Forward Air Corporation (NASDAQ:FWRD) shares have had a really impressive month, gaining 34% after a shaky period beforehand. Unfortunately, despite the strong performance over the last month, the full year gain of 9.7% isn't as attractive.

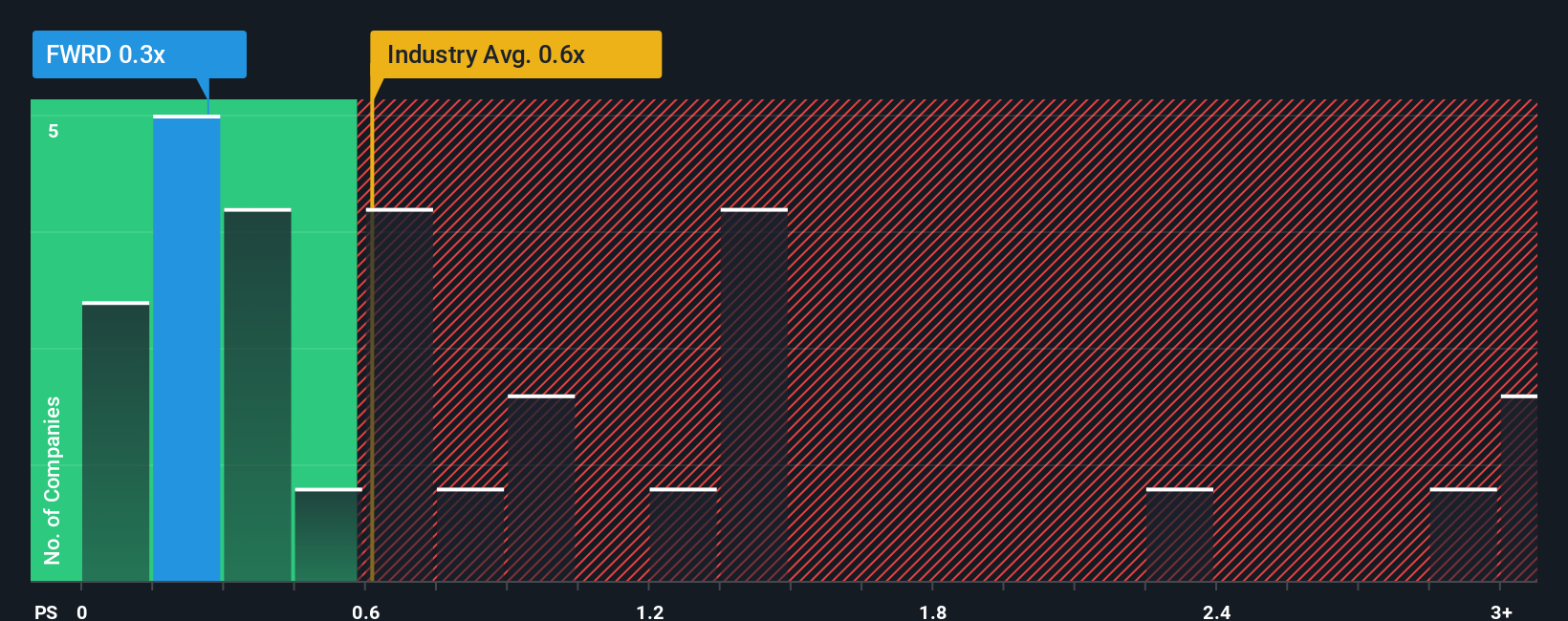

Even after such a large jump in price, it's still not a stretch to say that Forward Air's price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" compared to the Logistics industry in the United States, where the median P/S ratio is around 0.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Forward Air

How Has Forward Air Performed Recently?

Forward Air certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Keen to find out how analysts think Forward Air's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Forward Air's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 64% last year. Pleasingly, revenue has also lifted 44% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to remain somewhat buoyant, growing by 2.4% during the coming year according to the five analysts following the company. Meanwhile, the broader industry is forecast to contract by 0.7%, which would indicate the company is doing better than the majority of its peers.

Despite the marginal growth, we find it odd that Forward Air is trading at a fairly similar P/S to the industry. It looks like most investors aren't convinced the company can achieve positive future growth in the face of a shrinking broader industry.

What We Can Learn From Forward Air's P/S?

Forward Air appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We note that even though Forward Air trades at a similar P/S as the rest of the industry, it far eclipses them in terms of forecasted revenue growth. There could be some unobserved threats to revenue preventing the P/S ratio from matching the positive outlook. One such risk is that the company may not live up to analysts' revenue trajectories in tough industry conditions. It appears some are indeed anticipating revenue instability, because the company's current prospects should normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Forward Air (of which 2 are concerning!) you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.