Over the last 7 days, the United States market has remained flat, yet it is up 11% over the past year with earnings forecasted to grow by 14% annually. In this context of steady growth and optimistic earnings forecasts, identifying stocks that may be trading below their estimated value can offer investors opportunities for potential gains.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Verra Mobility (VRRM) | $24.17 | $47.93 | 49.6% |

| Peoples Financial Services (PFIS) | $47.24 | $93.66 | 49.6% |

| Mid Penn Bancorp (MPB) | $26.49 | $52.26 | 49.3% |

| MetroCity Bankshares (MCBS) | $26.99 | $53.10 | 49.2% |

| Ligand Pharmaceuticals (LGND) | $115.01 | $225.70 | 49% |

| Horizon Bancorp (HBNC) | $14.61 | $29.10 | 49.8% |

| German American Bancorp (GABC) | $36.95 | $72.97 | 49.4% |

| Clearfield (CLFD) | $38.12 | $75.13 | 49.3% |

| Central Pacific Financial (CPF) | $26.01 | $51.99 | 50% |

| Arrow Financial (AROW) | $24.97 | $49.74 | 49.8% |

Let's explore several standout options from the results in the screener.

Globalstar (GSAT)

Overview: Globalstar, Inc. offers mobile satellite services across various regions including the United States, Canada, Europe, Central and South America, with a market cap of approximately $2.78 billion.

Operations: The company's revenue primarily comes from its Mobile Satellite Services (MSS) Business, generating approximately $253.90 million.

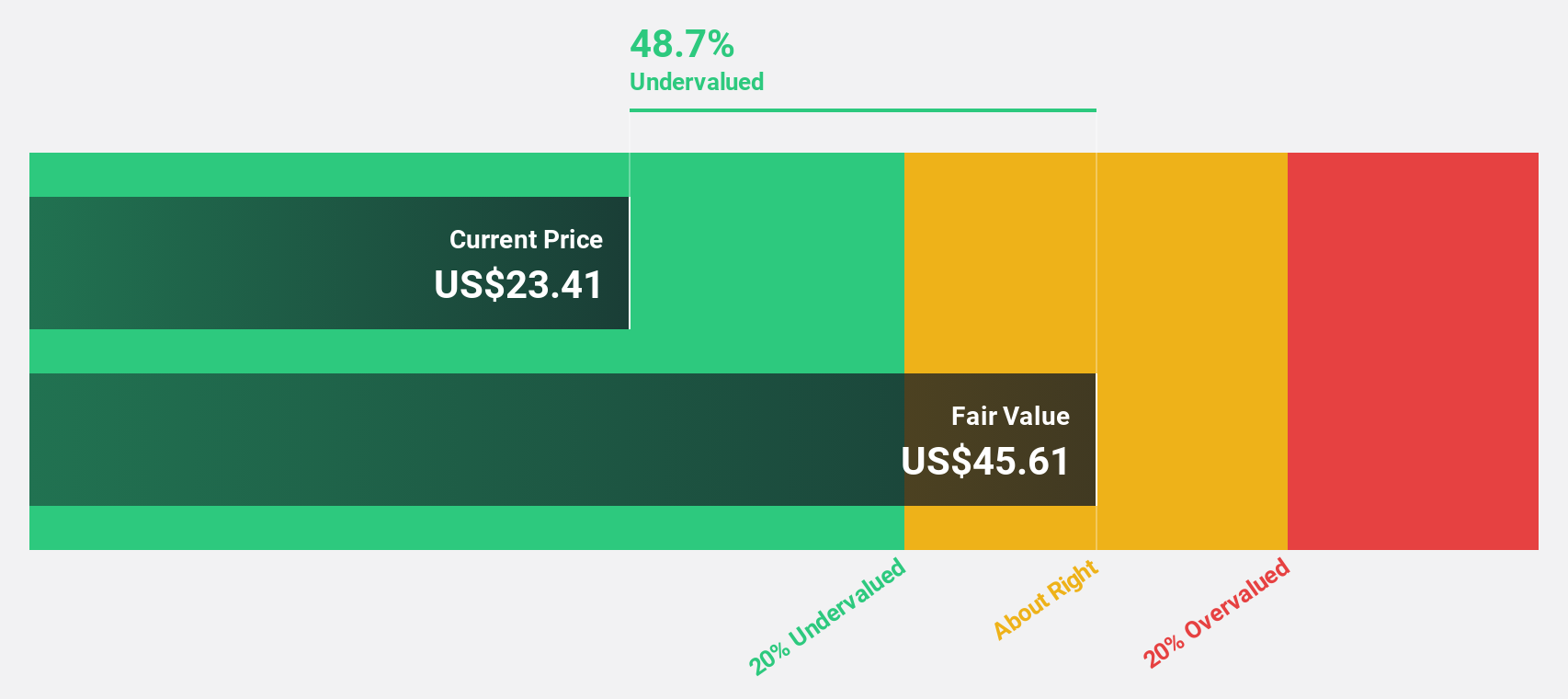

Estimated Discount To Fair Value: 48.7%

Globalstar is trading at US$23.38, significantly below its estimated fair value of US$45.61, suggesting it may be undervalued based on cash flows. The company forecasts becoming profitable within three years and anticipates revenue growth of 14.9% annually, surpassing the broader US market's growth rate. Recent developments include the opening of a Satellite Operations Control Center to enhance operational capabilities and strategic expansion in satellite communications, although recent earnings show continued net losses with increased revenue year-over-year.

- In light of our recent growth report, it seems possible that Globalstar's financial performance will exceed current levels.

- Get an in-depth perspective on Globalstar's balance sheet by reading our health report here.

StoneCo (STNE)

Overview: StoneCo Ltd. offers financial technology and software solutions to facilitate electronic commerce for merchants and integrated partners across in-store, online, and mobile channels in Brazil, with a market cap of approximately $3.74 billion.

Operations: StoneCo Ltd.'s revenue is primarily derived from its Financial Services segment, which generated R$12.24 billion, and its Software segment, which contributed R$1.60 billion.

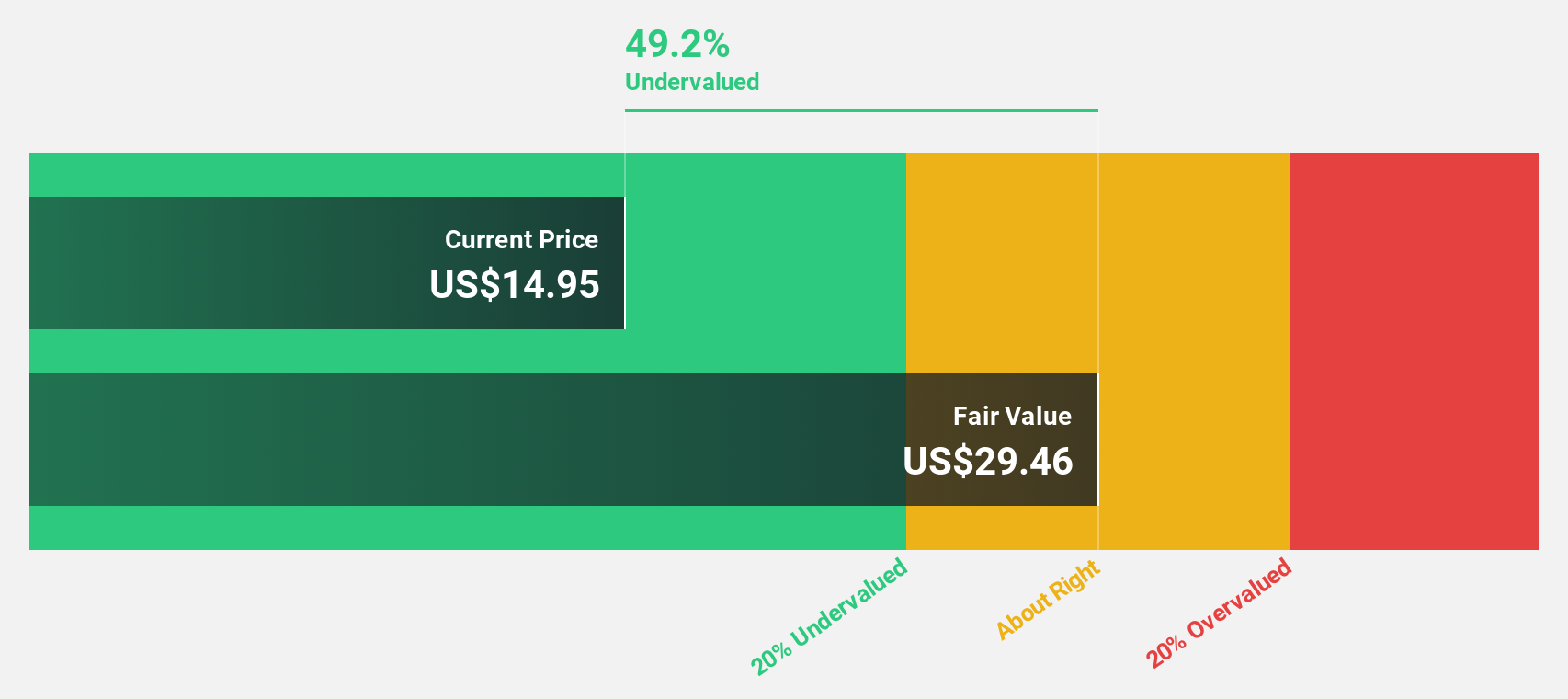

Estimated Discount To Fair Value: 47.6%

StoneCo is trading at US$15.09, considerably below its estimated fair value of US$28.80, highlighting potential undervaluation based on cash flows. The company reported strong first-quarter earnings with revenue growth and net income increases compared to the previous year. Despite a challenging financial position with debt not fully covered by operating cash flow, StoneCo's share repurchase program and forecasted profitability within three years underscore its strategic efforts to enhance shareholder value amidst ongoing M&A discussions.

- The growth report we've compiled suggests that StoneCo's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of StoneCo.

Eli Lilly (LLY)

Overview: Eli Lilly and Company is engaged in the discovery, development, and marketing of human pharmaceuticals across the United States, Europe, China, Japan, and other international markets with a market cap of approximately $735.57 billion.

Operations: Eli Lilly's revenue primarily comes from its pharmaceutical products segment, which generated $49.00 billion.

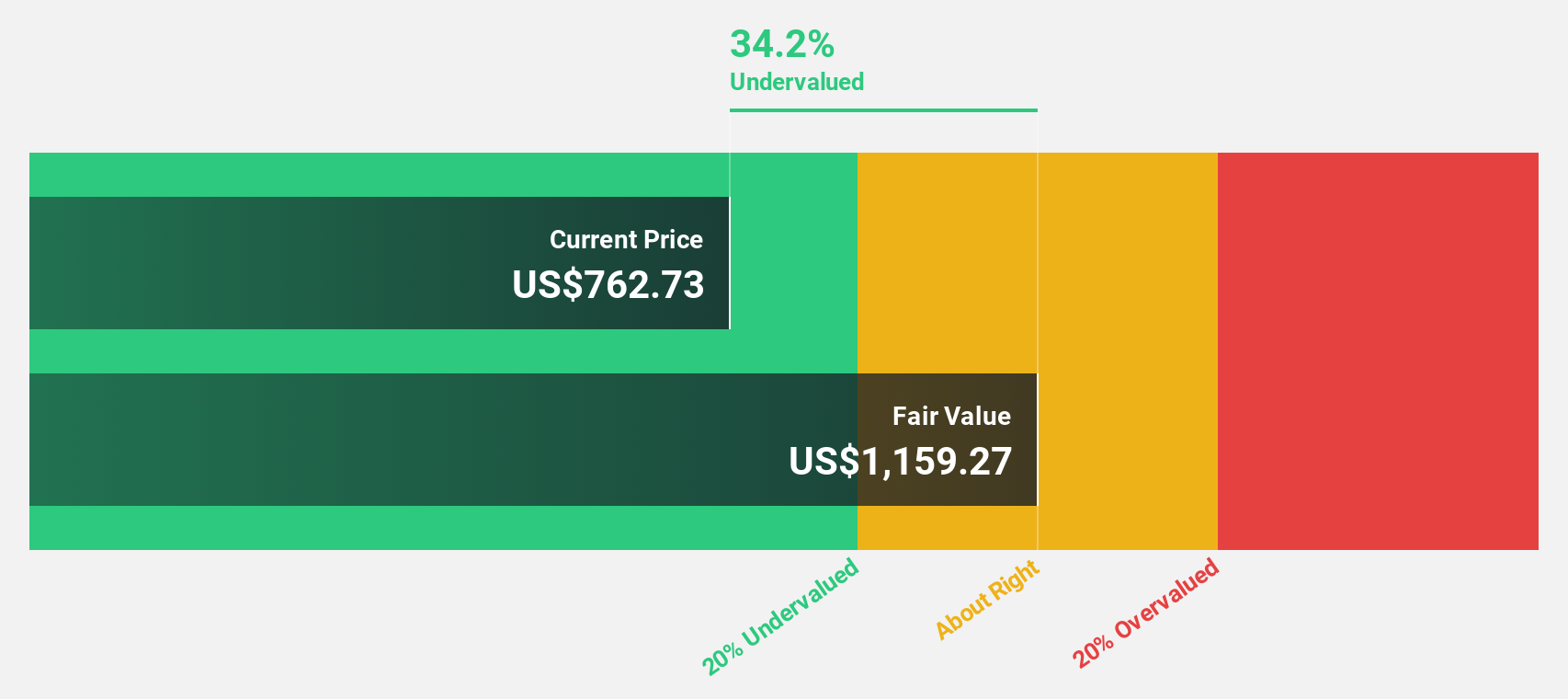

Estimated Discount To Fair Value: 30.3%

Eli Lilly is trading at US$807.58, significantly below its estimated fair value of US$1,159.27, suggesting potential undervaluation based on cash flows. The company's earnings are projected to grow significantly faster than the US market over the next three years. However, Eli Lilly carries a high level of debt and has a substantial acquisition in progress with Verve Therapeutics for up to $1.3 billion, which could impact future cash flows and financial stability.

- According our earnings growth report, there's an indication that Eli Lilly might be ready to expand.

- Navigate through the intricacies of Eli Lilly with our comprehensive financial health report here.

Taking Advantage

- Reveal the 171 hidden gems among our Undervalued US Stocks Based On Cash Flows screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com