Top 3 Consumer Stocks You'll Regret Missing This Quarter

Benzinga · 06/05 11:07

Share

Listen to the news

The most oversold stocks in the consumer discretionary sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

Champion Homes Inc (NYSE:SKY)

- On May 27, Champion Homes reported fourth-quarter financial results and missed its adjusted EPS and revenue estimates. “Champion delivered strong results across our family of brands and key business drivers in fiscal 2025,” said Tim Larson President and Chief Executive Officer of Champion Homes. The company's stock fell around 26% over the past month and has a 52-week low of $63.13.

- RSI Value: 25

- SKY Price Action: Shares of Champion Homes gained 1% to close at $65.64 on Tuesday.

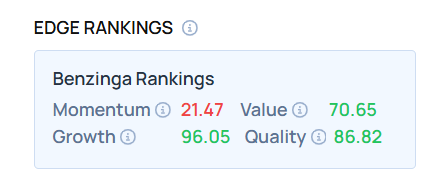

- Edge Stock Ratings: 21.47 Momentum score with Value at 70.65.

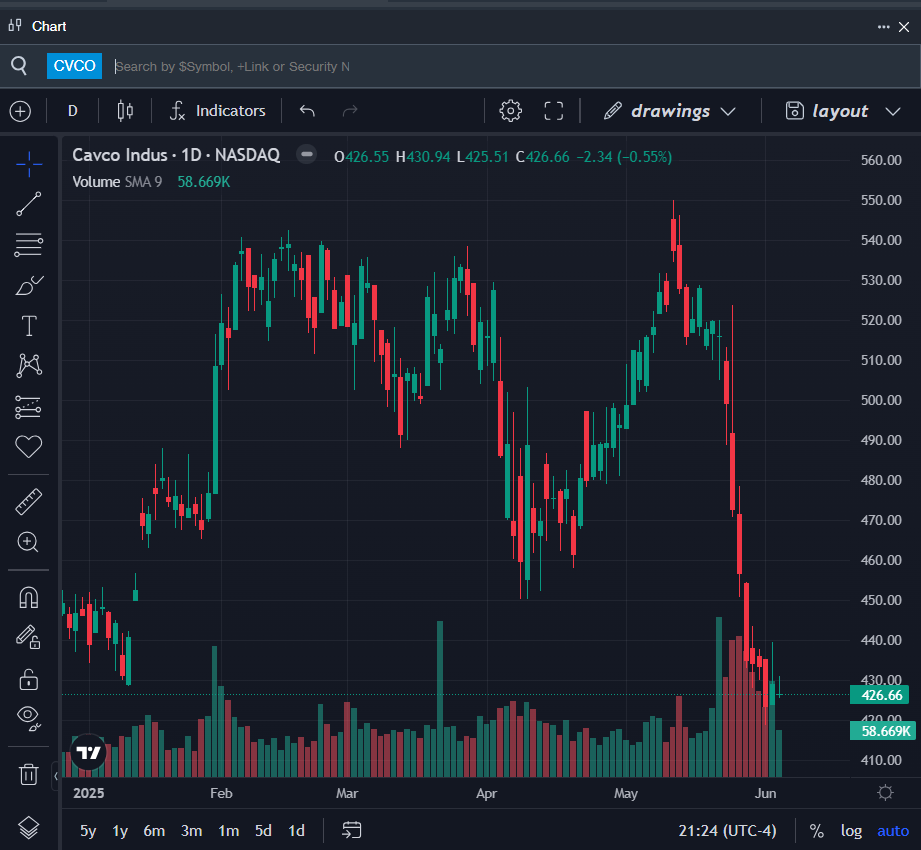

Cavco Industries Inc (NASDAQ:CVCO)

- On May 22, Cavco Industries posted better-than-expected quarterly earnings. Bill Boor, President and Chief Executive Officer, said, “A significant pickup in activity in March helped close out a solid quarter after unusually harsh weather across the southern states in February impacted the transition into the Spring selling season. We held production levels throughout the quarter and are well positioned to increase from here as the market allows.” The company's stock fell around 17% over the past month and has a 52-week low of $331.50.

- RSI Value: 27.3

- CVCO Price Action: Shares of Cavco Industries fell 0.6% to close at $426.66 on Wednesday.

- Benzinga Pro’s charting tool helped identify the trend in CVCO stock.

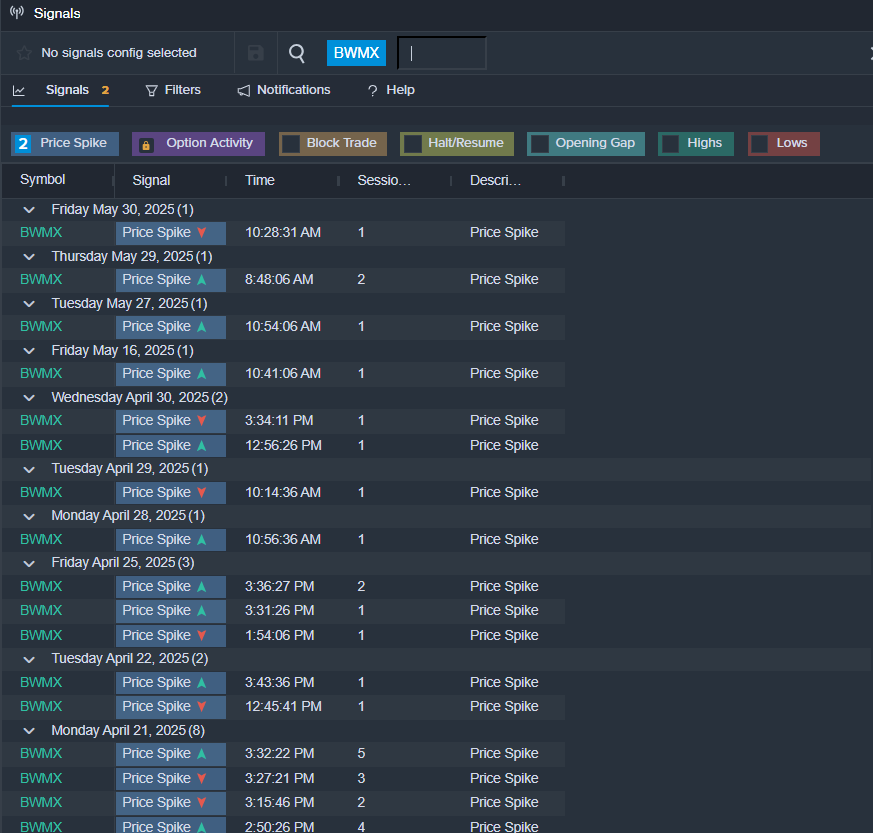

Betterware de Mexico SAPI de CV (NYSE:BWMX)

- On April 24, Betterware De Mexico reported worse-than-expected first-quarter financial results. The company's stock fell around 17% over the past month and has a 52-week low of $7.00.

- RSI Value: 24.5

- BWMX Ltd Price Action: Shares of BWMX fell 1.9% to close at $7.65 on Wednesday.

- Benzinga Pro’s signals feature notified of a potential breakout in BWMX shares.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

Photo via Shutterstock

Disclaimer:This article represents the opinion of the author only. It does not represent the opinion of Webull, nor should it be viewed as an indication that Webull either agrees with or confirms the truthfulness or accuracy of the information. It should not be considered as investment advice from Webull or anyone else, nor should it be used as the basis of any investment decision.

What's Trending

No content on the Webull website shall be considered a recommendation or solicitation for the purchase or sale of securities, options or other investment products. All information and data on the website is for reference only and no historical data shall be considered as the basis for judging future trends.

Copyright © 2025 Webull. All Rights Reserved