As the U.S. market experiences a cautious yet optimistic rise, with key indices like the S&P 500 and Nasdaq Composite reaching their highest levels since February, investors are keenly watching developments in U.S.-China trade talks that could impact small-cap stocks. In this environment, identifying promising small-cap companies—those often overlooked but possessing strong fundamentals and growth potential—can be particularly rewarding for investors seeking to diversify their portfolios amidst broader market movements.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| West Bancorporation | 169.96% | -1.41% | -8.52% | ★★★★★★ |

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| FineMark Holdings | 122.25% | 2.34% | -26.34% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| Gulf Island Fabrication | 19.65% | -2.17% | 42.26% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

| Vantage | 6.72% | -16.62% | -15.47% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Gibraltar Industries (ROCK)

Simply Wall St Value Rating: ★★★★★★

Overview: Gibraltar Industries, Inc. is a company that manufactures and delivers products and services across the residential, renewable energy, agtech, and infrastructure sectors both in the United States and internationally, with a market capitalization of approximately $1.77 billion.

Operations: Gibraltar Industries generates its revenue primarily from the residential sector, contributing $777.40 million, followed by renewables at $277.57 million. The agtech and infrastructure segments add $163.82 million and $87.48 million, respectively, to the total revenue stream.

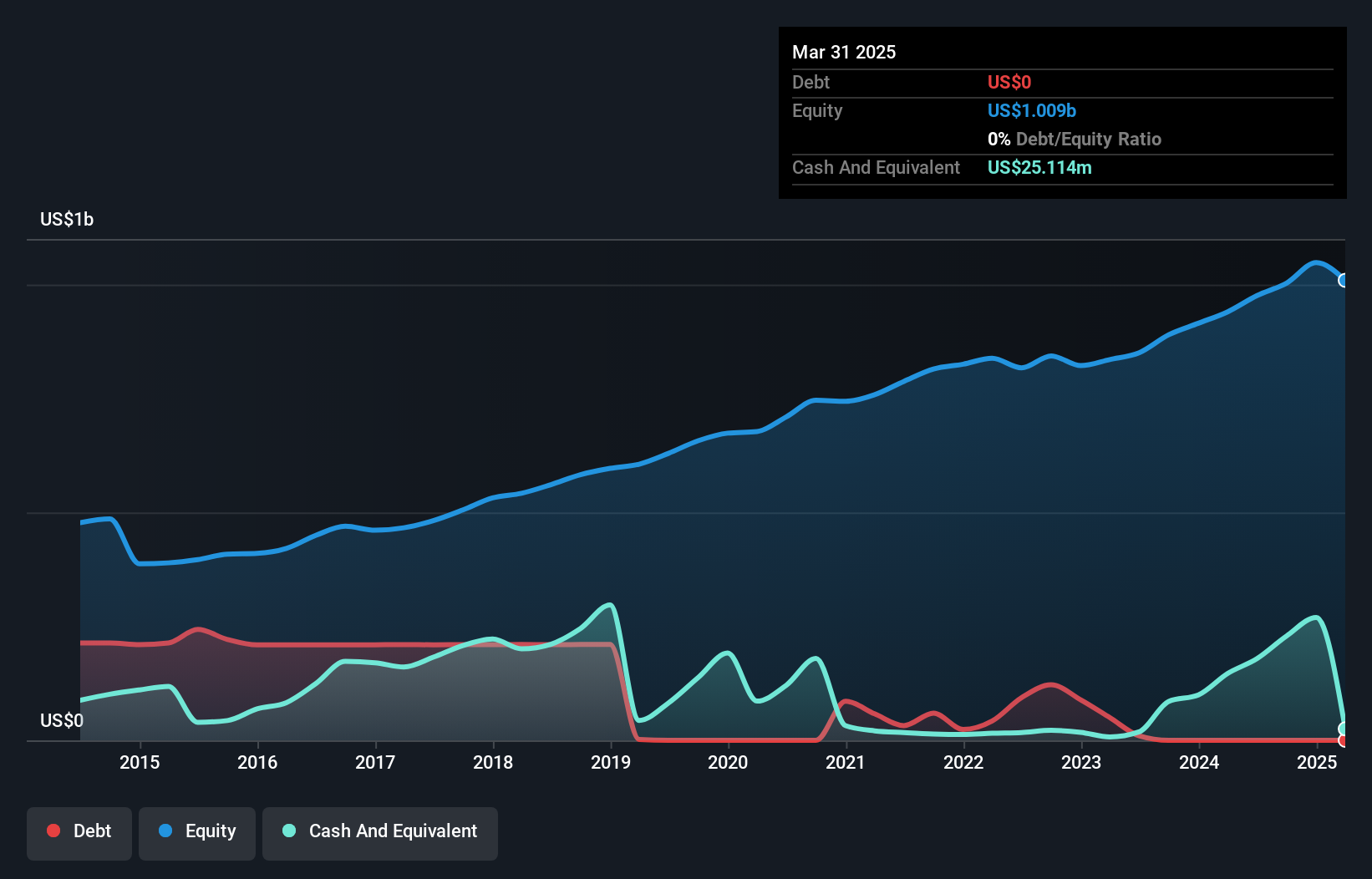

Gibraltar Industries, a small cap player in the building sector, is making waves with its strategic focus on renewables and Agtech. The company reported earnings growth of 16.7% last year, outpacing the industry average of -5.4%, and remains debt-free, enhancing its financial flexibility. Recent initiatives include acquisitions like Lane Supply and increased order activity in key sectors, which are expected to drive future revenue growth. Despite operational challenges in renewables and tariff-related costs affecting margins slightly at 10.7%, Gibraltar's shares trade at good value relative to peers with a projected annual revenue growth rate of 7.5%.

Central Pacific Financial (CPF)

Simply Wall St Value Rating: ★★★★★★

Overview: Central Pacific Financial Corp. is a bank holding company for Central Pacific Bank, offering various commercial banking products and services to businesses, professionals, and individuals in the United States, with a market cap of $720.80 million.

Operations: Central Pacific Financial generates revenue of $247.71 million primarily from its banking operations.

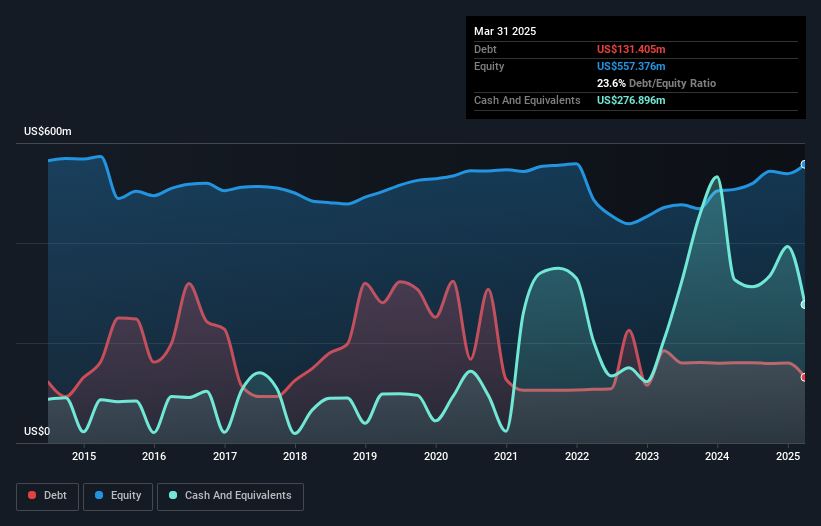

Central Pacific Financial, with total assets of US$7.4 billion and equity of US$557.4 million, is a financial institution primarily funded by customer deposits, which account for 96% of its liabilities. This bank has a net interest margin of 3%, with total loans standing at US$5.3 billion and deposits at US$6.6 billion. It maintains an allowance for bad loans at 0.2% of total loans, indicating prudent risk management practices. The company repurchased 77,316 shares recently for $2.14 million as part of its capital allocation strategy to enhance shareholder value amidst ongoing market dynamics in Hawaii's growing economy.

Flotek Industries (FTK)

Simply Wall St Value Rating: ★★★★★☆

Overview: Flotek Industries, Inc. is a technology-driven green chemistry and data company serving industrial and commercial markets globally, with a market cap of $427.43 million.

Operations: Flotek Industries generates revenue primarily from its Chemistry Technologies segment, contributing $192.20 million, and its Data Analytics segment, adding $9.81 million. The Chemistry Technologies segment is the predominant revenue driver for the company.

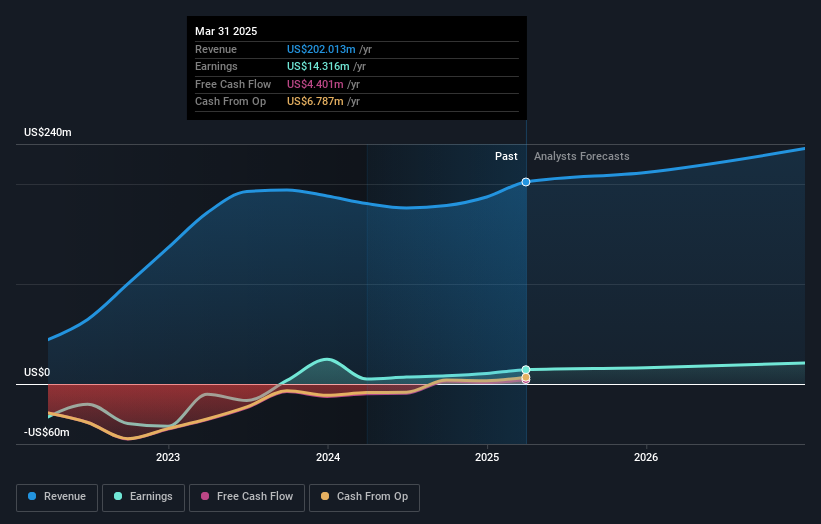

Flotek Industries, with its focus on innovative technologies and international expansion, is carving a niche in the chemicals sector. Its earnings surged 190.3% last year, outpacing the industry average of -3.4%, while maintaining high-quality earnings and an EBIT interest coverage of 14.8x. The company's debt to equity ratio rose from 0% to 0.5% over five years, yet it holds more cash than total debt, suggesting financial stability amidst market volatility. Trading at 56% below estimated fair value presents potential upside for investors seeking opportunities in this space despite recent share price fluctuations over three months.

Next Steps

- Gain an insight into the universe of 281 US Undiscovered Gems With Strong Fundamentals by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com