In the current U.S. market, stocks are experiencing mixed performance amid geopolitical tensions and fluctuating oil prices, with major indices like the S&P 500 and Nasdaq Composite seeing slight declines. In this environment, growth companies with high insider ownership can be particularly appealing as they often demonstrate strong alignment between management and shareholder interests, potentially leading to robust earnings growth even amidst economic uncertainties.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Zapp Electric Vehicles Group (ZAPP.F) | 16.1% | 120.2% |

| Super Micro Computer (SMCI) | 16.2% | 39.1% |

| Ryan Specialty Holdings (RYAN) | 15.5% | 91% |

| QT Imaging Holdings (QTIH) | 26.7% | 84.5% |

| Prairie Operating (PROP) | 34.5% | 75.7% |

| FTC Solar (FTCI) | 28.3% | 62.5% |

| Enovix (ENVX) | 12.1% | 58.4% |

| Credo Technology Group Holding (CRDO) | 12.1% | 45% |

| Atour Lifestyle Holdings (ATAT) | 22.6% | 24.1% |

| Astera Labs (ALAB) | 14.8% | 44.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

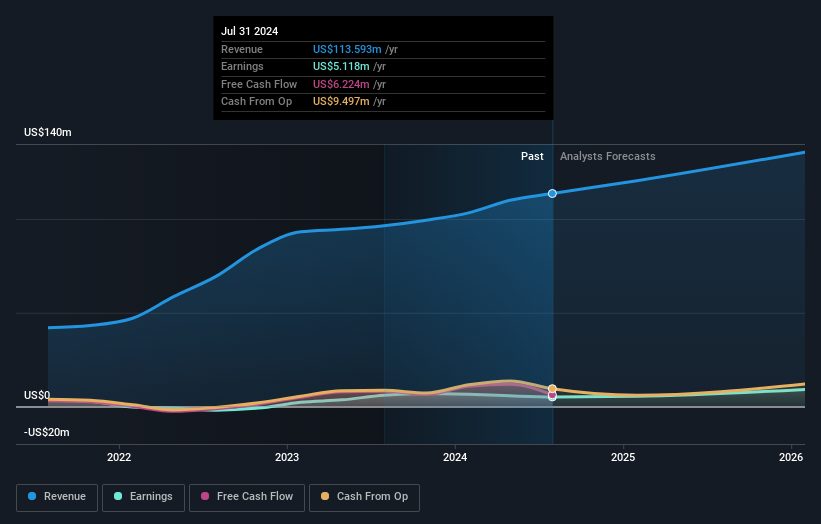

Mama's Creations (MAMA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mama's Creations, Inc., along with its subsidiaries, manufactures and markets fresh deli-prepared foods in the United States and has a market cap of approximately $299.38 million.

Operations: The company's revenue is primarily derived from its food processing segment, which generated $128.75 million.

Insider Ownership: 10.3%

Earnings Growth Forecast: 45.5% p.a.

Mama's Creations, Inc. demonstrates potential as a growth company with high insider ownership, driven by forecasted earnings growth of 45.5% per year, outpacing the US market. Recent Q1 results show increased sales (US$35.26 million) and net income (US$1.24 million), reflecting operational improvements despite lower profit margins compared to last year. The company's presence at IDDBA 2025 highlights its expanding product portfolio and commitment to innovation in deli solutions, supporting future revenue growth prospects above the market average.

- Click to explore a detailed breakdown of our findings in Mama's Creations' earnings growth report.

- Our comprehensive valuation report raises the possibility that Mama's Creations is priced higher than what may be justified by its financials.

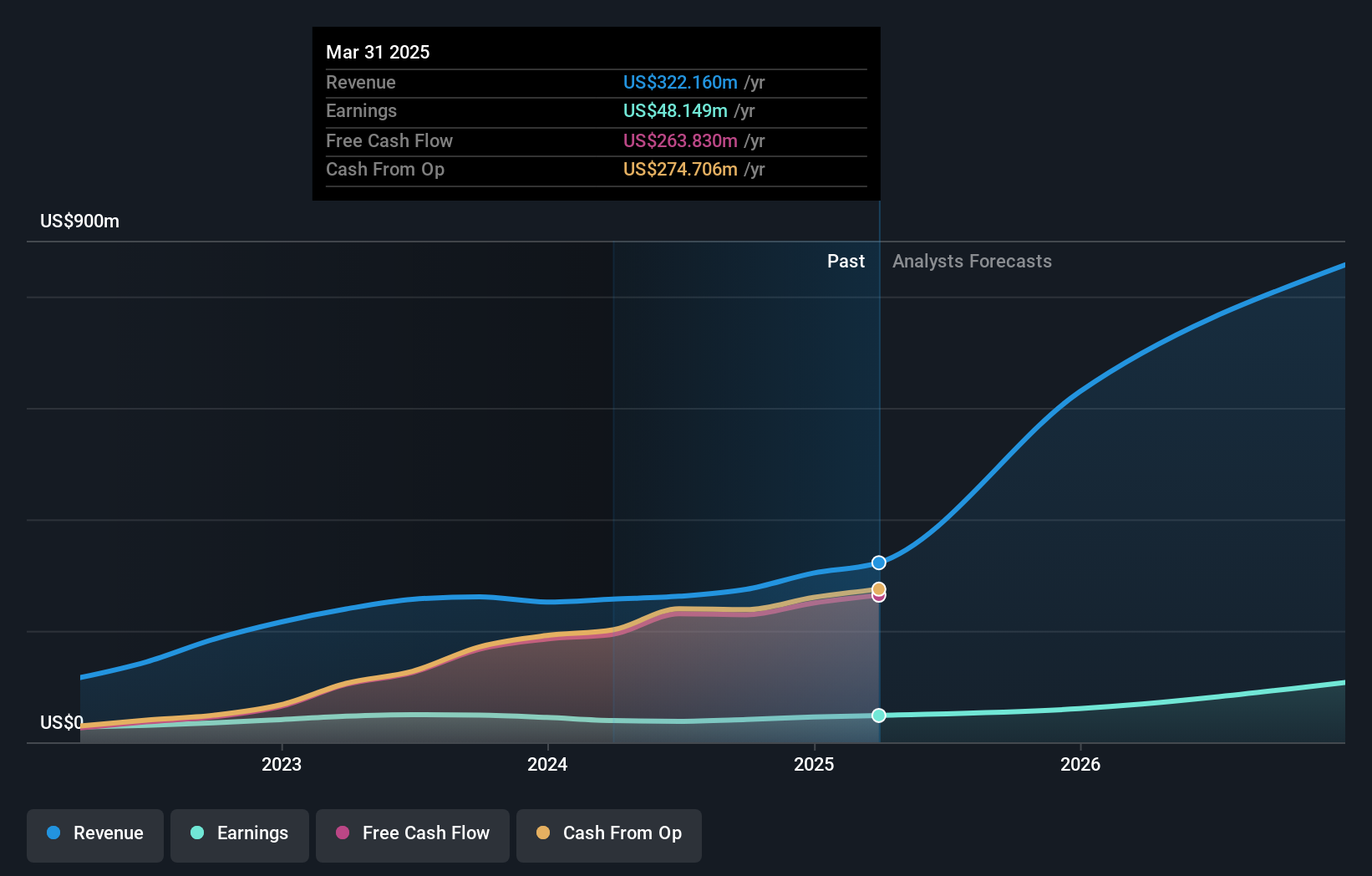

Coastal Financial (CCB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Coastal Financial Corporation, with a market cap of $1.25 billion, operates as the bank holding company for Coastal Community Bank, offering a range of banking products and services to small and medium-sized businesses, professionals, and individuals in the Puget Sound region in Washington.

Operations: Coastal Community Bank's revenue is derived from three main segments: CCBX ($222.52 million), Community Bank ($84.07 million), and Treasury & Administration ($15.57 million).

Insider Ownership: 14.4%

Earnings Growth Forecast: 48% p.a.

Coastal Financial's growth trajectory is supported by forecasted revenue and earnings growth rates of 50% and 48% per year, respectively, surpassing US market averages. Despite recent insider selling, the stock trades at a significant discount to its estimated fair value. Q1 results indicate strong performance with net interest income rising to US$76.06 million from US$62.21 million year-over-year. Recent auditor changes and executive transitions could impact future operations but align with strategic adjustments.

- Get an in-depth perspective on Coastal Financial's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Coastal Financial is trading behind its estimated value.

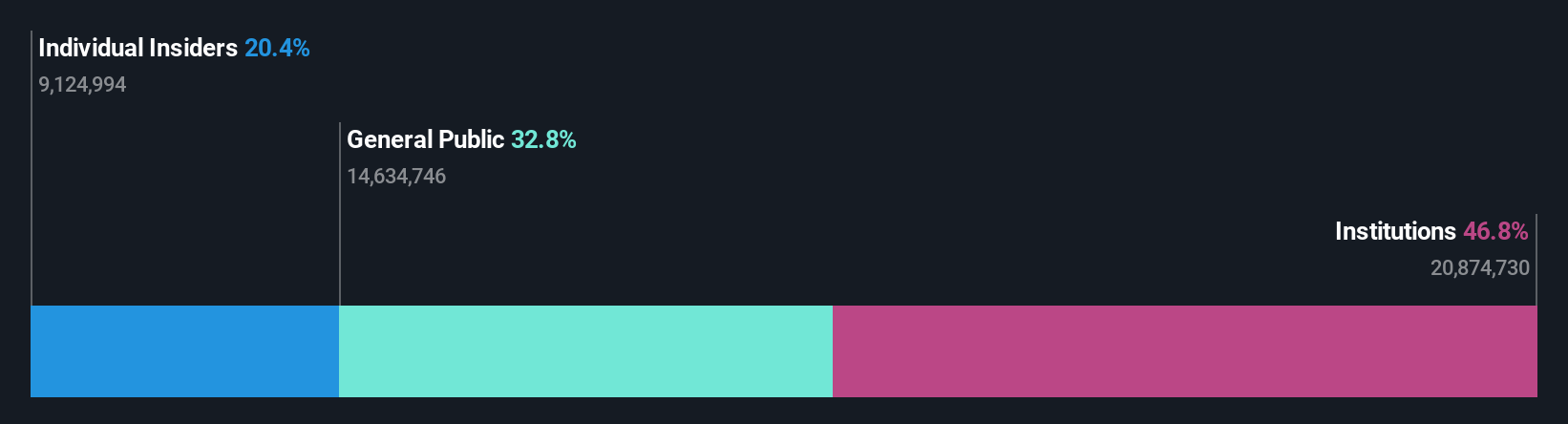

Bridge Investment Group Holdings (BRDG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bridge Investment Group Holdings Inc is a publicly owned real estate investment manager with a market cap of approximately $1.24 billion.

Operations: The company's revenue is primarily generated from its role as a fully integrated real estate investment manager, amounting to $453.73 million.

Insider Ownership: 20.4%

Earnings Growth Forecast: 95.9% p.a.

Bridge Investment Group Holdings faces challenges with a recent US$12.18 million net loss for Q1 2025 compared to a previous net income of US$9.82 million, and its dividend is not well covered by earnings. Despite high debt levels, the company is expected to become profitable within three years with forecasted earnings growth of 95.89% annually, exceeding market averages. Insider activity shows more shares sold than bought recently, yet the stock trades at good value relative to peers.

- Click here and access our complete growth analysis report to understand the dynamics of Bridge Investment Group Holdings.

- Upon reviewing our latest valuation report, Bridge Investment Group Holdings' share price might be too pessimistic.

Make It Happen

- Navigate through the entire inventory of 192 Fast Growing US Companies With High Insider Ownership here.

- Searching for a Fresh Perspective? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com