As of June 20, 2025, two stocks in the information technology sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to <a href=”https://pro.benzinga.com/”> Benzinga Pro</a>.

Here's the latest list of major overbought players in this sector.

Arqit Quantum Inc (NASDAQ:ARQQ)

- On May 27, Arqit Quantum announced it will acquire Ampliphae’s technology IP. “Encryption Intelligence is a vital choice for organisations looking to understand and reduce their encryption risk,” said Andy Leaver, CEO of Arqit. “By combining our quantum encryption expertise with Ampliphae’s analytics technologies, we can deliver unmatched protection and advisory services on a global scale.” The company's stock jumped around 54% over the past month and has a 52-week high of $52.79.

- RSI Value: 82

- ARQQ Price Action: Shares of Arqit Quantum gained 22.4% to close at $37.97 on Wednesday.

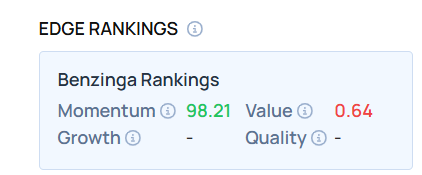

- Edge Stock Ratings: 98.21 Momentum score with Value at 0.64.

Silicon Motion Technology Corp. (NASDAQ:SIMO)

- On June 17, Roth Capital analyst Suji Desilva maintained Silicon Motion Technology with a Buy and raised the price target from $70 to $90. The company's stock gained around 10% over the past month and has a 52-week high of $85.87.

- RSI Value: 78.4

- SIMO Price Action: Shares of Silicon Motion Technology gained 4.5% to close at $71.49 on Wednesday.

Don't miss out on the full BZ Edge Rankings—compare all the key stocks now.

Read This Next:

Photo via Shutterstock