Olaplex Holdings, Inc. (NASDAQ:OLPX) shares have had a really impressive month, gaining 26% after a shaky period beforehand. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 5.1% over the last year.

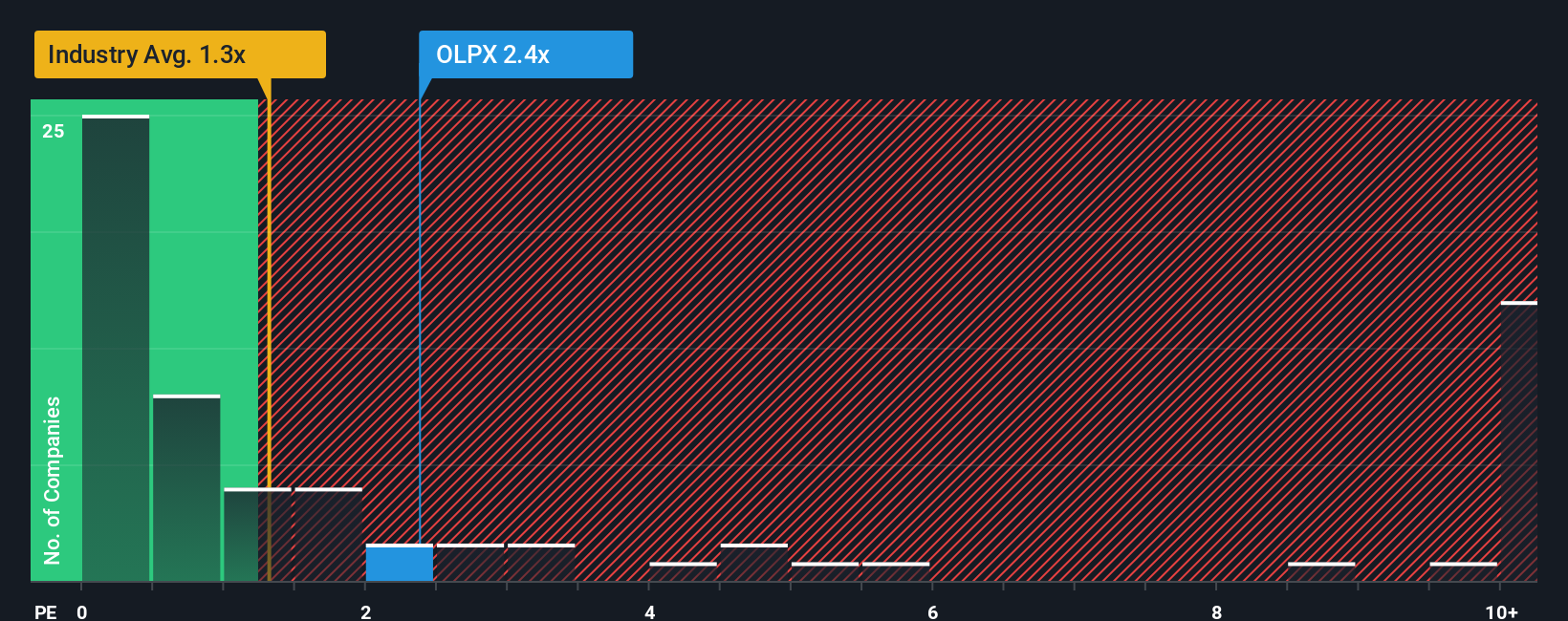

After such a large jump in price, given close to half the companies operating in the United States' Personal Products industry have price-to-sales ratios (or "P/S") below 1.3x, you may consider Olaplex Holdings as a stock to potentially avoid with its 2.4x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Olaplex Holdings

What Does Olaplex Holdings' Recent Performance Look Like?

Olaplex Holdings hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Olaplex Holdings' future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Olaplex Holdings?

The only time you'd be truly comfortable seeing a P/S as high as Olaplex Holdings' is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a frustrating 5.1% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 37% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 0.4% as estimated by the eight analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 4.1%, which is noticeably more attractive.

With this in consideration, we believe it doesn't make sense that Olaplex Holdings' P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What Does Olaplex Holdings' P/S Mean For Investors?

The large bounce in Olaplex Holdings' shares has lifted the company's P/S handsomely. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It comes as a surprise to see Olaplex Holdings trade at such a high P/S given the revenue forecasts look less than stellar. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

Before you settle on your opinion, we've discovered 1 warning sign for Olaplex Holdings that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.