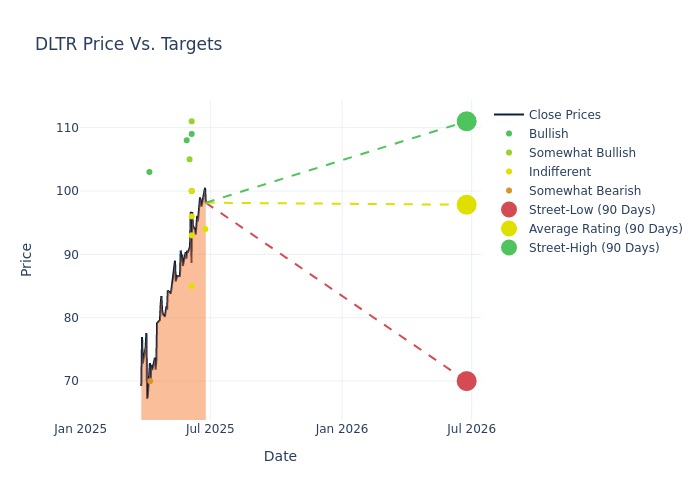

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $93.52, with a high estimate of $111.00 and a low estimate of $70.00. Witnessing a positive shift, the current average has risen by 8.95% from the previous average price target of $85.84.

Deciphering Analyst Ratings: An In-Depth Analysis

A clear picture of Dollar Tree's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Greg Melich | Evercore ISI Group | Raises | In-Line | $94.00 | $92.00 |

| Simeon Gutman | Morgan Stanley | Raises | Equal-Weight | $96.00 | $80.00 |

| Peter Keith | Piper Sandler | Raises | Neutral | $93.00 | $72.00 |

| Kelly Bania | BMO Capital | Raises | Market Perform | $85.00 | $80.00 |

| John Heinbockel | Guggenheim | Maintains | Buy | $100.00 | $100.00 |

| Scot Ciccarelli | Truist Securities | Raises | Buy | $109.00 | $100.00 |

| Greg Melich | Evercore ISI Group | Raises | In-Line | $92.00 | $86.00 |

| Matthew Boss | JP Morgan | Raises | Overweight | $111.00 | $72.00 |

| Joseph Feldman | Telsey Advisory Group | Raises | Market Perform | $100.00 | $95.00 |

| Joseph Feldman | Telsey Advisory Group | Maintains | Market Perform | $95.00 | $95.00 |

| Edward Kelly | Wells Fargo | Raises | Overweight | $105.00 | $90.00 |

| Scot Ciccarelli | Truist Securities | Raises | Buy | $100.00 | $89.00 |

| Michael Lasser | UBS | Raises | Buy | $108.00 | $95.00 |

| Joseph Feldman | Telsey Advisory Group | Raises | Market Perform | $95.00 | $82.00 |

| Scot Ciccarelli | Truist Securities | Raises | Buy | $89.00 | $84.00 |

| John Heinbockel | Guggenheim | Raises | Buy | $100.00 | $95.00 |

| Robert Ohmes | B of A Securities | Lowers | Underperform | $70.00 | $75.00 |

| Paul Lejuez | Citigroup | Raises | Buy | $103.00 | $76.00 |

| Edward Kelly | Wells Fargo | Raises | Overweight | $90.00 | $85.00 |

| Greg Melich | Evercore ISI Group | Lowers | In-Line | $79.00 | $85.00 |

| John Heinbockel | Guggenheim | Lowers | Buy | $95.00 | $100.00 |

| Matthew Boss | JP Morgan | Lowers | Neutral | $78.00 | $88.00 |

| Scot Ciccarelli | Truist Securities | Raises | Buy | $84.00 | $76.00 |

| Greg Melich | Evercore ISI Group | Raises | In-Line | $85.00 | $79.00 |

| Joseph Feldman | Telsey Advisory Group | Raises | Market Perform | $82.00 | $75.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Dollar Tree. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Dollar Tree compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Dollar Tree's stock. This comparison reveals trends in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Dollar Tree's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Dollar Tree analyst ratings.

Delving into Dollar Tree's Background

Dollar Tree operates discount stores across the United States and Canada, with over 8,800 shops under its namesake banner. About 50% of Dollar Tree's sales in fiscal 2024 were consumables (including food, health and beauty, and cleaning products), around 45% variety items (including toys and homewares), and 5% seasonal items. Dollar Tree sells most of its merchandise at the $1.25 price point and positions its stores in well-populated suburban markets. The retailer has agreed to sell Family Dollar (with about 7,000 stores) to private equity investors for $1 billion.

Key Indicators: Dollar Tree's Financial Health

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Revenue Growth: Over the 3M period, Dollar Tree showcased positive performance, achieving a revenue growth rate of 11.29% as of 30 April, 2025. This reflects a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Consumer Staples sector.

Net Margin: Dollar Tree's net margin is impressive, surpassing industry averages. With a net margin of 7.4%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 8.71%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Dollar Tree's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 1.86%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: With a high debt-to-equity ratio of 2.03, Dollar Tree faces challenges in effectively managing its debt levels, indicating potential financial strain.

Analyst Ratings: Simplified

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.