The United States market has been flat over the last week but is up 10% over the past year, with earnings forecast to grow by 15% annually. In this environment, identifying high growth tech stocks that can capitalize on these favorable conditions involves looking for companies with strong innovation and robust financial health.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 26.38% | 39.09% | ★★★★★★ |

| Mereo BioPharma Group | 53.63% | 66.57% | ★★★★★★ |

| Ardelyx | 21.03% | 60.42% | ★★★★★★ |

| TG Therapeutics | 26.46% | 38.75% | ★★★★★★ |

| AVITA Medical | 27.36% | 60.93% | ★★★★★★ |

| Blueprint Medicines | 21.12% | 60.77% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.63% | 60.61% | ★★★★★★ |

| Alkami Technology | 20.53% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 35.07% | 59.92% | ★★★★★★ |

| Lumentum Holdings | 22.99% | 103.97% | ★★★★★★ |

Click here to see the full list of 227 stocks from our US High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Trade Desk (TTD)

Simply Wall St Growth Rating: ★★★★★☆

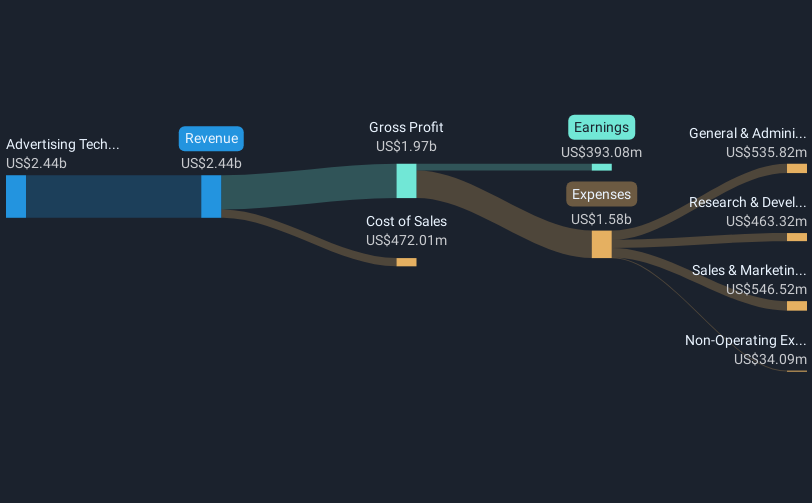

Overview: The Trade Desk, Inc. is a technology company that provides a global advertising platform for digital ad buyers, with a market cap of approximately $33.75 billion.

Operations: The company generates revenue primarily from its advertising technology platform, totaling approximately $2.57 billion.

The Trade Desk, a leader in the digital advertising space, is enhancing its capabilities through strategic partnerships and technological innovations, notably in AI-driven creative optimization. Recently, it expanded its generative AI offerings by integrating Rembrand's Virtual Product Ad solution into its platform. This integration allows advertisers to embed brands seamlessly within digital content, enhancing viewer engagement by making ads contextually relevant without disrupting the user experience. Moreover, The Trade Desk's collaboration with Instacart leverages retail media data to optimize programmatic campaign performance significantly. These initiatives not only bolster The Trade Desk's market position but also cater to evolving advertiser and consumer demands for more integrated and intelligent advertising solutions across various channels including CTV and online platforms.

- Dive into the specifics of Trade Desk here with our thorough health report.

Examine Trade Desk's past performance report to understand how it has performed in the past.

Nutanix (NTNX)

Simply Wall St Growth Rating: ★★★★★☆

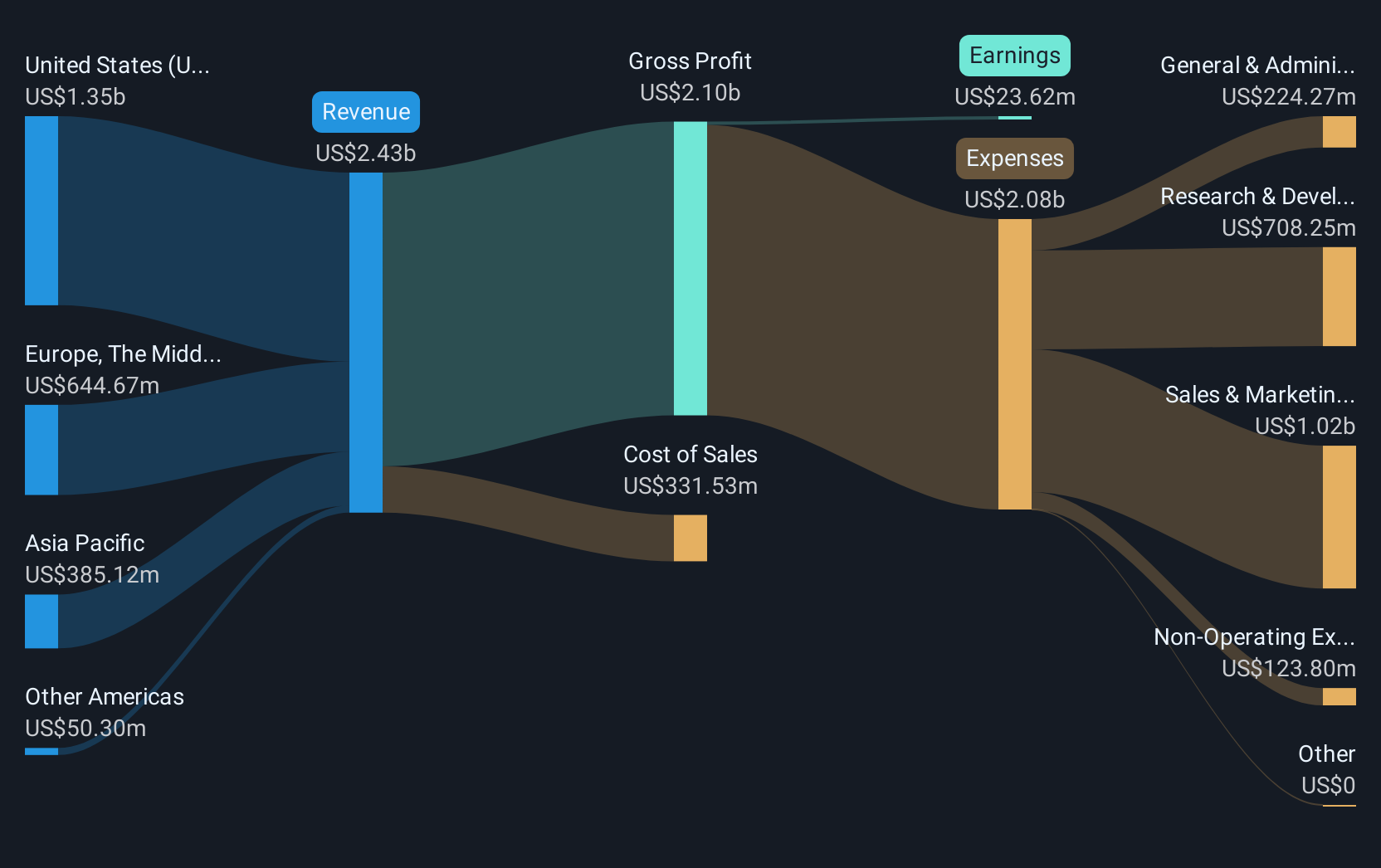

Overview: Nutanix, Inc. offers an enterprise cloud platform across various global regions including North America, Europe, the Asia Pacific, the Middle East, Latin America, and Africa with a market cap of $19.73 billion.

Operations: The company generates revenue through its Internet Software & Services segment, amounting to $2.43 billion.

Nutanix has demonstrated robust growth with a notable 66.8% annual increase in earnings, signaling strong operational efficiencies and market demand. With revenue rising at 14.2% annually, surpassing the US market's growth of 8.7%, Nutanix is capitalizing on industry trends such as cloud-native solutions and enterprise AI to expand its offerings. Recent strategic moves include repurchasing shares worth $188.65 million and launching innovative products like Cloud Native AOS, enhancing Kubernetes integration across hybrid environments. These initiatives reflect Nutanix's commitment to evolving tech landscapes and its agility in responding to dynamic market needs, positioning it favorably for sustained growth.

- Click here to discover the nuances of Nutanix with our detailed analytical health report.

Gain insights into Nutanix's historical performance by reviewing our past performance report.

Pure Storage (PSTG)

Simply Wall St Growth Rating: ★★★★★☆

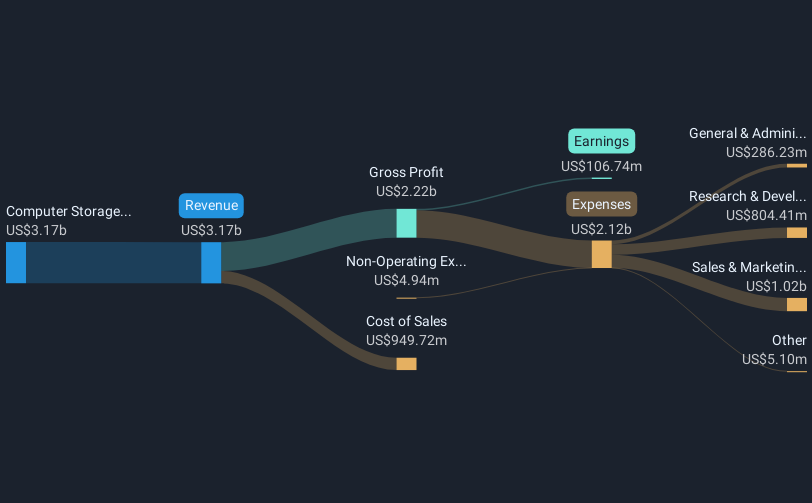

Overview: Pure Storage, Inc. provides data storage and management technologies, products, and services globally with a market capitalization of $17.28 billion.

Operations: Pure Storage generates revenue primarily from its computer storage devices, amounting to $3.25 billion. The company operates both in the United States and internationally, focusing on data storage and management solutions.

Pure Storage is redefining data management with its latest Enterprise Data Cloud (EDC) launch, aimed at simplifying storage across various platforms. This innovation aligns with the increasing demand for high-performance solutions as evidenced by a 11.2% annual revenue growth and a significant leap in earnings growth at 35% annually. The company's commitment to R&D is evident from its recent product expansions like FlashArray//XL R5, which dramatically enhances performance density and scalability. With these strategic advancements, Pure Storage not only addresses current technological demands but also sets a robust foundation for future growth in the data-centric world of business.

- Unlock comprehensive insights into our analysis of Pure Storage stock in this health report.

Evaluate Pure Storage's historical performance by accessing our past performance report.

Key Takeaways

- Get an in-depth perspective on all 227 US High Growth Tech and AI Stocks by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com