Top 3 Real Estate Stocks You May Want To Dump In June

Benzinga · 2d ago

Share

Listen to the news

As of June 24, 2025, three stocks in the real estate sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here's the latest list of major overbought players in this sector.

Jones Lang LaSalle Inc (NYSE:JLL)

- On May 7, JLL named Kelly Howe as CFO, effective July 1. The company's stock jumped around 11% over the past month and has a 52-week high of $288.50.

- RSI Value: 70.9

- JLL Price Action: Shares of Jones Lang LaSalle gained 3.8% to close at $247.58 on Monday.

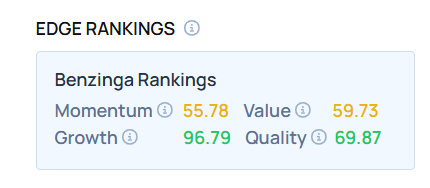

- Edge Stock Ratings: 55.78 Momentum score with Value at 59.73.

Hudson Pacific Properties Inc (NYSE:HPP)

- On June 16, Hudson Pacific Properties announced a $300 million investment from Cohen & Steers to support the company’s balance sheet recapitalization.. The company's stock gained around 41% over the past month and has a 52-week high of $6.28.

- RSI Value: 72.6

- HPP Price Action: Shares of Hudson Pacific Properties fell 1.1% to close at $2.80 on Monday.

WP Carey Inc (NYSE:WPC)

- On June 12, W. P. Carey increased its dividend from 89 cents to 90 cents per share. The company's stock gained around 3% over the past month and has a 52-week high of $66.10.

- RSI Value: 71.3

- WPC Price Action: Shares of WP Carey gained 1.8% to close at $64.53 on Tuesday.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

Photo via Shutterstock

Disclaimer:This article represents the opinion of the author only. It does not represent the opinion of Webull, nor should it be viewed as an indication that Webull either agrees with or confirms the truthfulness or accuracy of the information. It should not be considered as investment advice from Webull or anyone else, nor should it be used as the basis of any investment decision.

What's Trending

No content on the Webull website shall be considered a recommendation or solicitation for the purchase or sale of securities, options or other investment products. All information and data on the website is for reference only and no historical data shall be considered as the basis for judging future trends.

Copyright © 2025 Webull. All Rights Reserved