FactSet Research Systems (NYSE:FDS) posted mixed results for the third quarter on Monday.

The company reported quarterly sales of $585.52 million, surpassing analyst expectations of $580.50 million and representing a 5.9% year-over-year gain. The company reported quarterly adjusted earnings per share of $4.27, missing the street view of $4.29.

“We are pleased with our third quarter performance, which reflects the execution of our enterprise solution strategy. With a healthy pipeline and increased momentum, we are well-positioned to finish the fiscal year with strength,” said Phil Snow, CEO of FactSet. “As FactSet prepares for its next chapter of leadership, I’m proud of the solid foundation we’ve established, built on innovation, client trust, and industry-leading data and workflow solutions. This platform gives me great conviction in the Company’s continued success.”

FactSet reiterated its adjusted diluted EPS outlook of $16.80 to $17.40 versus the consensus of $17.07. The company reiterated revenues of $2.305 billion-$2.325 billion versus the consensus of $2.310 billion. FactSet maintained an adjusted operating margin of 36%-37%.

FactSet Research shares fell 0.3% to trade at $435.65 on Tuesday.

These analysts made changes to their price targets on FactSet Research following earnings announcement.

- Morgan Stanley analyst Toni Kaplan maintained FactSet Research Systems with an Underweight rating and raised the price target from $390 to $393.

- Wells Fargo analyst Jason Haas maintained the stock with an Underweight rating and raised the price target from $402 to $405.

- RBC Capital analyst Ashish Sabadra reiterated FactSet Research with a Sector Perform and maintained a $503 price target.

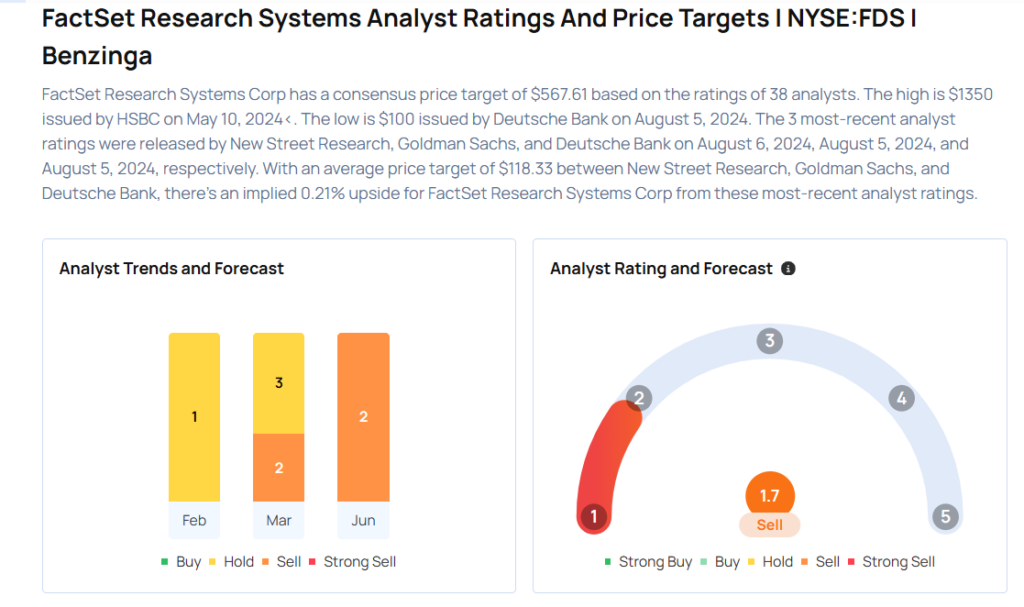

Considering buying FDS stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock