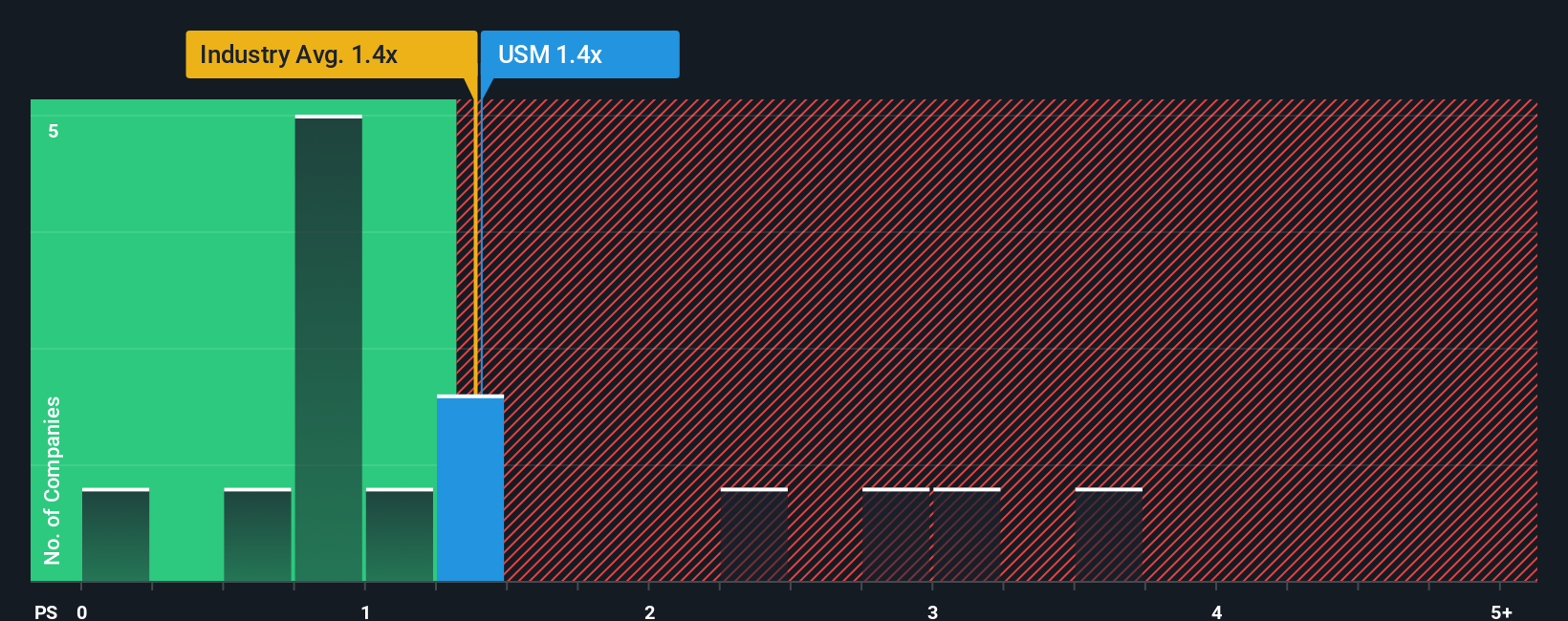

With a median price-to-sales (or "P/S") ratio of close to 1.2x in the Wireless Telecom industry in the United States, you could be forgiven for feeling indifferent about United States Cellular Corporation's (NYSE:USM) P/S ratio of 1.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for United States Cellular

How United States Cellular Has Been Performing

United States Cellular could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think United States Cellular's future stacks up against the industry? In that case, our free report is a great place to start.How Is United States Cellular's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like United States Cellular's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 4.1%. As a result, revenue from three years ago have also fallen 9.7% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 0.3% each year as estimated by the six analysts watching the company. Meanwhile, the broader industry is forecast to expand by 4.8% per annum, which paints a poor picture.

With this information, we find it concerning that United States Cellular is trading at a fairly similar P/S compared to the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our check of United States Cellular's analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

And what about other risks? Every company has them, and we've spotted 1 warning sign for United States Cellular you should know about.

If these risks are making you reconsider your opinion on United States Cellular, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.