Cleveland-Cliffs (NYSE:CLF) recently announced its earnings for Q1 2025, reporting a decline in sales and an increased net loss compared to the same period the previous year. Despite these financial challenges, the company's stock moved up by 19% over the past week, in contrast to the broader market's modest 2% climb. This significant price movement for Cleveland-Cliffs, given its recent earnings report, suggests other influences may have been at play, potentially offsetting the financial performance impact, as no major market news accompanied this period.

The news of Cleveland-Cliffs' improved share price performance following a challenging earnings report highlights the complex dynamics influencing investor sentiment. While the company's Q1 2025 earnings showed a US$1.18 billion loss, the recent tariff-backed protection and expectations of synergies from the Stelco acquisition may bolster its future prospects. This optimism is reflected in the significant 19% share price increase, despite short-term financial setbacks.

Over the past five years, Cleveland-Cliffs delivered a total return of 10.69%, including share price and dividends—a modest gain considering the stock's recent volatility. In contrast, the company's performance in the past year lagged behind both the US market return of 11.9% and the US Metals and Mining industry return of 0.4%. These figures indicate that while Cleveland-Cliffs has experienced recent positive momentum, it trails industry and market averages over the longer term.

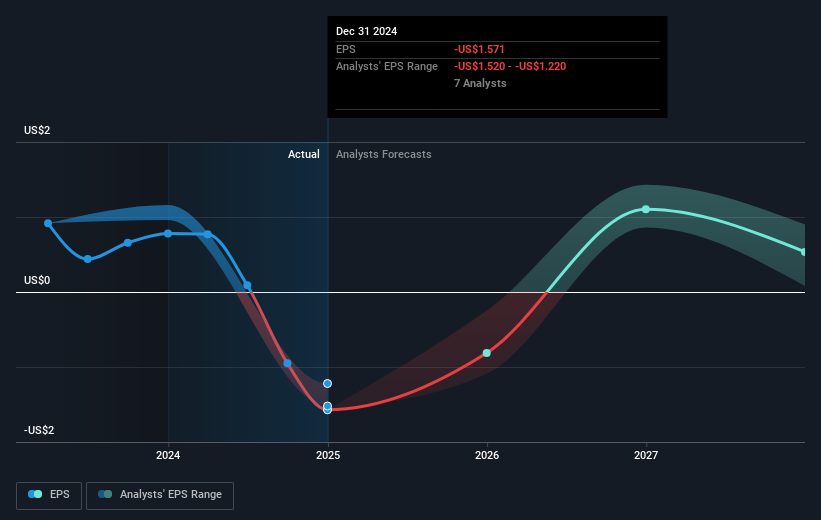

The potential impact of the tariff and acquisition news on revenue and earnings forecasts is significant. Analysts anticipate an annual revenue growth of 5.2% over the next three years and a shift from a 3.9% decline in profit margins to a 2.2% gain by 2028. However, this optimistic outlook is tempered by existing risks, including trade disruptions and high interest rates, which could impede the company's progress.

With the current share price at US$8.61 and a consensus price target of US$10.91, the stock has room to grow, with a potential upside of 21.1%. However, the analysts' divided perspectives on Cleveland-Cliffs' future highlight the uncertainty ahead. Investors are encouraged to scrutinize these projections against personal expectations and market conditions.

Understand Cleveland-Cliffs' track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com