Wall Street's Most Accurate Analysts Give Their Take On 3 Utilities Stocks Delivering High-Dividend Yields

Benzinga · 06/10 12:00

Share

Listen to the news

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the utilities sector.

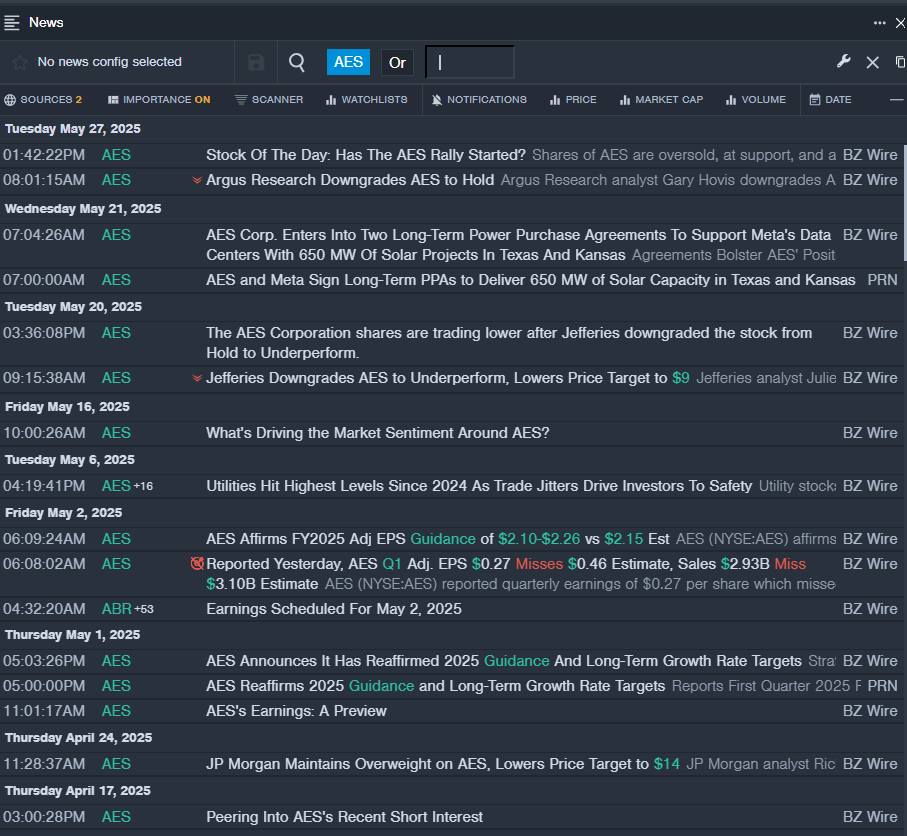

The AES Corporation (NYSE:AES)

- Dividend Yield: 6.43%

- Argus Research analyst Gary Hovis downgraded the stock from Buy to Hold on May 27, 2025. This analyst has an accuracy rate of 62%.

- Jefferies analyst Julien Dumoulin-Smith downgraded the stock from Hold to Underperform and cut the price target from $10 to $9 on May 20, 2025. This analyst has an accuracy rate of 68%.

- Recent News: On May 1, AES reaffirmed its 2025 guidance and long-term growth rate targets.

- Benzinga Pro’s real-time newsfeed alerted to latest AES news.

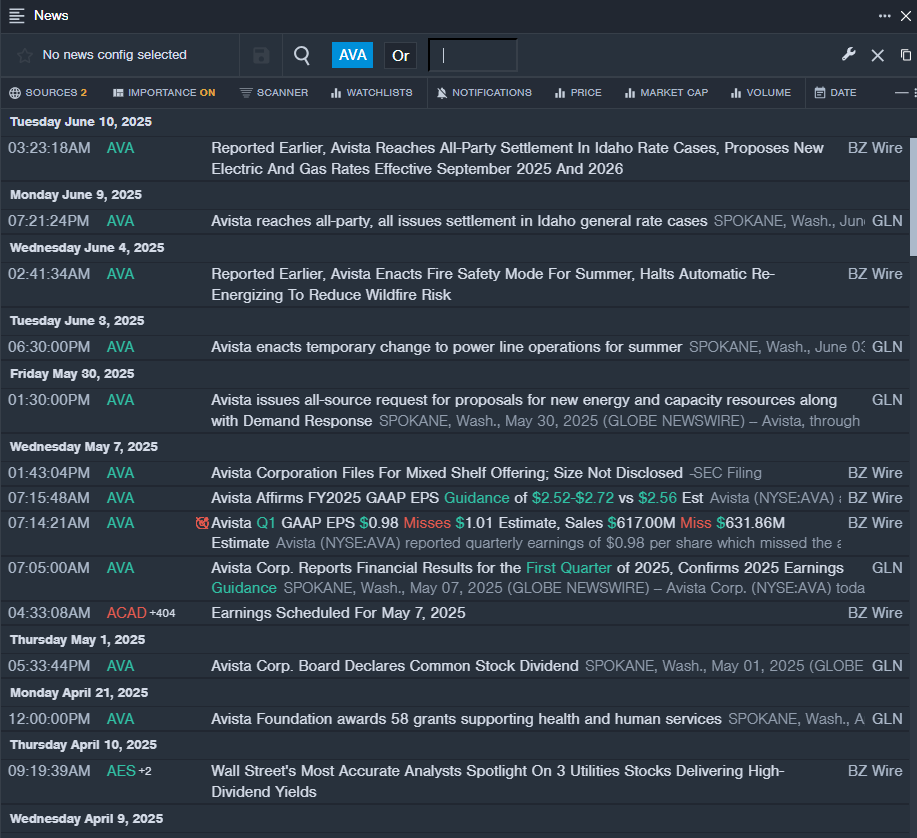

Avista Corporation (NYSE:AVA)

- Dividend Yield: 5.25%

- Jefferies analyst Julien Dumoulin-Smith maintained a Hold rating and cut the price target from $40 to $39 on Jan. 28, 2025. This analyst has an accuracy rate of 68%.

- B of A Securities analyst Ross Fowler reinstated an Underperform rating with a price target of $37 on Sept. 12, 2024. This analyst has an accuracy rate of 62%.

- Recent News: On June 9, Avista reached all-party, all issues settlement in Idaho general rate cases.

- Benzinga Pro's real-time newsfeed alerted to latest AVA news

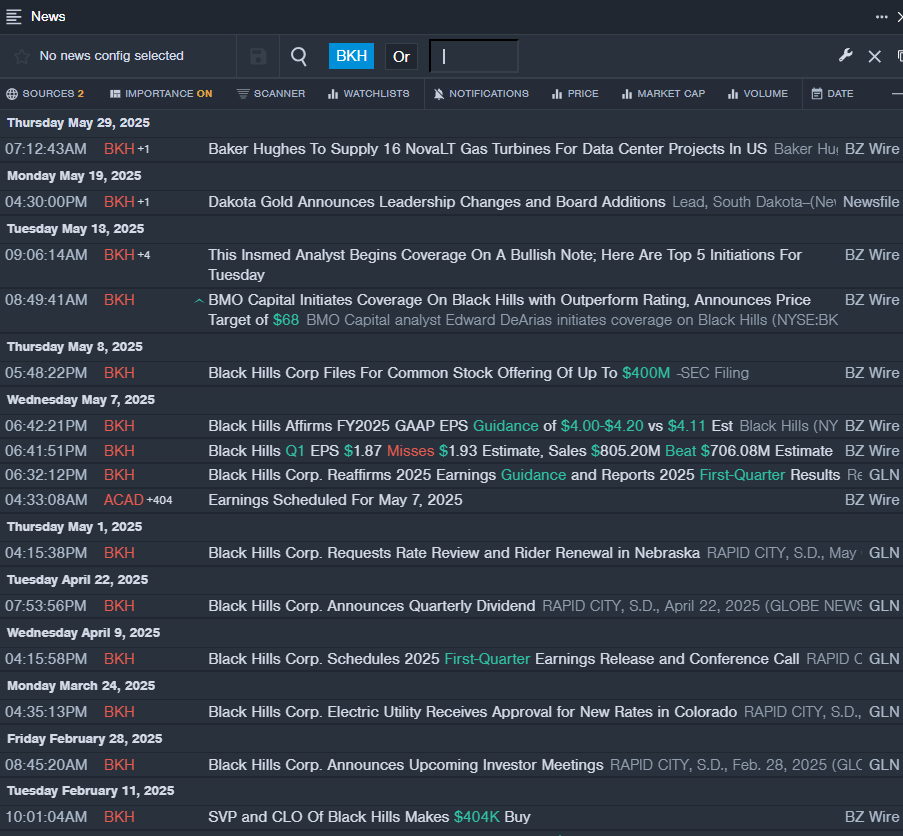

Black Hills Corporation (NYSE:BKH)

- Dividend Yield: 4.71%

- Scotiabank analyst Andrew Weisel maintained a Sector Perform rating and cut the price target from $67 to $66 on Feb. 7, 2025. This analyst has an accuracy rate of 64%.

- Wells Fargo analyst Sarah Akers maintained an Equal-Weight rating and increased the price target from $61 to $64 on Aug. 2, 2024. This analyst has an accuracy rate of 67%.

- Recent News: On May 7, Black Hills posted mixed results for the first quarter.

- Benzinga Pro’s real-time newsfeed alerted to latest BKH news

Read More:

Photo via Shutterstock

Disclaimer:This article represents the opinion of the author only. It does not represent the opinion of Webull, nor should it be viewed as an indication that Webull either agrees with or confirms the truthfulness or accuracy of the information. It should not be considered as investment advice from Webull or anyone else, nor should it be used as the basis of any investment decision.

What's Trending

No content on the Webull website shall be considered a recommendation or solicitation for the purchase or sale of securities, options or other investment products. All information and data on the website is for reference only and no historical data shall be considered as the basis for judging future trends.

Copyright © 2025 Webull. All Rights Reserved