It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Allegion (NYSE:ALLE). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

How Quickly Is Allegion Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. We can see that in the last three years Allegion grew its EPS by 11% per year. That's a good rate of growth, if it can be sustained.

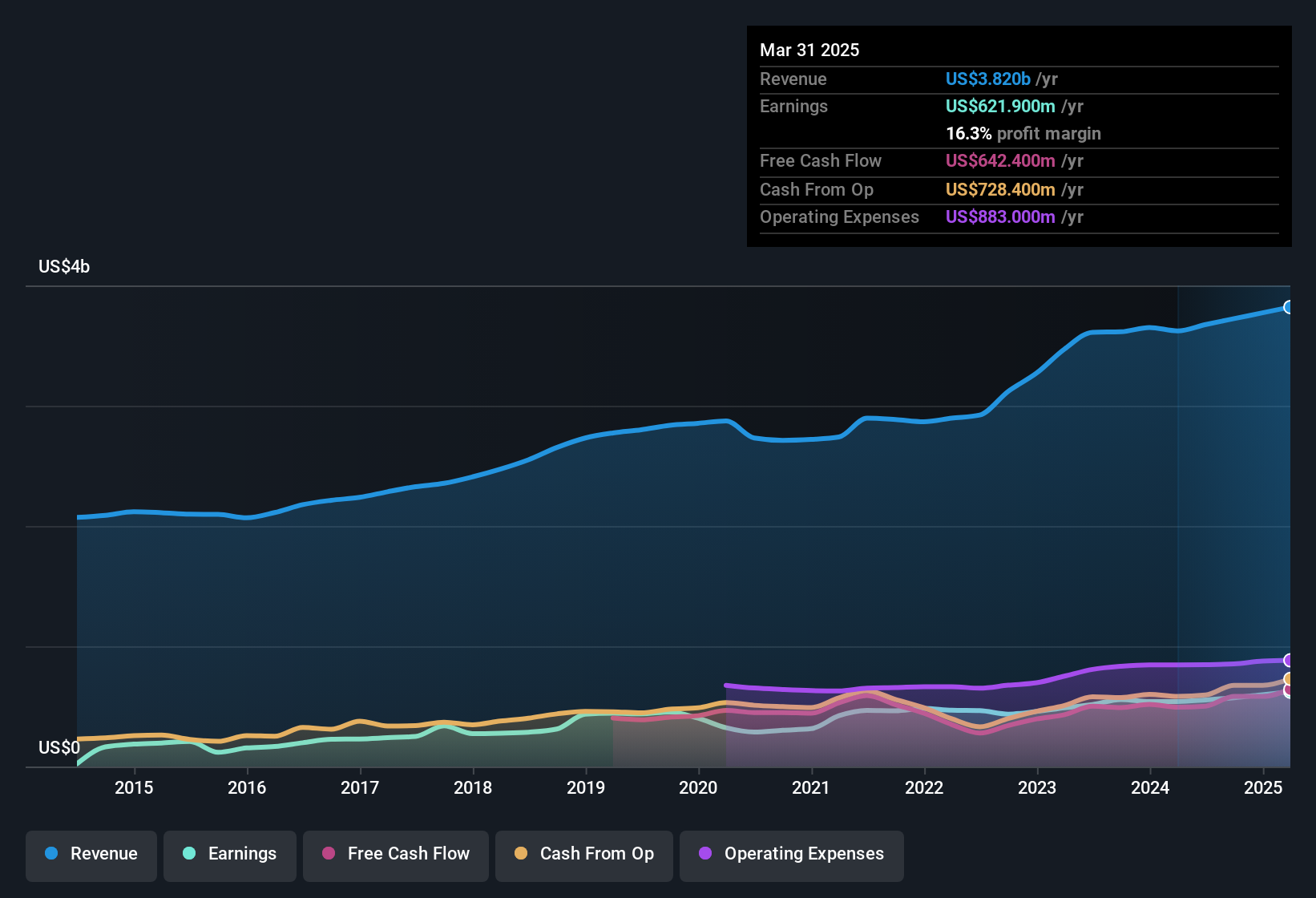

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Allegion maintained stable EBIT margins over the last year, all while growing revenue 5.5% to US$3.8b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

See our latest analysis for Allegion

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Allegion?

Are Allegion Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We do note that, in the last year, insiders sold US$714k worth of shares. But that's far less than the US$2.9m insiders spent purchasing stock. We find this encouraging because it suggests they are optimistic about Allegion'sfuture. It is also worth noting that it was President John Stone who made the biggest single purchase, worth US$1.1m, paying US$141 per share.

On top of the insider buying, it's good to see that Allegion insiders have a valuable investment in the business. Indeed, they hold US$31m worth of its stock. That's a lot of money, and no small incentive to work hard. Despite being just 0.3% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. That's because Allegion's CEO, John Stone, is paid at a relatively modest level when compared to other CEOs for companies of this size. For companies with market capitalisations over US$8.0b, like Allegion, the median CEO pay is around US$14m.

Allegion's CEO took home a total compensation package worth US$8.5m in the year leading up to December 2024. That is actually below the median for CEO's of similarly sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is Allegion Worth Keeping An Eye On?

One important encouraging feature of Allegion is that it is growing profits. In addition, insiders have been busy adding to their sizeable holdings in the company. That should do plenty in prompting budding investors to undertake a bit more research - or even adding the company to their watchlists. However, before you get too excited we've discovered 1 warning sign for Allegion that you should be aware of.

The good news is that Allegion is not the only stock with insider buying. Here's a list of small cap, undervalued companies in the US with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.