Sysco (NYSE:SYY) recently announced a collaboration with the MICHELIN Guide, making it the official food distributor for a prestigious California culinary event. This partnership underscores Sysco's influence in the culinary distribution sector, potentially adding weight to its stock's 4% move over the past quarter. Additionally, an incremental dividend increase and a significant share buyback may have further supported the stock's performance. The market remained relatively flat over the past week, with Sysco's share price aligning more with broader market trends, which rose nearly 10% over the past year, rather than deviating significantly due to company-specific events.

We've discovered 1 weakness for Sysco that you should be aware of before investing here.

Rare earth metals are the new gold rush. Find out which 24 stocks are leading the charge.

The collaboration with the MICHELIN Guide positions Sysco as a significant player in the culinary distribution sector, potentially influencing its strategic goals outlined in the narrative. This partnership could bolster Sysco's brand prestige, possibly enhancing revenue streams and supporting its pricing initiatives. Considering Sysco's focus on pricing agility tools and market expansions, the partnership could solidify its market position and contribute to revenue growth despite broader economic challenges.

Over the past five years, Sysco's total share return, including dividends, was 53.59%, marking substantial progress and establishing a context for evaluating short-term price movements. Despite underperforming the US Consumer Retailing industry over the past year, Sysco's long-term performance shows resilience and hints at the benefits of its operational strategies.

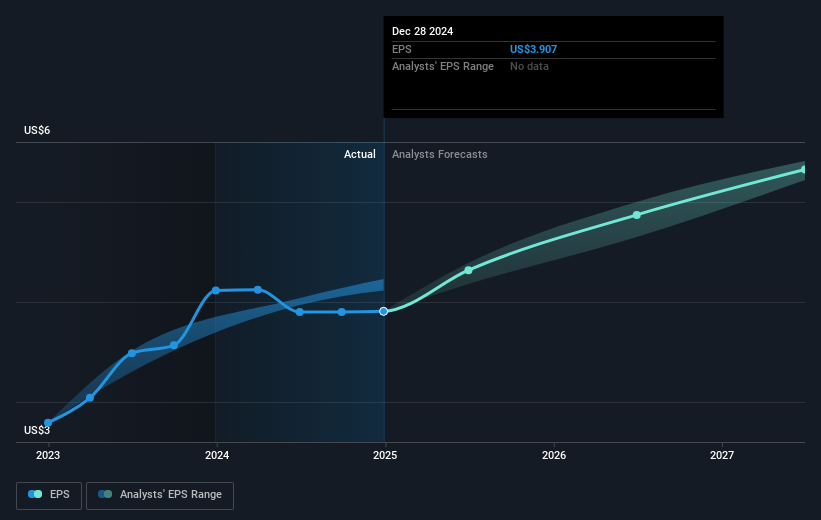

With analysts forecasting Sysco's revenue to grow 4% annually, the recent MICHELIN partnership could provide additional catalysts to validate these predictions. Earnings projections of US$2.5 billion by 2028 reflect confidence in Sysco's ability to navigate economic uncertainties and enhance profitability through workforce improvement and fulfillment capacity expansions.

The company's current share price of US$70.01 sits below the consensus price target of US$79.68, suggesting potential for appreciation if projected earnings and revenue targets are met. While the share price discount to the target indicates room for growth, stakeholders must consider industry headwinds and macroeconomic factors influencing Sysco's operational environment.

Assess Sysco's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com