This Dow Analyst Is No Longer Bullish; Here Are Top 5 Downgrades For Monday

Benzinga · 3d ago

Share

Listen to the news

Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades, downgrades and initiations, please see our analyst ratings page.

- Jefferies analyst Hamzah Mazari downgraded Bright Horizons Family Solutions Inc. (NYSE:BFAM) from Buy to Hold and lowered the price target from $146 to $135. Bright Horizons Family shares closed at $122.33 on Friday. See how other analysts view this stock.

- JP Morgan analyst Anthony Paolone downgraded the rating for Howard Hughes Holdings Inc. (NYSE:HHH) from Overweight to Neutral and lowered the price target from $82 to $76. Howard Hughes shares closed at $69.26 on Friday. See how other analysts view this stock.

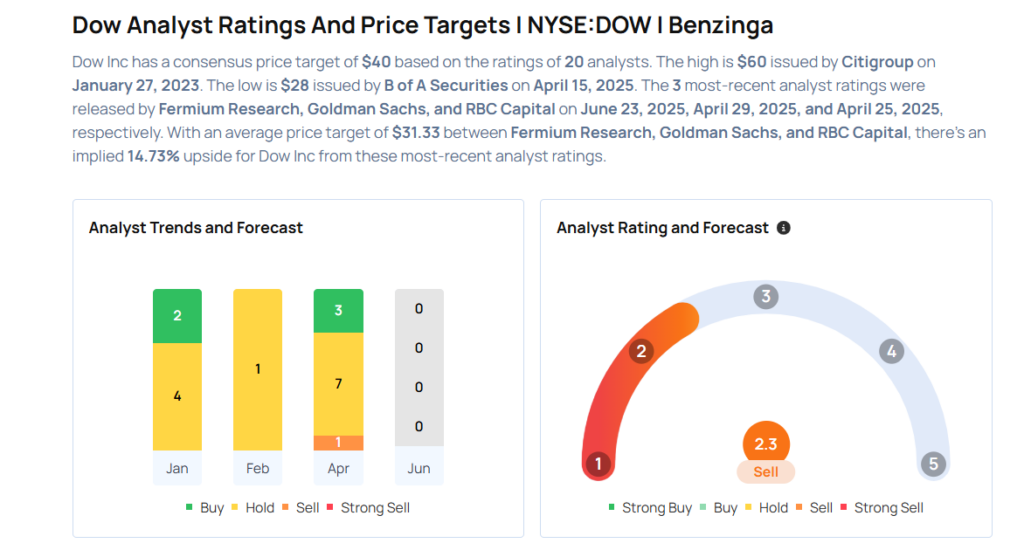

- Fermium Research analyst Frank Mitsch downgraded Dow Inc. (NYSE:DOW) from Buy to Hold and announced a $30 price target. Dow shares closed at $27.76 on Friday. See how other analysts view this stock.

- Keybanc analyst Sangita Jain downgraded the rating for KBR, Inc. (NYSE:KBR) from Overweight to Sector Weight. KBR shares closed at $48.93 on Friday. See how other analysts view this stock.

- JP Morgan analyst Michael Mueller downgraded Lineage, Inc. (NASDAQ:LINE) from Neutral to Underweight and slashed the price target from $55 to $50. Lineage shares closed at $44.76 on Friday. See how other analysts view this stock.

Considering buying DOW stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Disclaimer:This article represents the opinion of the author only. It does not represent the opinion of Webull, nor should it be viewed as an indication that Webull either agrees with or confirms the truthfulness or accuracy of the information. It should not be considered as investment advice from Webull or anyone else, nor should it be used as the basis of any investment decision.

What's Trending

No content on the Webull website shall be considered a recommendation or solicitation for the purchase or sale of securities, options or other investment products. All information and data on the website is for reference only and no historical data shall be considered as the basis for judging future trends.

Copyright © 2025 Webull. All Rights Reserved