In the latest quarter, 4 analysts provided ratings for BioLine Rx (NASDAQ:BLRX), showcasing a mix of bullish and bearish perspectives.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 0 | 0 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 2 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 1 | 0 | 0 | 0 | 0 |

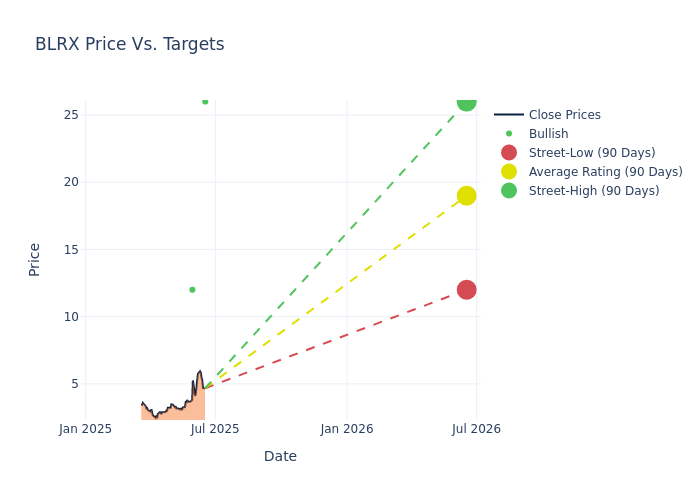

Analysts have set 12-month price targets for BioLine Rx, revealing an average target of $22.5, a high estimate of $26.00, and a low estimate of $12.00. This upward trend is apparent, with the current average reflecting a 10.67% increase from the previous average price target of $20.33.

Decoding Analyst Ratings: A Detailed Look

An in-depth analysis of recent analyst actions unveils how financial experts perceive BioLine Rx. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Joseph Pantginis | HC Wainwright & Co. | Maintains | Buy | $26.00 | $26.00 |

| Justin Walsh | Jones Trading | Announces | Buy | $12.00 | - |

| Joseph Pantginis | HC Wainwright & Co. | Maintains | Buy | $26.00 | $26.00 |

| Joseph Pantginis | HC Wainwright & Co. | Raises | Buy | $26.00 | $9.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to BioLine Rx. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of BioLine Rx compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for BioLine Rx's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

To gain a panoramic view of BioLine Rx's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on BioLine Rx analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

About BioLine Rx

BioLine Rx Ltd is a commercial-stage biopharmaceutical company focused on oncology. The company's current development and commercialization pipeline consists of two clinical-stage therapeutic candidates motixafortide (BL-8040), a novel peptide for the treatment of stem-cell mobilization and solid tumors, and AGI-134, an immuno-oncology agent in development for solid tumors. In addition, the company has an off-strategy, legacy therapeutic product called BL-5010 for the treatment of skin lesions. The company has generated revenues from milestone payments under previously existing out-licensing agreements.

A Deep Dive into BioLine Rx's Financials

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Decline in Revenue: Over the 3M period, BioLine Rx faced challenges, resulting in a decline of approximately -96.28% in revenue growth as of 31 March, 2025. This signifies a reduction in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: BioLine Rx's net margin is impressive, surpassing industry averages. With a net margin of 2010.59%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): BioLine Rx's ROE stands out, surpassing industry averages. With an impressive ROE of 29.88%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): BioLine Rx's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 12.44%, the company showcases efficient use of assets and strong financial health.

Debt Management: BioLine Rx's debt-to-equity ratio stands notably higher than the industry average, reaching 0.66. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

Understanding the Relevance of Analyst Ratings

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.