In the last week, the United States market has been flat, but it has seen a 9.9% increase over the past year with earnings forecasted to grow by 15% annually. In this environment, identifying stocks that are not only resilient but also poised for growth can be crucial, making lesser-known companies like Village Super Market and other promising small caps potential hidden gems worth exploring.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| West Bancorporation | 169.96% | -1.41% | -8.52% | ★★★★★★ |

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| Morris State Bancshares | 9.62% | 4.26% | 5.10% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Gulf Island Fabrication | 19.65% | -2.17% | 42.26% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

| Vantage | 6.72% | -16.62% | -15.47% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Village Super Market (VLGE.A)

Simply Wall St Value Rating: ★★★★☆☆

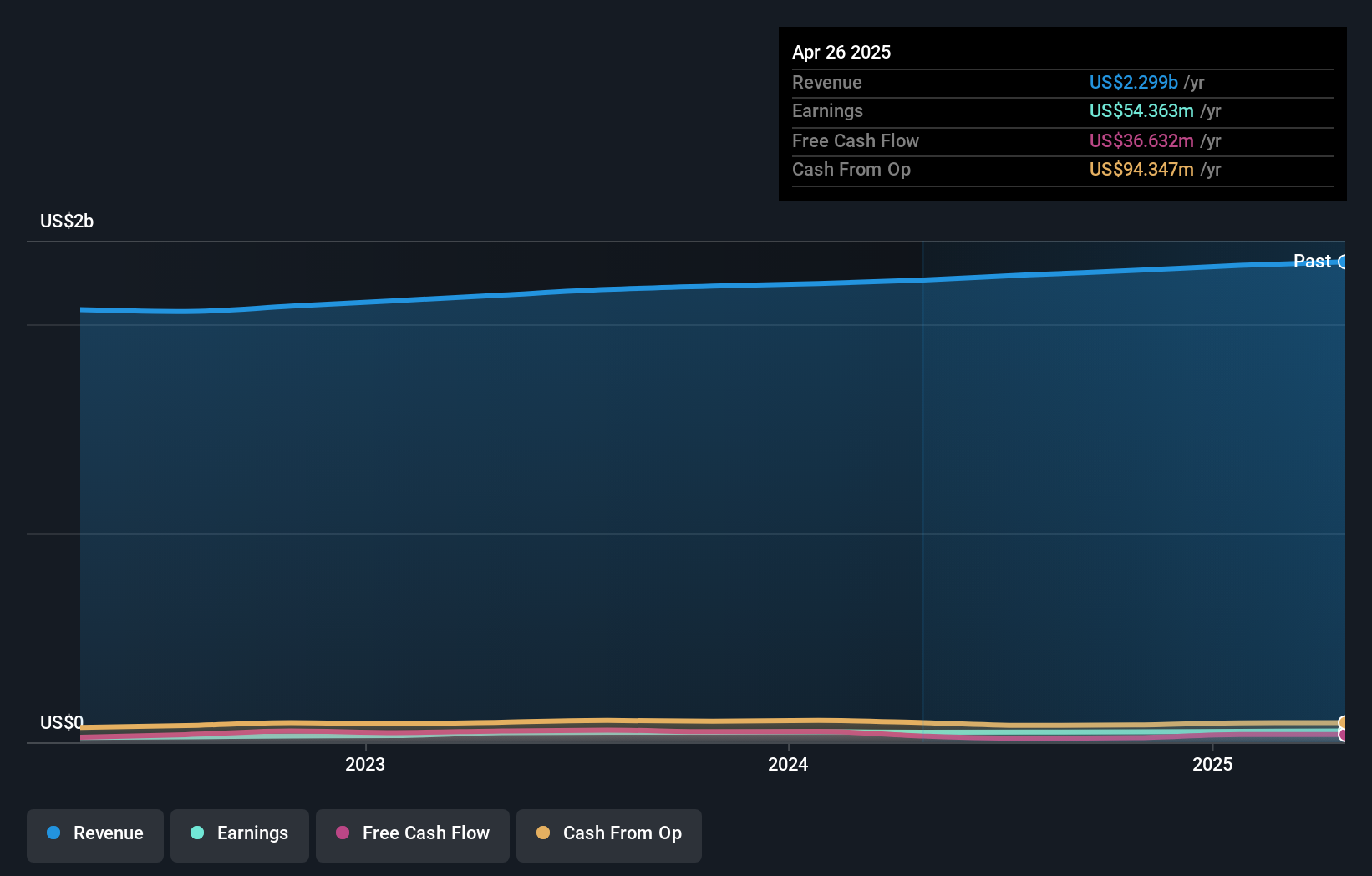

Overview: Village Super Market, Inc. operates a chain of supermarkets in the United States with a market capitalization of approximately $549.22 million.

Operations: Village Super Market generates revenue primarily from the retail sale of food and nonfood products, totaling approximately $2.30 billion.

Village Super Market, a nimble player in the retail sector, has demonstrated robust performance with earnings growth of 12.2% over the past year, outpacing the Consumer Retailing industry at 7.4%. Recent earnings announcements highlight sales of US$563.67 million for Q3 2025, up from US$546.4 million last year, while net income rose to US$11.16 million from US$8.97 million. The company trades at a notable discount of 23.8% below its estimated fair value and maintains high-quality earnings with more cash than total debt; however, insider selling in recent months and an increased debt-to-equity ratio from 2.4% to 12.8% warrant attention.

- Unlock comprehensive insights into our analysis of Village Super Market stock in this health report.

Assess Village Super Market's past performance with our detailed historical performance reports.

DRDGOLD (DRD)

Simply Wall St Value Rating: ★★★★★☆

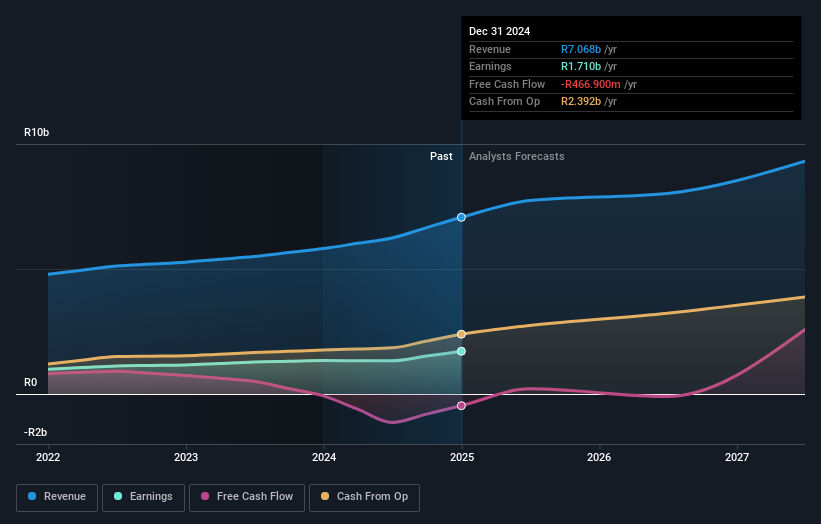

Overview: DRDGOLD Limited is a South African gold mining company specializing in the extraction of gold from surface mine tailings, with a market capitalization of approximately $1.23 billion.

Operations: The company generates revenue primarily from two segments: Ergo, contributing ZAR 5.05 billion, and FWGR, with ZAR 2.02 billion.

DRDGOLD, a notable player in the mining sector, stands out with its debt-free status and impressive earnings growth of 28% over the past year. Despite facing challenges like wet weather impacting production yields, it managed to produce 1,093 kg of gold last quarter from 6.05 million metric tonnes of ore. Trading at a significant discount of 81.8% below estimated fair value suggests potential upside for investors. However, it's not all smooth sailing as free cash flow remains negative amid high capital expenditures reaching US$2.99 billion recently. Revenue is expected to grow annually by approximately 11%, indicating future opportunities despite current hurdles.

SunCoke Energy (SXC)

Simply Wall St Value Rating: ★★★★☆☆

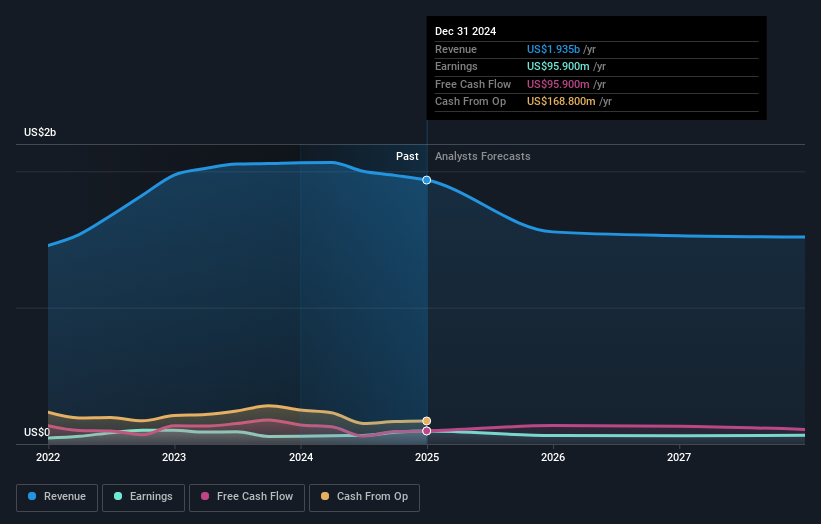

Overview: SunCoke Energy, Inc. operates as an independent producer of coke in the Americas and Brazil with a market capitalization of approximately $701.76 million.

Operations: The company generates revenue primarily from its Domestic Coke segment, contributing $1.76 billion, followed by Logistics at $107.40 million and Brazil Coke at $34.60 million.

SunCoke Energy, a player in the coke production sector, has seen earnings rise by 52% over the past year, outpacing industry averages. Despite this growth, it faces challenges with a high net debt to equity ratio of 41.9%, though interest payments are well covered at 6.7x EBIT. The company is trading at about $9.80 per share, significantly below its estimated fair value by nearly 68%. Recent strategic moves include acquiring Phoenix Global and securing a U.S. Steel supply extension through September 2025, which may stabilize revenue amid expected earnings declines of around 16% annually over three years.

Next Steps

- Dive into all 284 of the US Undiscovered Gems With Strong Fundamentals we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com