The United States market has seen a positive trend, rising 2.0% in the last week and 12% over the past year, with all sectors contributing to this growth. In such an environment, identifying reliable dividend stocks that offer attractive yields can provide investors with steady income while potentially benefiting from expected earnings growth in the coming years.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 6.25% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 7.03% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 6.64% | ★★★★★★ |

| Ennis (NYSE:EBF) | 5.41% | ★★★★★★ |

| Chevron (NYSE:CVX) | 4.96% | ★★★★★★ |

| CompX International (NYSEAM:CIX) | 4.82% | ★★★★★★ |

| Universal (NYSE:UVV) | 4.96% | ★★★★★★ |

| Credicorp (NYSE:BAP) | 5.15% | ★★★★★☆ |

| Southside Bancshares (NYSE:SBSI) | 5.18% | ★★★★★☆ |

| Huntington Bancshares (NasdaqGS:HBAN) | 3.98% | ★★★★★☆ |

Click here to see the full list of 147 stocks from our Top US Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Magic Software Enterprises (NasdaqGS:MGIC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Magic Software Enterprises Ltd. is a company that offers proprietary application development, vertical software solutions, business process integration, IT outsourcing services, and cloud-based services both in Israel and internationally, with a market cap of $777.24 million.

Operations: Magic Software Enterprises Ltd. generates its revenue through proprietary application development, vertical software solutions, business process integration, IT outsourcing services, and cloud-based services.

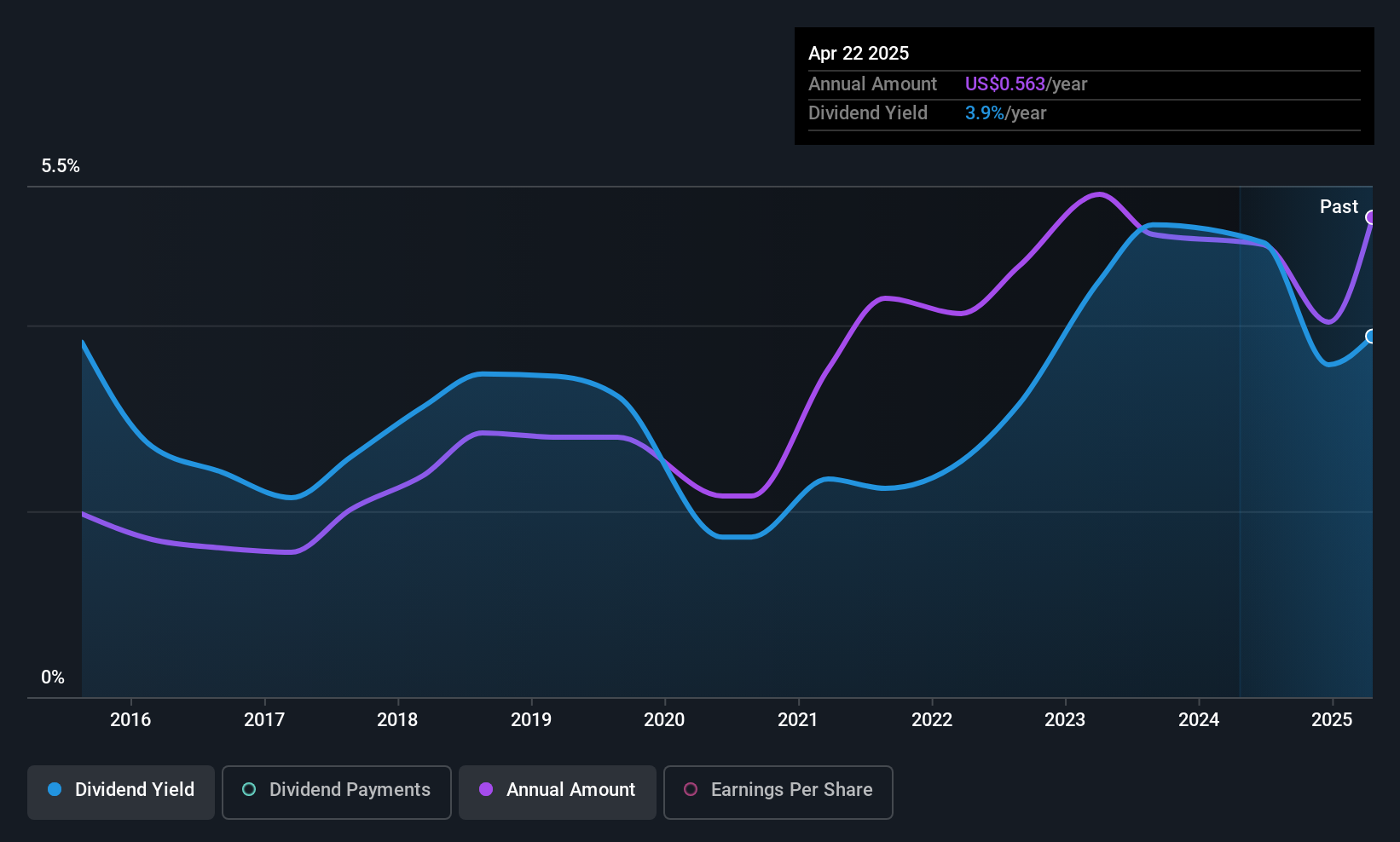

Dividend Yield: 3.5%

Magic Software Enterprises has a history of volatile dividend payments, despite recent increases. Its payout ratio of 74.9% suggests dividends are covered by earnings, and a cash payout ratio of 47.8% indicates strong cash flow support. However, its dividend yield is lower than the top US dividend payers at 3.53%. Recent revenue guidance between $593 million and $603 million reflects steady growth, but impending delisting due to a merger with Matrix I.T Ltd may impact future accessibility for investors seeking stable dividends in the US market.

- Take a closer look at Magic Software Enterprises' potential here in our dividend report.

- Our valuation report here indicates Magic Software Enterprises may be overvalued.

Alexander & Baldwin (NYSE:ALEX)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Alexander & Baldwin, Inc. (NYSE: ALEX) is a real estate investment trust specializing in Hawai'i commercial real estate, notably as the state's largest owner of grocery-anchored neighborhood shopping centers, with a market cap of approximately $1.30 billion.

Operations: Alexander & Baldwin's revenue segments consist of $199.54 million from Commercial Real Estate and $29.66 million from Land Operations.

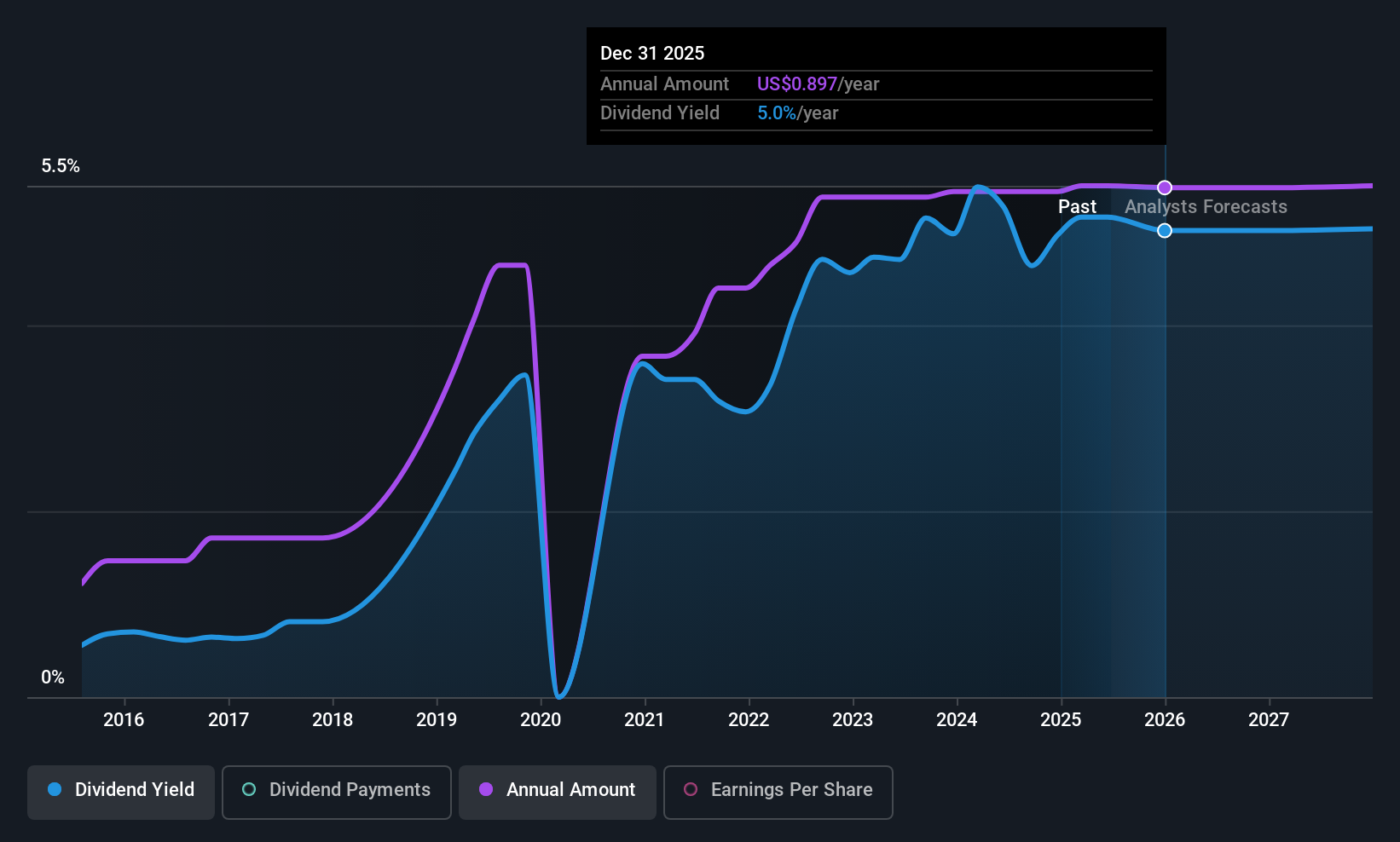

Dividend Yield: 5%

Alexander & Baldwin's dividend yield of 5.02% is competitive, supported by a 67% payout ratio and a cash payout ratio of 60.6%, indicating dividends are covered by earnings and cash flows. However, its dividend history has been volatile over the past decade. The company plans to redevelop Komohana Industrial Park, potentially enhancing future revenue streams, though high debt levels may pose risks for dividend stability amidst forecasted earnings decline.

- Dive into the specifics of Alexander & Baldwin here with our thorough dividend report.

- Upon reviewing our latest valuation report, Alexander & Baldwin's share price might be too pessimistic.

Universal (NYSE:UVV)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Universal Corporation is involved in sourcing, processing, and supplying leaf tobacco and plant-based ingredients globally, with a market cap of approximately $1.62 billion.

Operations: Universal Corporation generates revenue primarily from its Tobacco Operations, which account for $2.61 billion, and its Ingredients Operations, contributing $338.61 million.

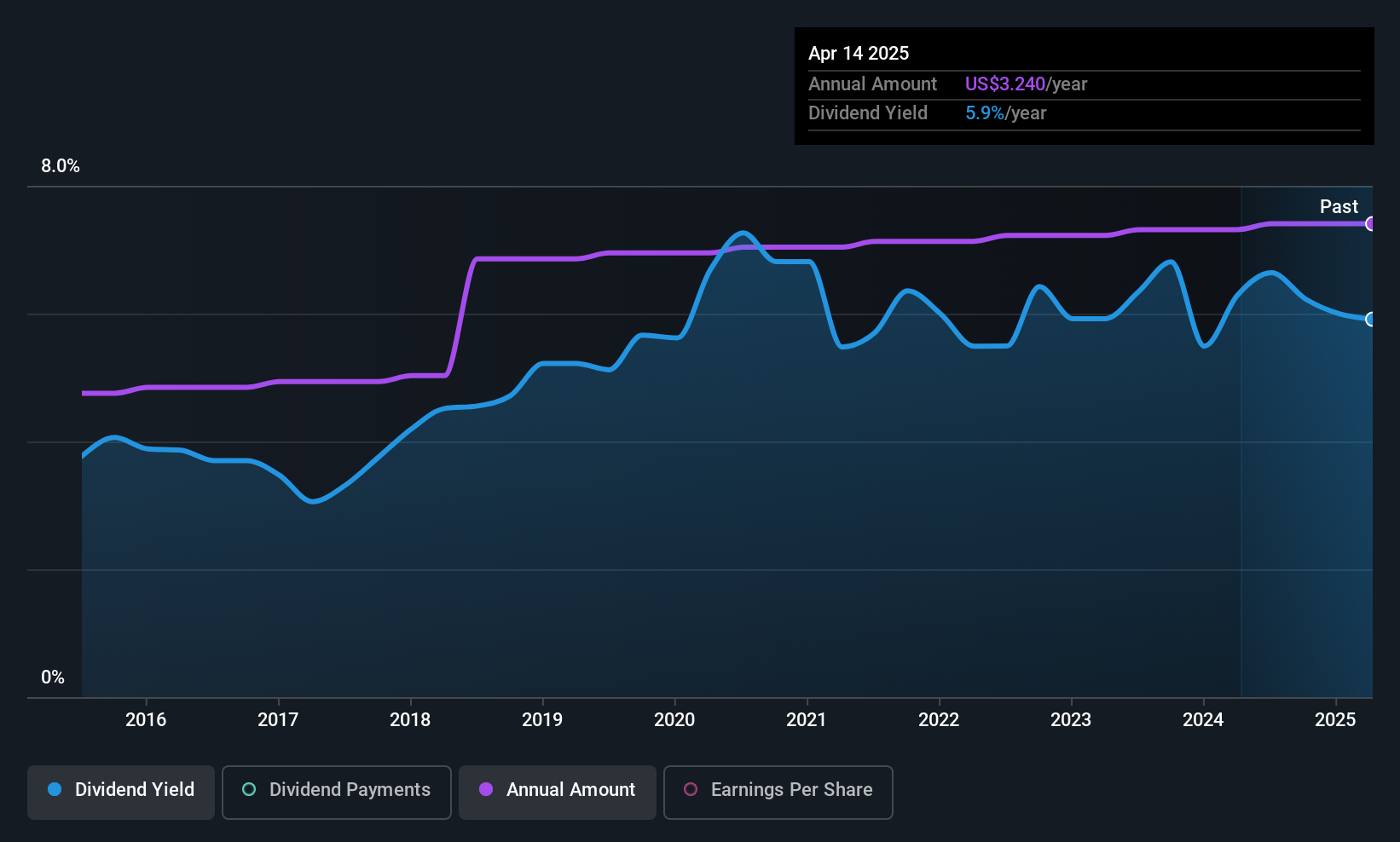

Dividend Yield: 5%

Universal Corporation offers a robust dividend yield of 4.96%, ranking in the top 25% among US dividend payers. Its dividends have been stable and reliably growing over the past decade, with a payout ratio of 85% covered by earnings and a low cash payout ratio of 30.3%. Despite recent declines in net income to US$95.05 million for fiscal year 2025, Universal's dividends remain well-supported by its financial structure, though its high debt level warrants attention.

- Click here and access our complete dividend analysis report to understand the dynamics of Universal.

- Our valuation report here indicates Universal may be undervalued.

Make It Happen

- Take a closer look at our Top US Dividend Stocks list of 147 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com