Experts have been betting on the growth prospects of Oscar Health Inc. (NYSE:OSCR) as the stock surged by 16.51% on Wednesday and 32.56% in the last five trading sessions.

What Happened: According to an X post shared by Ruth Capital, Oscar Health’s fundamentals are strong as it reported robust revenue in its first quarter with a $1 billion free cash flow. Additionally, the post highlights the company’s ties with President Donald Trump.

Meanwhile, underscoring the downside, Ruth Capital explains extreme volatility, and earnings from government subsidies could affect the stock.

Jake Ruth, the co-founder of Stock Unlock, shared his personal story on X, as he has been holding the company’s shares since he was an employee at the firm.

He highlights that “the fact this is becoming a retail meme stock is the best thing that’s ever happened to my net worth.”

Oscar Health’s connection to Trump is primarily through Joshua Kushner, the co-founder and vice-chairman of Oscar Health and brother of Jared Kushner, who served as a senior advisor to President Trump. Jared Kushner is married to Trump’s daughter, Ivanka Trump. Therefore, Oscar Health has an indirect connection to the Trump family through Joshua Kushner’s familial relationship.

Why It Matters: Technical analysis of Oscar Health paints a largely bullish picture for the stock. According to Benzinga Pro, its price of $18.77 apiece is higher than the short and long-term simple daily moving averages.

Its momentum indicator, MACD, was also bullish as the MACD line was at 0.40, above the signal line of 0.12 and a positive histogram value of 0.28. This meant that the stock’s 12-day exponential moving average was trading above the 26-day EMA.

However, the relative strength index of 70.94 meant that the stock was overbought and the prices could correct.

The stock has surged by 38.52% in 2025 and gained just 4.05% over the year.

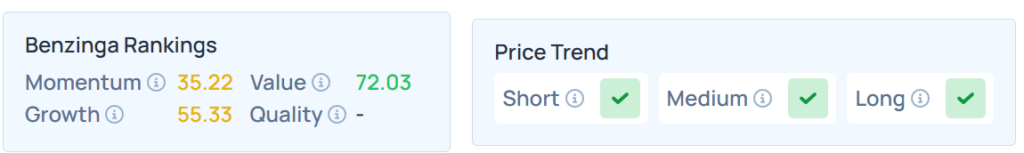

Benzinga Edge Stock Rankings shows that OSCR had a stronger price trend over the short, medium, and long term. Its momentum ranking was moderate, and its value ranking was good at the 72.03th percentile. The details of other metrics are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, declined slightly on Wednesday. The SPY was down 0.015% at $597.44, while the QQQ was 0.017% lower at $528.99, according to Benzinga Pro data.

During the market close on Thursday, the futures of the S&P 500, Dow Jones, and the Nasdaq 100 indices were trading lower.

Read Next:

Image Via Shutterstock