The United States market has remained flat over the past week but shows a 10.0% increase over the past year, with earnings projected to grow by 15% annually. In such a climate, identifying stocks that are potentially undervalued can offer opportunities for investors looking to capitalize on assets priced below their estimated value.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Verra Mobility (VRRM) | $24.17 | $48.02 | 49.7% |

| Valley National Bancorp (VLY) | $8.67 | $17.22 | 49.7% |

| TransMedics Group (TMDX) | $123.56 | $246.12 | 49.8% |

| StoneCo (STNE) | $14.52 | $29.00 | 49.9% |

| Roku (ROKU) | $80.99 | $160.61 | 49.6% |

| Peoples Financial Services (PFIS) | $46.96 | $93.66 | 49.9% |

| Horizon Bancorp (HBNC) | $14.60 | $29.08 | 49.8% |

| First Internet Bancorp (INBK) | $23.32 | $46.30 | 49.6% |

| Central Pacific Financial (CPF) | $26.09 | $51.99 | 49.8% |

| Arrow Financial (AROW) | $25.09 | $49.68 | 49.5% |

Let's explore several standout options from the results in the screener.

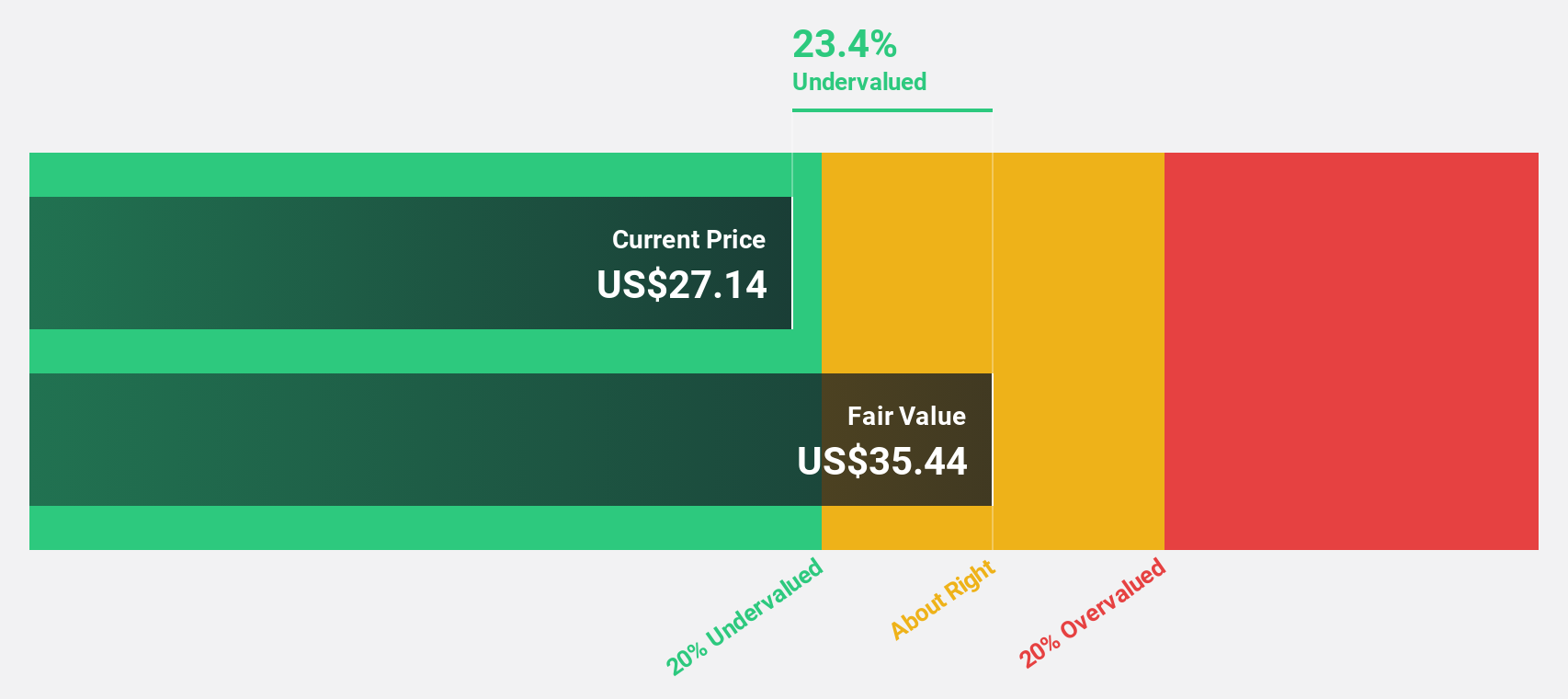

Sportradar Group (SRAD)

Overview: Sportradar Group AG, operating globally across various regions including Switzerland and the United States, offers sports data services for the sports betting and media industries, with a market cap of $7.59 billion.

Operations: The company's revenue is primarily derived from its data processing segment, which generated €1.15 billion.

Estimated Discount To Fair Value: 27.7%

Sportradar Group's recent partnership with DAZN for the FIFA Club World Cup 2025 enhances its extensive soccer portfolio, potentially boosting cash flows. The company's earnings have grown significantly, and it trades at a discount to its estimated fair value of US$35.13 per share. Despite forecasted revenue growth being slower than 20% annually, Sportradar's earnings are expected to outpace the broader US market growth rate, highlighting its potential as an undervalued stock based on cash flows.

- The analysis detailed in our Sportradar Group growth report hints at robust future financial performance.

- Dive into the specifics of Sportradar Group here with our thorough financial health report.

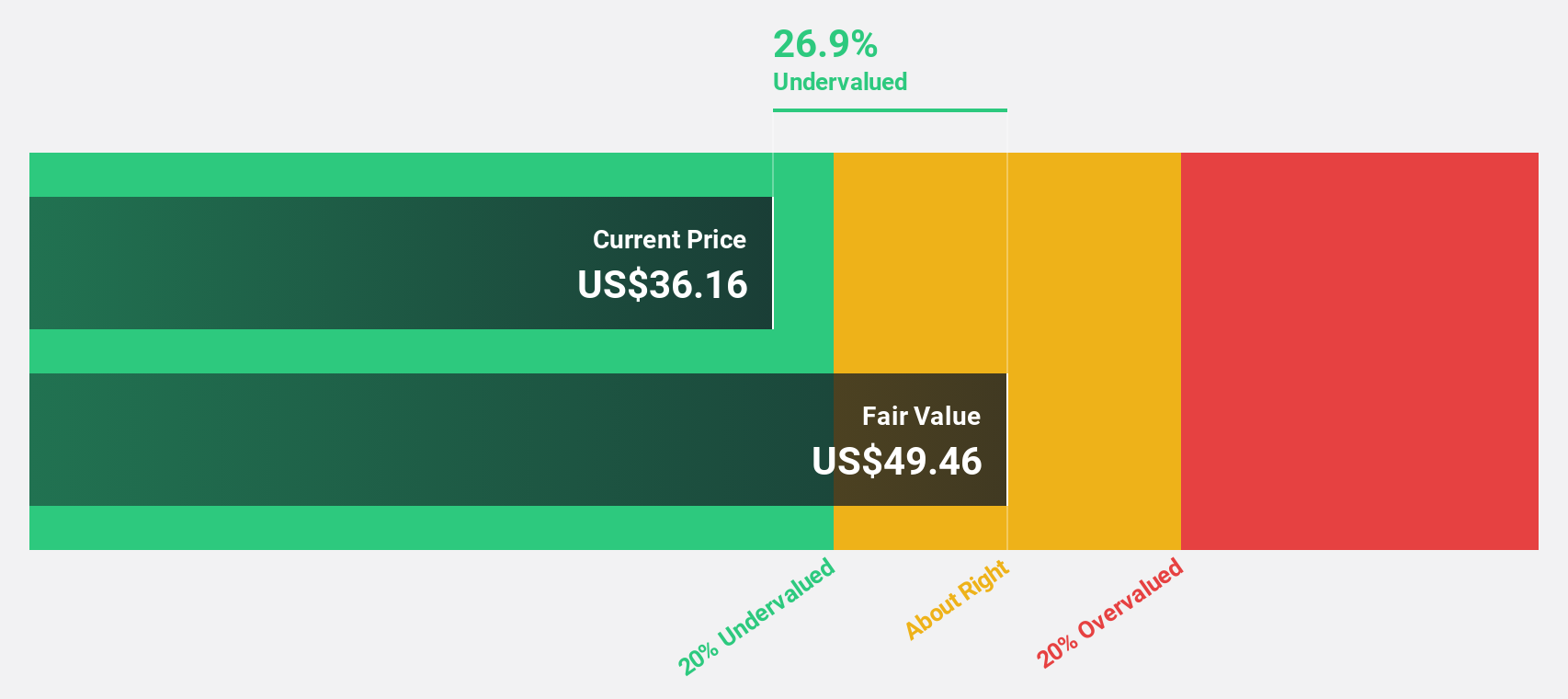

American Healthcare REIT (AHR)

Overview: American Healthcare REIT, Inc. is a self-managed real estate investment trust that acquires, owns, and operates a diversified portfolio of clinical healthcare properties such as senior housing and skilled nursing facilities, with a market cap of approximately $5.79 billion.

Operations: The company generates revenue from various segments, including $133.87 million from outpatient medical buildings, $278.80 million from its Shop segment, $49.02 million from triple-net leased properties, and $1.65 billion from integrated senior health campuses.

Estimated Discount To Fair Value: 27.6%

American Healthcare REIT is trading at US$35.87, significantly below its estimated fair value of US$49.52, suggesting potential undervaluation based on cash flows. Despite recent shareholder dilution and a dividend not fully covered by free cash flows, the company's earnings are projected to grow 42.93% annually with revenue growth outpacing the broader US market at 8.7% per year. Recent guidance revisions indicate improved financial performance for 2025, enhancing its attractiveness as an investment prospect.

- The growth report we've compiled suggests that American Healthcare REIT's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of American Healthcare REIT.

Corebridge Financial (CRBG)

Overview: Corebridge Financial, Inc. offers retirement solutions and insurance products in the United States with a market cap of $17.94 billion.

Operations: Corebridge Financial, Inc.'s revenue is primarily derived from its Individual Retirement segment at $7.20 billion, followed by Life Insurance at $4.26 billion, Institutional Markets at $4.03 billion, and Group Retirement at $2.71 billion.

Estimated Discount To Fair Value: 26.2%

Corebridge Financial, trading at US$32.63, is undervalued relative to its estimated fair value of US$44.24, presenting a potential opportunity based on cash flows. Despite a challenging first quarter with a net loss of US$664 million and revenue decline, earnings are projected to grow 36.3% annually, outpacing the broader market. Recent share buybacks totaling US$2.69 billion may enhance shareholder value despite current financial pressures from high debt levels and reduced profit margins.

- Upon reviewing our latest growth report, Corebridge Financial's projected financial performance appears quite optimistic.

- Take a closer look at Corebridge Financial's balance sheet health here in our report.

Taking Advantage

- Click through to start exploring the rest of the 168 Undervalued US Stocks Based On Cash Flows now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com