Motorola Solutions (NYSE:MSI) has seen notable recent activity, including a change in co-lead underwriters for a $500 million fixed-income offering and ongoing talks to acquire Silvus Technologies for $4.5 billion. Over the past month, the company's stock price rose by 3%, aligning with the broader market's 2% weekly increase. These financial and strategic developments, along with the affirmation of a regular quarterly dividend and enhancements in public safety AI, may have added weight to the positive price movement, reflecting a period of growth and adaptability in line with market trends.

We've identified 1 risk for Motorola Solutions that you should be aware of.

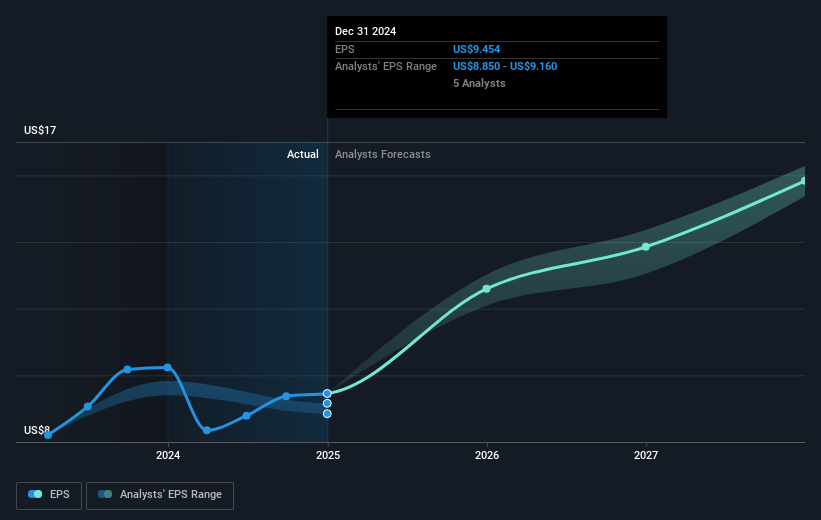

Motorola Solutions' recent financial maneuvers, such as the change in co-lead underwriters for a US$500 million fixed-income offering and acquisition discussions with Silvus Technologies, could have substantial implications on its revenue and earnings projections. While the company's stock rose by 3% in the short term, it is important to consider its long-term performance: over the past five years, the total shareholder return, including share price appreciation and dividends, reached 182.74%. This showcases the company's ability to deliver value over time. Comparatively, Motorola underperformed the US Communications industry over the past year, which returned 32.3%.

The new product introductions and acquisitions are expected to support future revenue and elevate recurring revenue streams. However, tariff costs and integration risks may challenge earnings growth. The company's shares currently trade at a price that is approximately 16.5% below the consensus analyst price target of US$493.89. This discount suggests room for potential appreciation, provided the company meets or exceeds analysts' expectations for revenue and earnings growth. Investors should assess how these developments might affect future forecasts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com