T. Rowe Price Group (NasdaqGS:TROW) recently launched three active transparent equity ETFs on NASDAQ, enhancing their investment product suite. Over the last quarter, the company's stock price experienced a 1.66% increase. This performance aligns with broader market movements, suggesting the ETFs might have added weight to these trends. Despite global market volatility, such as the Israel-Iran conflict impacting indices like the Dow Jones, TROW's moves remain relatively steady. Other company actions, including dividend announcements and a stock repurchase program, provided further support to its shareholder returns amid fluctuating market conditions.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent launch of three active transparent equity ETFs by T. Rowe Price Group has implications for its international expansion efforts and diversified offerings strategy. This aligns with the company's narrative of seeking growth through new markets and increasing its ETF business. The ETFs could enhance the firm's appeal in asset allocation models, potentially driving revenue growth alongside its international partnerships in Japan, Korea, and Canada.

Over a three-year period, T. Rowe Price's total shareholder return, including dividends, was 2.25%. This performance provides a broader context to its recent stock price fluctuations. In the shorter one-year timeframe, however, TROW's shares underperformed the US Capital Markets industry, indicative of the ongoing challenges it faces amid market pressures.

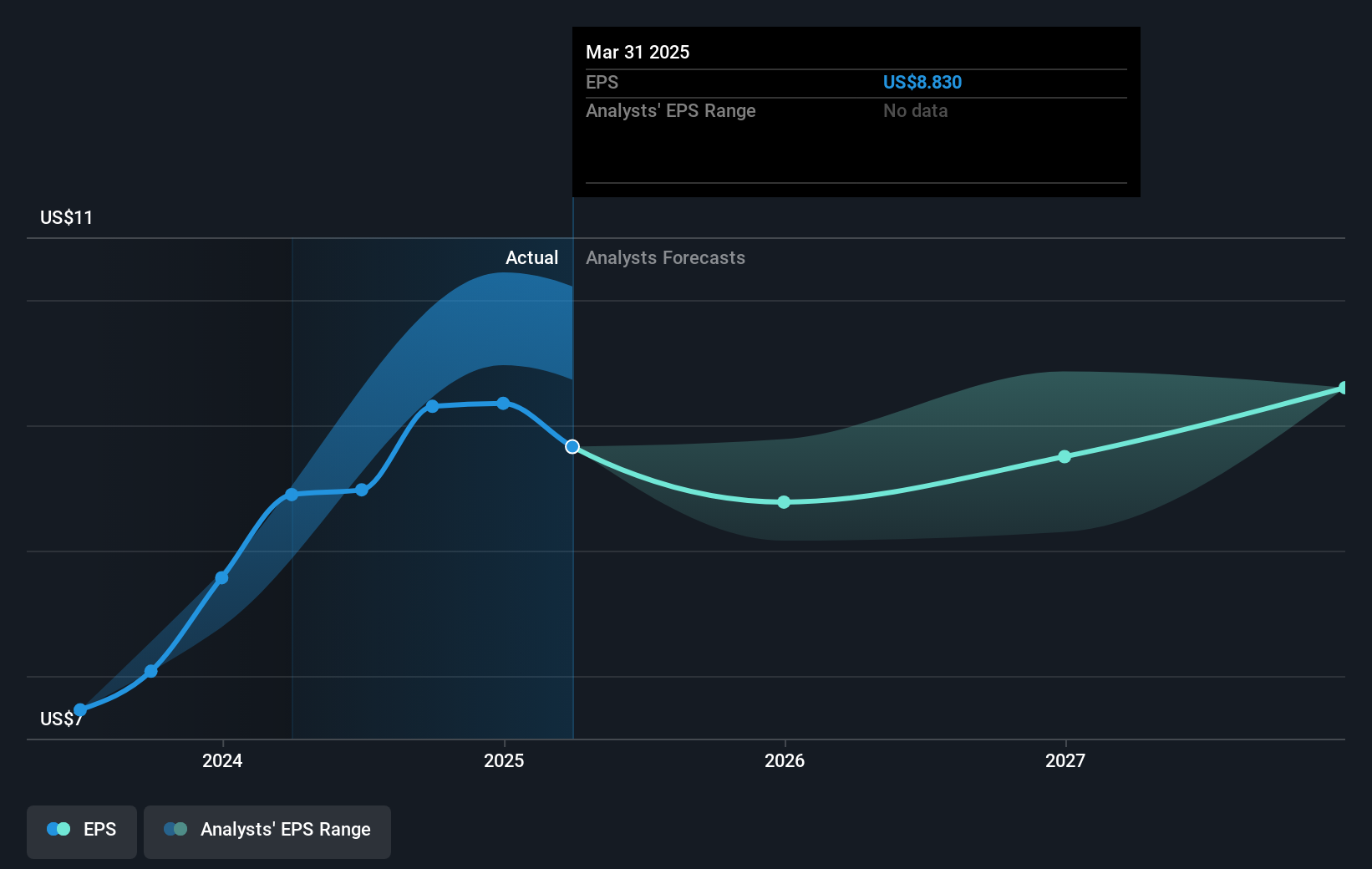

The introduction of new ETFs is poised to affect revenue forecasts positively through higher net inflows, yet analysts project a conservative annual revenue growth of 1.4% over the next three years. Earnings expectations hold steady at approximately US$2.0 billion, maintaining a cautious outlook given the prevailing market conditions.

In terms of valuation, the stock's current price of US$90.16 sits slightly below the consensus analyst price target of approximately US$93.46. This suggests that, on average, analysts believe the stock to be fairly priced relative to its projected earnings and revenue growth. Observers should weigh these projections against their understanding of the company's strategy and market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Sector ETFs

Sector ETFs enable investors to invest in a specific industry in one security.

Investing with Sector ETFs

Do sector or industry ETFs make sense for you? Learn more!