As the United States stock market navigates through geopolitical tensions and anticipates the Federal Reserve's interest rate decision, investors are closely monitoring key economic indicators and global developments. In such a volatile environment, dividend stocks can offer stability and income potential, making them an attractive option for those seeking reliable returns amidst uncertainty.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Valley National Bancorp (VLY) | 5.23% | ★★★★★☆ |

| Universal (UVV) | 5.54% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.68% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 7.24% | ★★★★★★ |

| Ennis (EBF) | 5.36% | ★★★★★★ |

| Dillard's (DDS) | 6.33% | ★★★★★★ |

| Credicorp (BAP) | 5.06% | ★★★★★☆ |

| CompX International (CIX) | 5.00% | ★★★★★★ |

| Columbia Banking System (COLB) | 6.55% | ★★★★★★ |

| Citizens & Northern (CZNC) | 6.13% | ★★★★★☆ |

Click here to see the full list of 151 stocks from our Top US Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

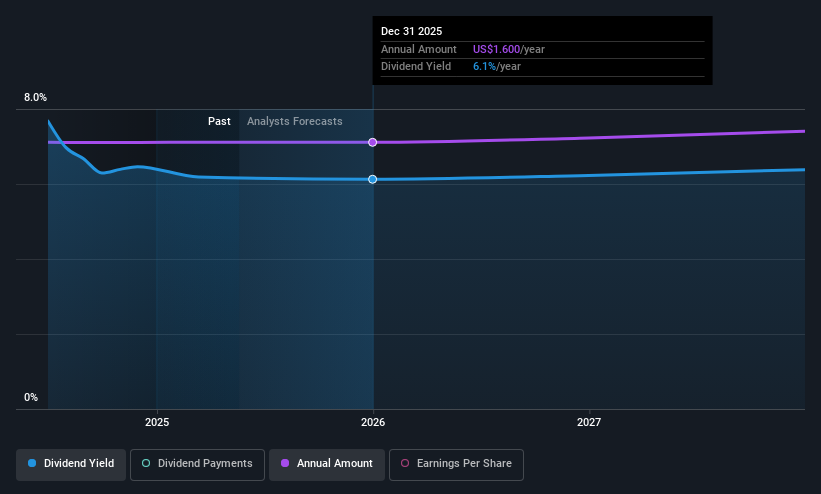

Timberland Bancorp (TSBK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Timberland Bancorp, Inc. is the bank holding company for Timberland Bank, offering a range of community banking services in Washington, with a market cap of $241.31 million.

Operations: Timberland Bancorp, Inc. generates its revenue primarily from its community banking services, with a reported $76.81 million in this segment.

Dividend Yield: 3.5%

Timberland Bancorp offers a stable and reliable dividend, with payments increasing over the past decade. The recent 4% increase to $0.26 per share reflects ongoing growth, supported by a low payout ratio of 30.1%. Despite a dividend yield of 3.46%, below the top US market payers, its dividends are well covered by earnings. Recent earnings show growth in net income and interest income, enhancing its ability to sustain payouts amid strategic share buybacks totaling $9.57 million since July 2023.

- Dive into the specifics of Timberland Bancorp here with our thorough dividend report.

- Our valuation report here indicates Timberland Bancorp may be undervalued.

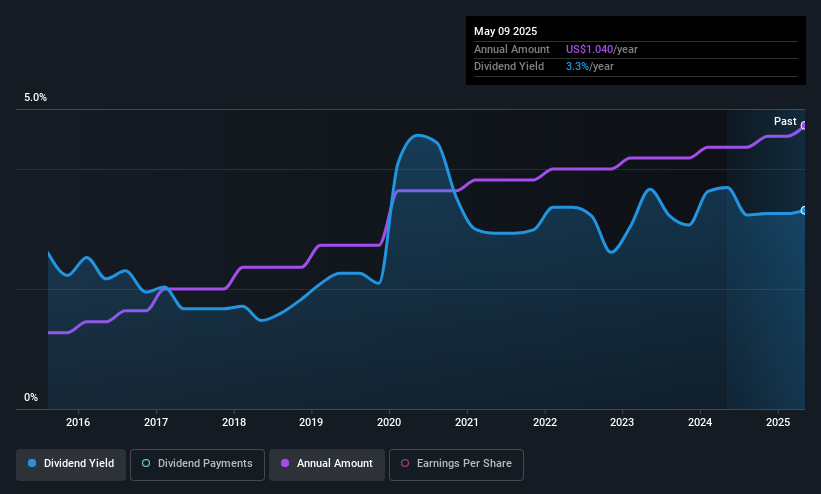

RLI (RLI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: RLI Corp. is an insurance holding company that underwrites property, casualty, and surety insurance products, with a market cap of approximately $6.68 billion.

Operations: RLI Corp.'s revenue segments include $145.95 million from surety, $883.61 million from casualty, and $534.52 million from property insurance products.

Dividend Yield: 3.6%

RLI Corp. recently increased its quarterly dividend by 6.7% to $0.16 per share, reflecting a commitment to returning value to shareholders despite a volatile dividend history over the past decade. The company's dividends are well covered, with a low payout ratio of 18.9% and cash payout ratio of 40.6%, indicating sustainability from both earnings and cash flows. However, RLI's dividend yield of 3.6% remains below the top tier in the US market.

- Navigate through the intricacies of RLI with our comprehensive dividend report here.

- Our valuation report unveils the possibility RLI's shares may be trading at a premium.

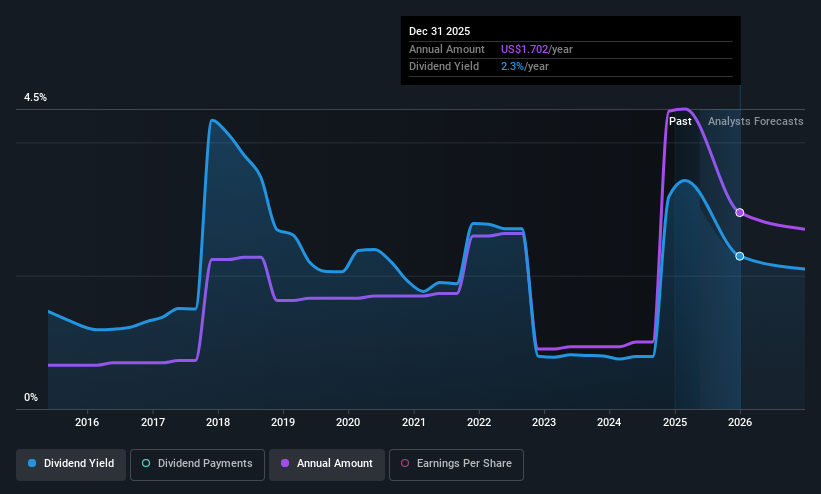

Sila Realty Trust (SILA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sila Realty Trust, Inc., based in Tampa, Florida, is a net lease real estate investment trust specializing in the healthcare sector with a market cap of $1.32 billion.

Operations: Sila Realty Trust generates its revenue primarily from commercial real estate investments in the healthcare sector, amounting to $184.47 million.

Dividend Yield: 6.6%

Sila Realty Trust offers a dividend yield of 6.62%, placing it in the top 25% of US dividend payers, yet its dividends have been unreliable over four years due to volatility and declining payments. With a payout ratio of 75.9% and cash payout ratio of 73.3%, dividends are covered by earnings and cash flows, but recent earnings show declines, with net income dropping to US$7.1 million from US$14.98 million year-over-year.

- Take a closer look at Sila Realty Trust's potential here in our dividend report.

- The valuation report we've compiled suggests that Sila Realty Trust's current price could be inflated.

Seize The Opportunity

- Get an in-depth perspective on all 151 Top US Dividend Stocks by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com